Ohio-based independent oil refiner and marketer Marathon Petroleum Corp. (NYSE:MPC) reported marginally weaker-than-expected second-quarter earnings on lower gross margins and elevated costs. The company’s earnings per share (adjusted for special items) came in at $1.03, a penny below the Zacks Consensus Estimate.

Moreover, Marathon Petroleum’s revenues of $18,354 million missed the Zacks Consensus Estimate of $19,361 million.

Segmental Performance

Refining & Marketing: Operating income from the Refining & Marketing segment – which is the main contributor to Marathon Petroleum earnings – was $562 million compared with $1,025 million in the year-ago quarter. The deterioration reflects narrower gross margin.

Total refined product sales volumes were 2,370 thousand barrels per day (mbpd), up 1% from the 2,348 mbpd in the year-ago quarter. Moreover, throughput improved from 1,889 mbpd in the year-ago quarter to 2,023 mbpd.Capacity utilization, at 103%, was up from 96% in the second quarter of 2016.

Speedway: Income from the Speedway retail stations totaled $239 million, 24% higher than the $193 million earned in the year-ago period. Rise in merchandise margins, lower operating costs and increased light product margin benefited the results.

Midstream: This unit includes Marathon Petroleum’s 100% interest in MPLX L.P. (NYSE:MPLX) , a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $332 million, up from $253 million in the second quarter of 2016. Earnings were buoyed by contributions from the recently acquired Oklahoma-to-Illinois Ozark pipeline system, better returns from pipeline equity investments as well as increased NGL processing and fractionation activity.

Total Expenses

Marathon Petroleum – which spun off from Marathon Oil Corp. (NYSE:MRO) in 2011 – reported expenses of $17,326 million in second-quarter 2017, 12% higher than $15,475 million in the year-ago quarter.

Capital Expenditure, Balance Sheet & Share Repurchase

In the reported quarter, Marathon Petroleum spent $784 million on capital programs (63% on the Midstream segment). As of Jun 30, 2017, the company had cash and cash equivalents of $1,450 million and total debt of $12,606 million, with a debt-to-capitalization ratio of 38%.

During the quarter under review, Marathon Petroleum returned $936 million of capital to shareholders, including $750 million of share repurchases.

Dividend Hike

Prior to the earnings release, Marathon Petroleum also announced that its board of directors declared a quarterly cash dividend of 40 cents a share, an 11% increase over the current quarterly dividend of 36 cents a share. The dividend will be paid to stockholders of record on Sep 11 and paid on Aug 16.

Share Performance

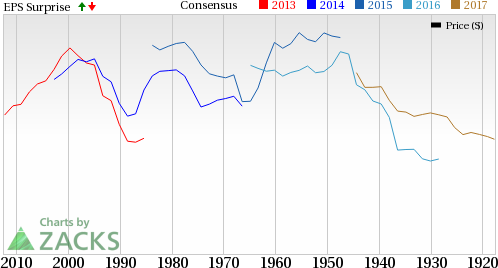

Shares of Marathon Petroleum have gained 3.5% during the second quarter, underperforming the industry’s 4.7% increase.

Zacks Rank & Stock Picks

Marathon Petroleum carries a Zacks Rank #3 (Hold).

Meanwhile, one can look at better-ranked energy players like Range Resources Corp. (NYSE:RRC) . Fort Worth, TX-based independent oil and gas producer – sporting a Zacks Rank #1 (Strong Buy) – has a good earnings surprise history, beating estimates in 3 of the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

MPLX LP (MPLX): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Marathon Oil Corporation (MRO): Free Stock Analysis Report

Original post