Have you been eager to see how Marathon Petroleum (NYSE:MPC) – a leading downstream operator – performed in Q2 in comparison with the market expectations? Let’s quickly scan through the key facts from this Findlay, OH-based company’s earnings release this morning:

About Marathon Petroleum: Marathon Petroleum is a leading independent refiner, transporter and marketer of petroleum products. The company operates in three segments: Refining and Marketing, Speedway (Retail), and Pipeline Transportation.

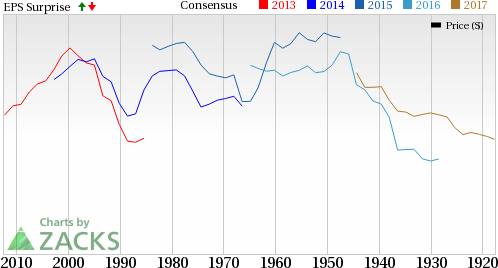

Zacks Rank & Surprise History: Currently, Marathon Petroleum has a Zacks Rank #3 (Hold) but that could change following its second quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a good record: it’s gone past estimates in 3 of the last four quarters resulting in an average positive surprise of 189.75%.

We have highlighted some of the key details from the just-released announcement below:

Earnings Miss Estimate: Earnings per share (adjusted for special items) came in at $1.03, missing the Zacks Consensus Estimate of $1.04. Lower margins and increased costs led to the underperformance.

Revenue Came in Lower than Expected: Marathon Petroleum posted revenues of $18,354 million, missing the Zacks Consensus Estimate of $19,361 million. However, revenues rose 9% year-over-year.

Total Costs: Total costs and expenses came in at $17,326 million, up 12% year-over-year.

Key Stats: Operating income from the Refining & Marketing segment – which is the main contributor to Marathon Petroleum earnings – was $562 million compared with $1,025 million in the year-ago quarter. The deterioration reflects narrower gross margin.

Total refined product sales volumes were 2,370 thousand barrels per day (mbpd), up 1% from the 2,348 mbpd in the year-ago quarter. Moreover, throughput improved from 1,889 mbpd in the year-ago quarter to 2,023 mbpd.

Income from the Speedway retail stations totaled $239 million, 24% higher than the $193 million earned in the year-ago period. Rise in merchandise margins, lower operating costs and increased light product margin benefited the results.

Finally, Midstream segment profitability was $332 million, up from $253 million in the second quarter of 2016. Earnings were buoyed by contributions from the recently acquired Oklahoma-to-Illinois Ozark pipeline system, better returns from pipeline equity investments as well as increased NGL processing and fractionation activity.

Share Performance: Shares of Marathon Petroleum have gained 3.5% during the second quarter, underperforming the industry’s 4.7% increase.

Check back later for our full write up on this Marathon Petroleum earnings report later!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Original post