To me, there’s almost nothing better than finding a great company that I truly want to own at a fair valuation, or better yet, undervalued. In the long run, it has been my experience that this usually leads to outsized future returns, especially if you buy stocks when they are undervalued at the time. But there is quite often a side effect that can prove very disconcerting. Once an undervalued stock starts moving to the upside, momentum will often carry it above what prudent fair valuation would dictate.

As a result of the recent run-up in the market, many of my holdings have, by the strictest of definitions, become overvalued. This begs the general question: what do I do now? Moreover, additional questions pop up such as: If I do sell, should I sell a part of my position, or all of it? When should I pull the trigger, or put another way, how much overvaluation (risk) should I accept before I sell? Since the market is overheated, should I go to cash or look for alternative investments at better valuations to invest in?

Answering these and other important questions correctly could have a major impact on my financial future. Therefore, prudence dictates that I must take great care to think things through to their logical conclusions. However, experience has taught me that there is no general, or one-size-fits-all, answer to any of these important questions. The only way to truly get these questions right, is to analyze each specific company (stock) that I own one at a time, basing my decision on the individual merits of each.

On the other hand, there are general principles that should always be kept at the forefront of your mind when attempting to make sound and proper decisions about overvaluation, or any investing decisions for that matter. A few of the more important ones can be gleaned from following or adhering to the lessons of master investors like Warren Buffett or Charlie Munger. For example, these legends of investing have shared the following principles that they believe in, and that apply to sound investing, and I believe are appropriate to this article’s subject matter:

"Inactivity strikes us as intelligent behavior." Warren Buffett, 1996 Berkshire Hathaway Annual Report

"Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn't do any good to look at the cards." Warren Buffett

"If you aren't willing to own a stock for ten years don't even think about owning it for ten minutes" Warren Buffett, 1996 Berkshire Hathaway Annual Report

"Investment students need only two well taught courses: - How to Value a Business, and - How to think about market prices" Warren Buffett, 1996 Berkshire Hathaway Annual Report

Consequently, I suggest that it is wise counsel to keep the principles underpinning the above quotes in mind when contemplating buy, sell or hold decisions based on overvaluation. Additionally, I believe these principles provide wise counsel no matter what type of investing decision is being contemplated.

Moreover, there are several challenges making it difficult to correctly answer the question cited above. First and foremost, you must, within a reasonable degree of accuracy, accomplish the task of correctly ascertaining fair valuation. How could you expect to know if your stock is overvalued if you do not know what fair value is? Common sense and a historical precedent can be of great value in computing fair valuation. But, most importantly, an accurate as possible forecast of the future will be your best gauge.

There is also the dilemma created by a market whose nature is often one of temporarily behaving irrationally. In other words, a stock can become overvalued, stay there for a long time, and often continue advancing far beyond what any rational computation would justify. Therefore, at the end of the day, all one can do is run the numbers out to their logical conclusions, and make their best judgments based on those calculations. The point being, investors should understand that there is no perfect answer to any of these questions, only reasonable ones. However, it has been my experience that reasonable answers generally pan out in the long run, but they do not always provide instant gratification over the short run.

How I Plan To Specifically Deal With The Many Faces Of Overvaluation In My Portfolio

The great recession of 2008, in addition to the pain and suffering it caused, also brought a great opportunity. In perhaps the greatest self-help book ever written, Think and Grow Rich, author Napoleon Hill offered up an extremely important piece of general wisdom as follows: “in every adversity lies the seed of a greater or equivalent benefit.” The great recession of 2008 was no exception to Napoleon Hill’s axiom. As a result of the massive selloff in stock prices, good and bad stocks alike saw their valuations decimated. When this occurred, I continued to avoid what I considered the bad stocks as I always had, but rejoiced in the opportunity to purchase good stocks on sale.

However, as I alluded to earlier, a side effect of buying stocks on sale usually leads to the necessity of dealing with future overvaluation. This side effect has currently manifested itself in my portfolio at present time. Therefore, in lieu of offering generalizations about what to do with overvaluation, I would like to share my own deliberations of what I might do on several currently overvalued holdings. The key here is that my decisions will be based on the specific situations regarding each holding. However, and as a reminder to the reader, the underlying principles based on the lessons of the masters referenced above will remain at the forefront of my mind at all times.

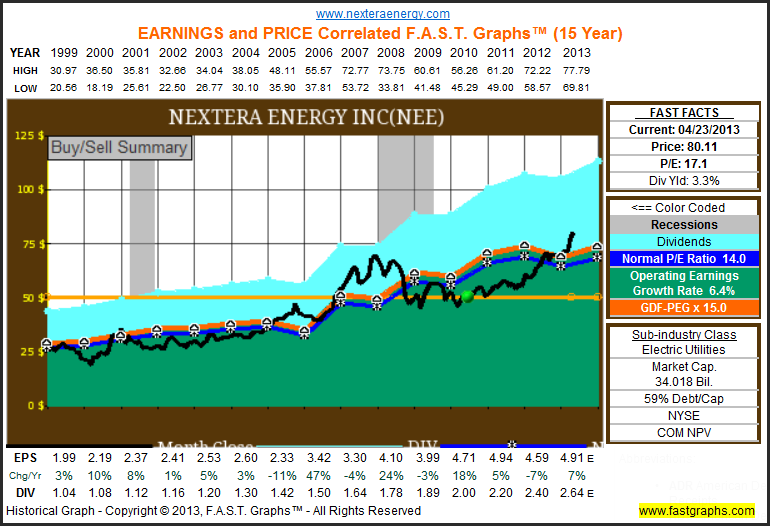

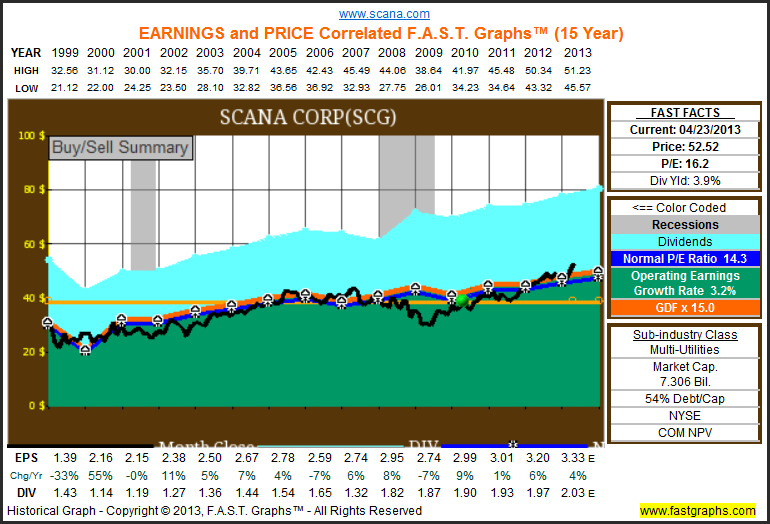

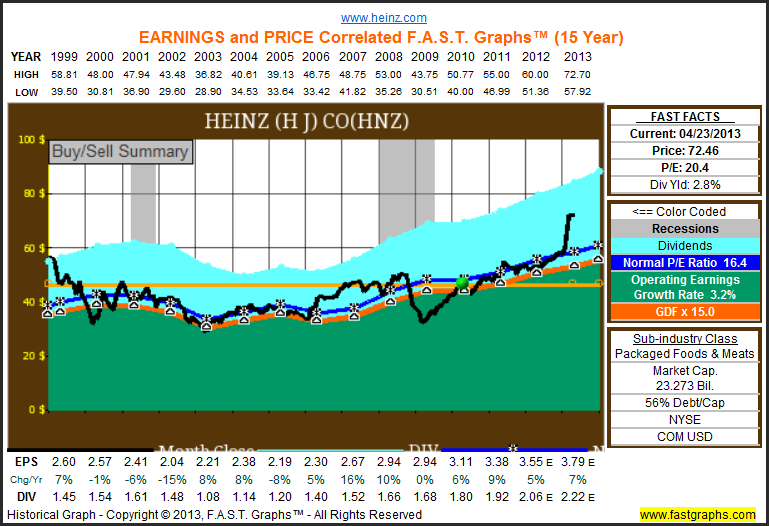

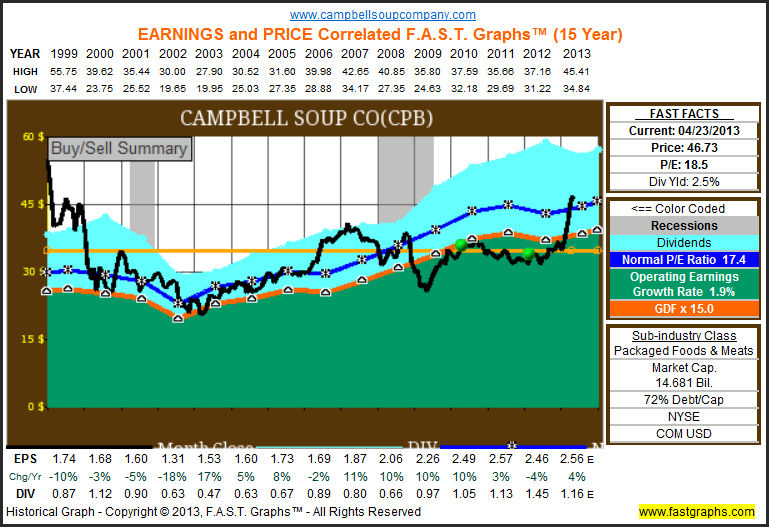

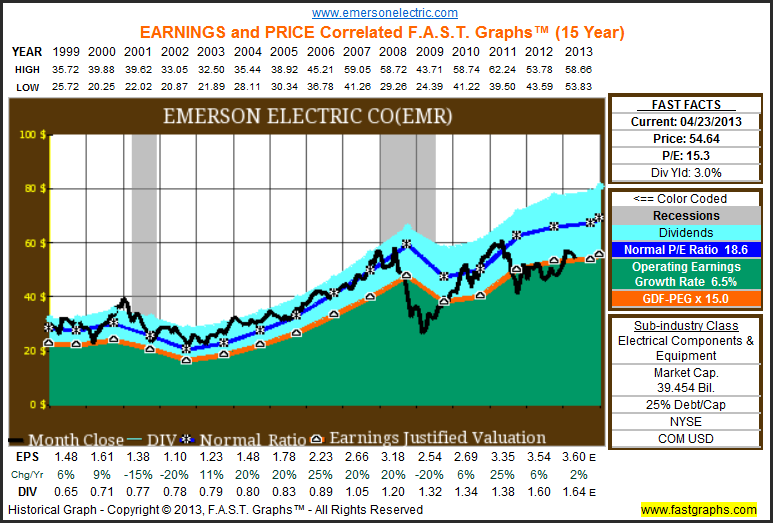

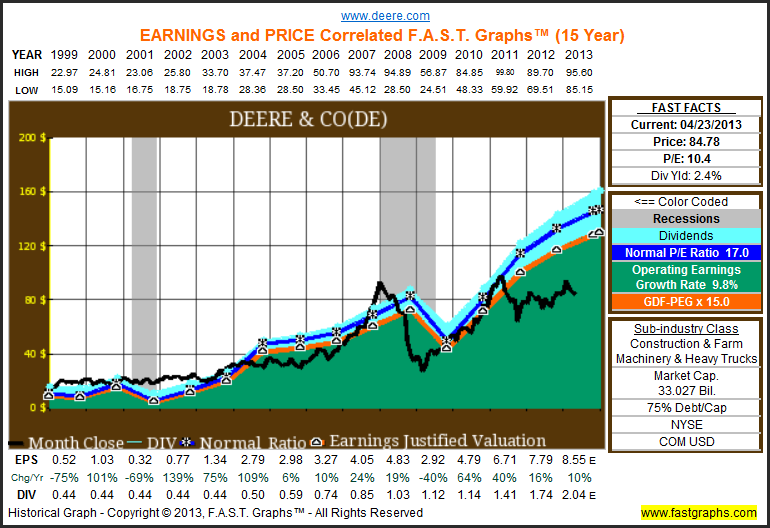

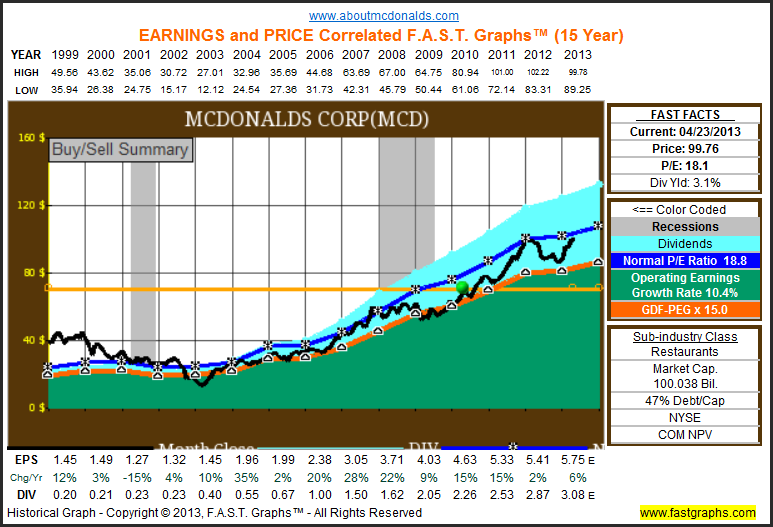

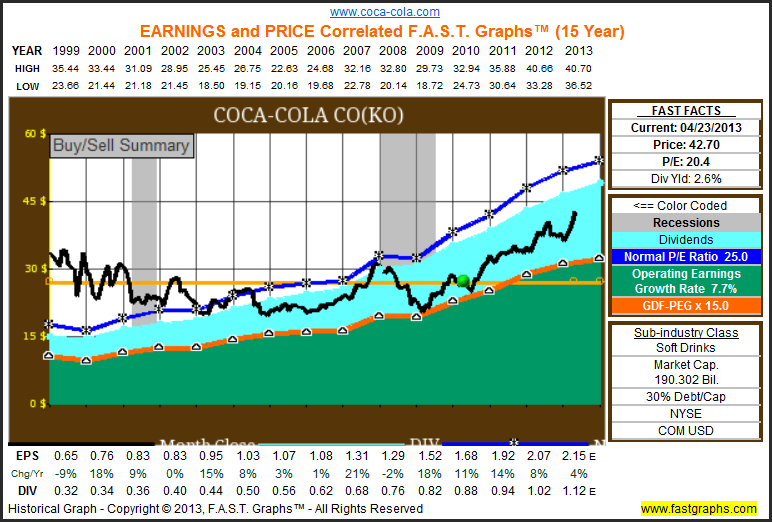

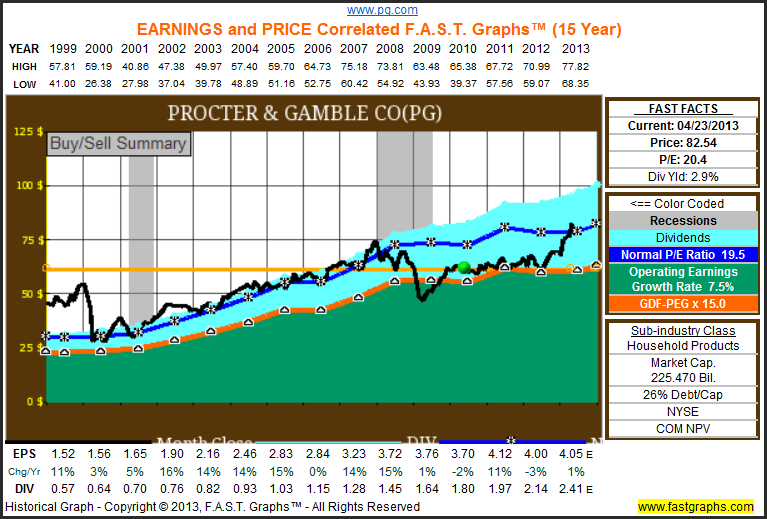

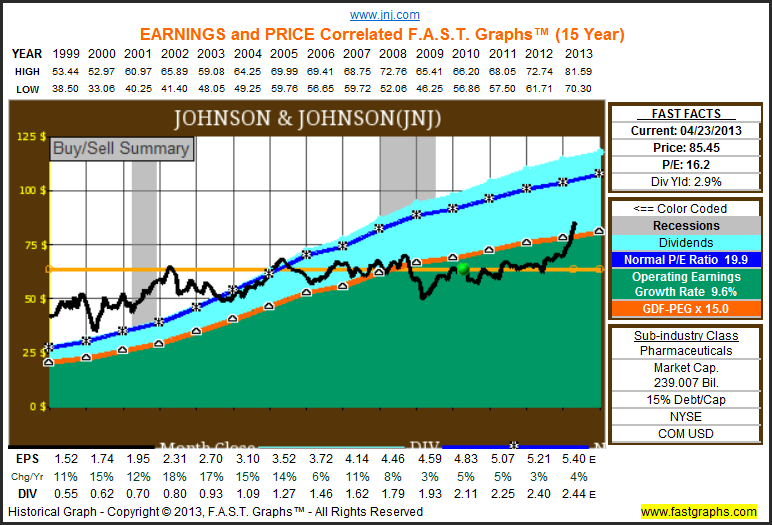

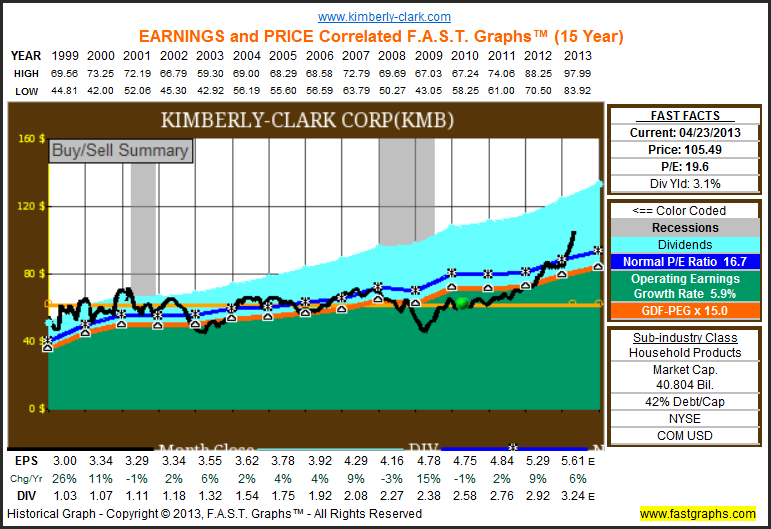

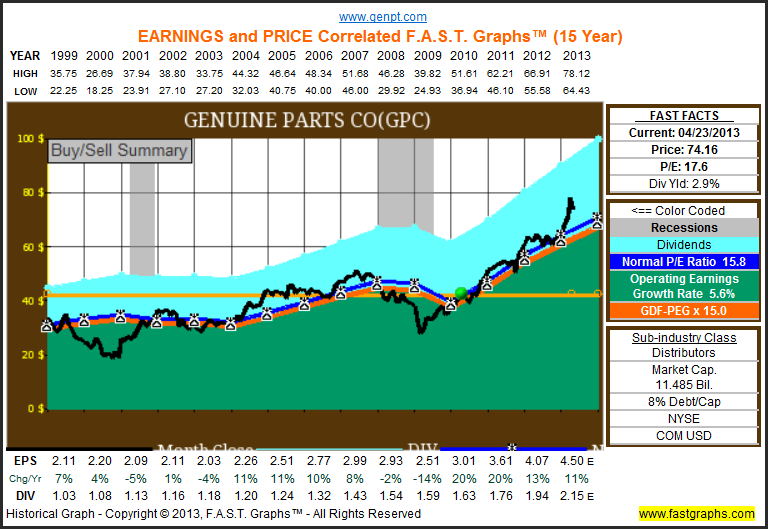

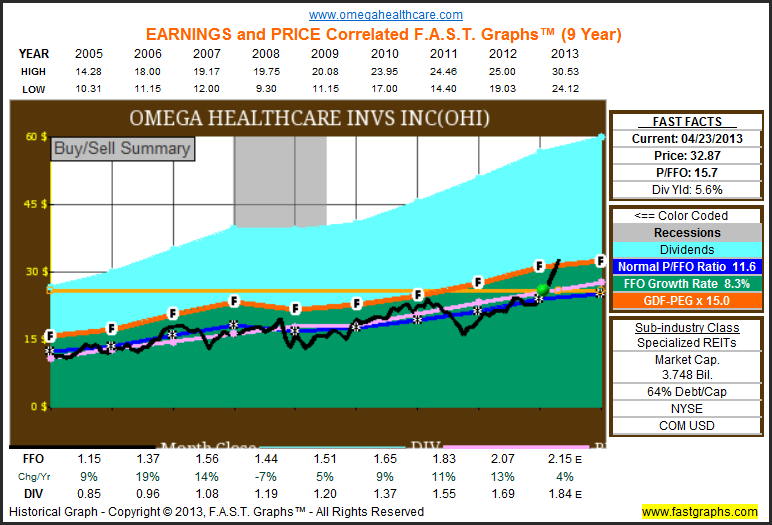

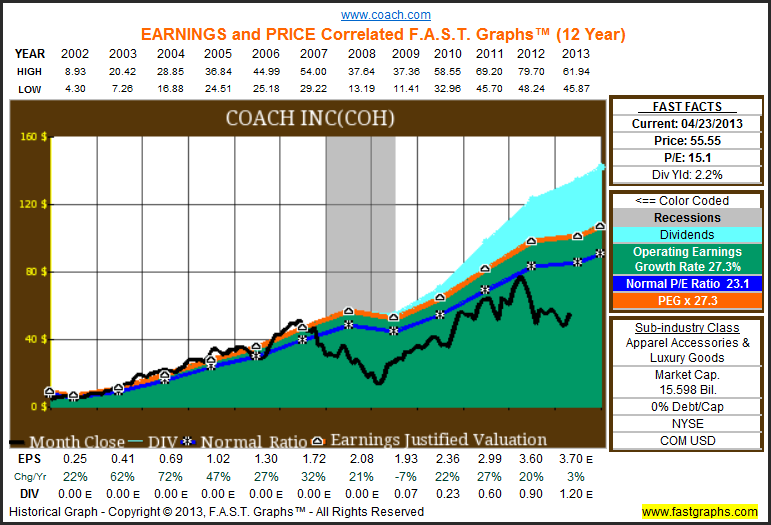

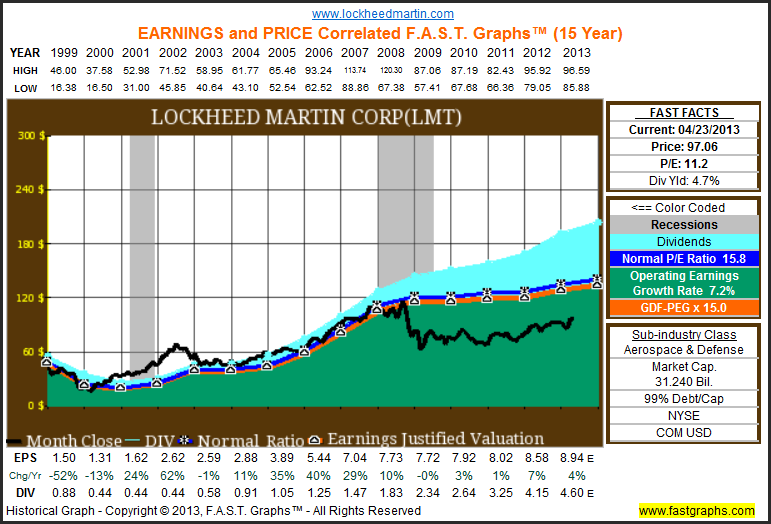

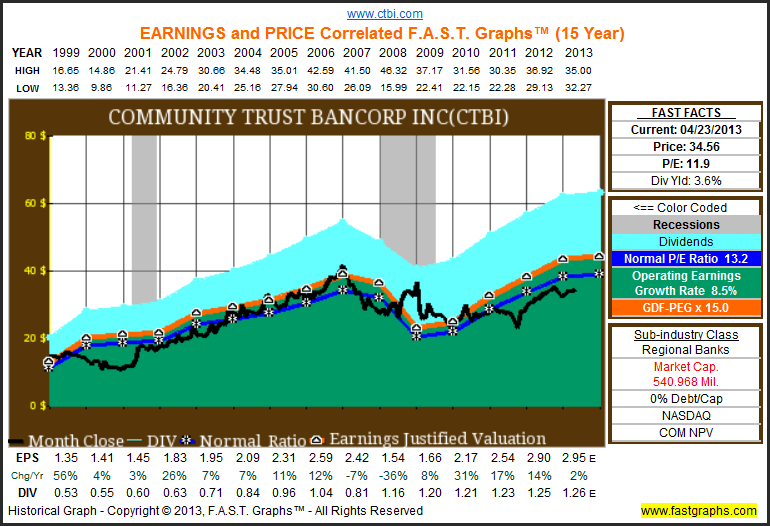

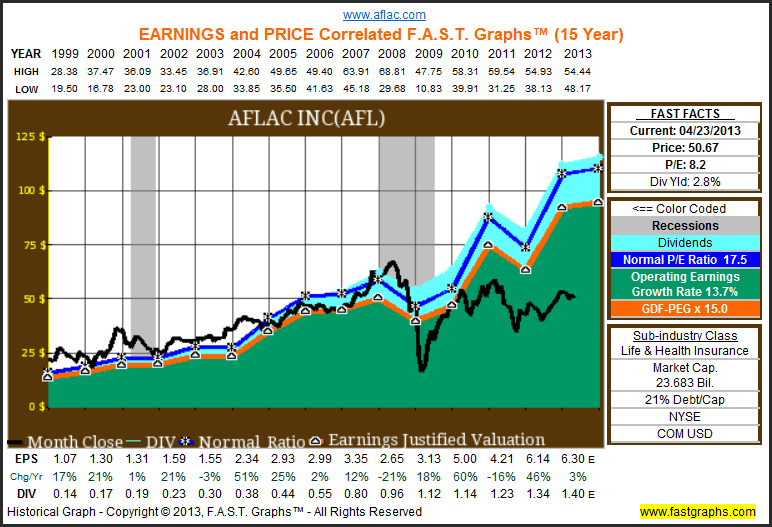

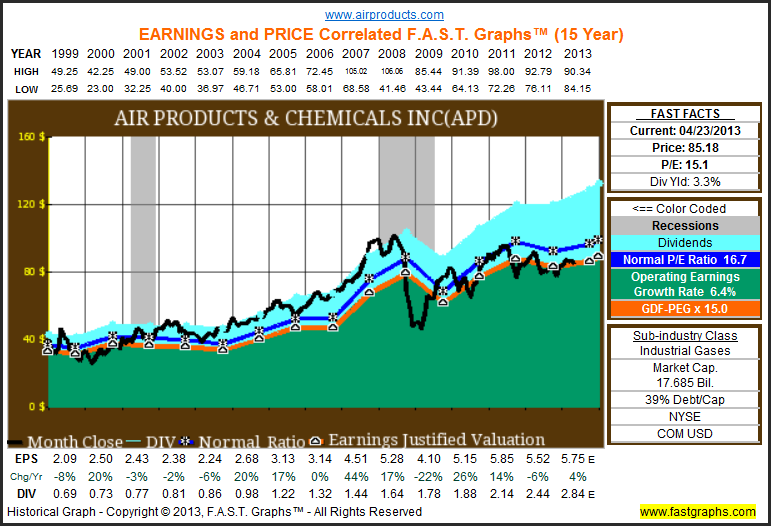

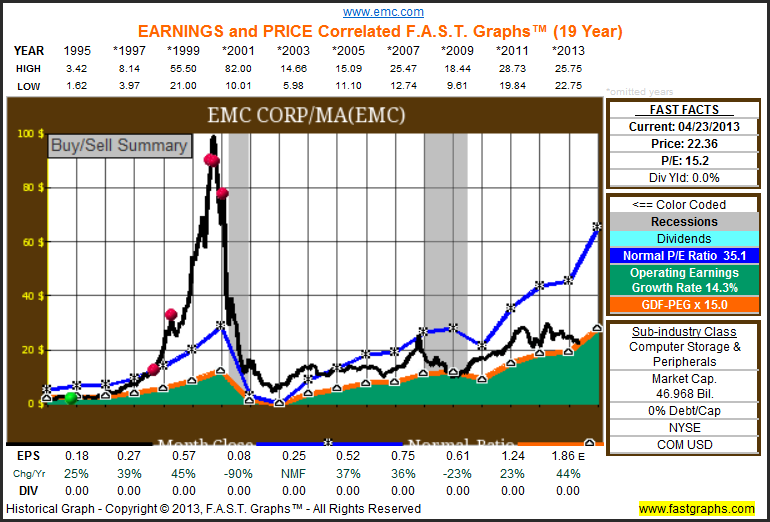

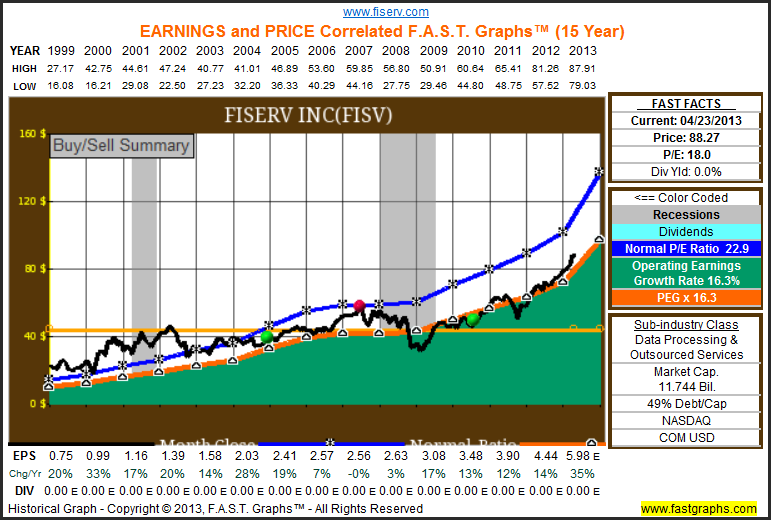

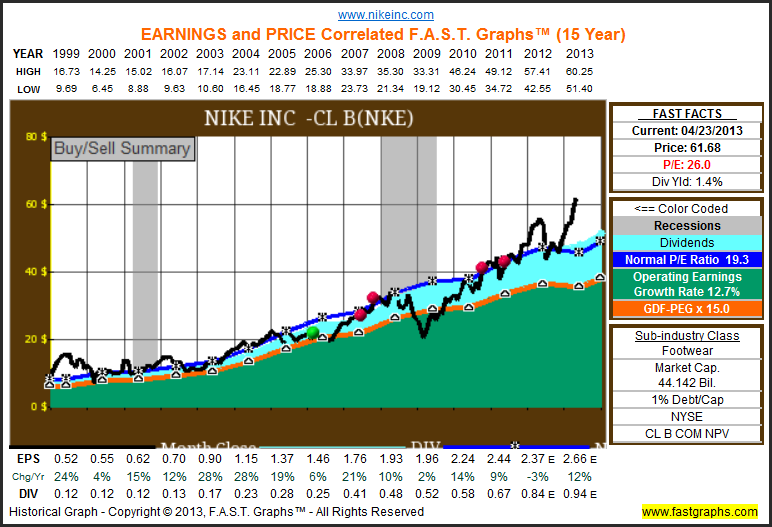

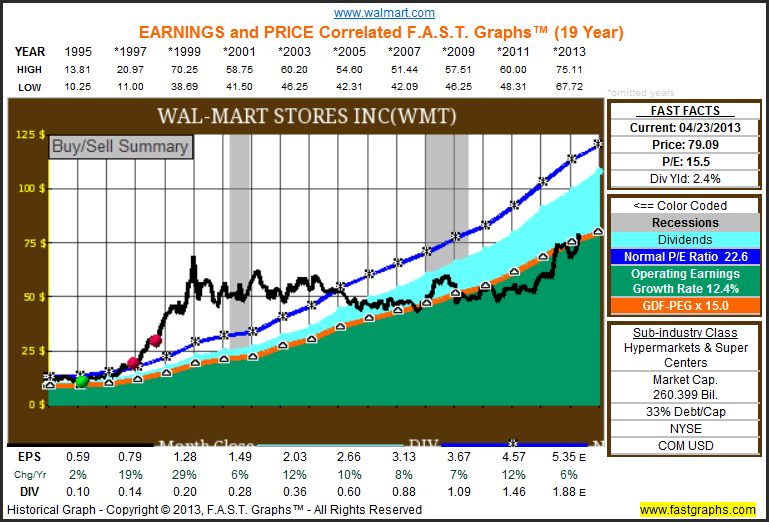

As usual, I will utilize the fundamentals analyzer software tool F.A.S.T. Graphs™ to articulate my thinking regarding each example I will present. I have marked each graph with a green dot illustrating when the stock was purchased, and the yellow line indicates cost basis. For new readers, the orange line represents a calculated earnings justified fair valuation. The black line on the graph represents monthly closing stock prices. The light blue shaded area illustrates dividends paid out of earnings, and the dark blue line illustrates the normal price earnings ratio that the market has historically applied.

What Do I Do With My Two Utilities With Moderate Overvaluation?

My first two examples will examine two utilities, SCANA Corp. (SCG), and Nextera Energy Inc (NEE) (formerly Florida Power & Light). In both cases, these were purchased because they offered a current yield at time of purchase of more than 4%. In my mind, I saw these as quasi bond alternatives. In other words, my objective for owning them was their high yield, and low betas (approximately .5 for each), and not because I expected any significant capital appreciation. Consequently, since both were purchased for their income, I have no intention of selling either as long as their dividends remain intact.

Based on the earnings and price correlated graphs on each, both were purchased when they were undervalued, and both are currently modestly overvalued. However, I do not believe the downside potential from overvaluation on either sample warrants a sell. On the other hand, I should also add that I do not believe that either company is a sound purchase at today’s overvalued levels.

Essentially, this decision is based on the fact that finding a suitable replacement trading at fair value or below, low betas and with a similar yield and quality, is not readily available in today’s marketplace. Furthermore, these are typical low growth utilities, and my low cost basis provides me a margin of safety that would be hard to replicate. In these cases, I take the lead of Warren Buffett where inactivity strikes me as intelligent behavior.

Nextera Energy Inc

SCANA Corp

When The Sell Decision Is Made For Me

As a general statement, there are usually only two reasons why I will ever sell a common stock when I am in control of the decision. The first and most common reason is dangerous overvaluation. I define overvaluation as dangerous when it is at a level that would take years for me to recover my current profits if the stock were to move into fair value range. It’s important to add here that it needs to be understood that a precise calculation of fair value is nebulous at best. Consequently, I am reticent to act unless overvaluation is so high as to be too obvious to ignore.

My second reason would be a permanent deterioration in the fundamentals of the company. It’s important to emphasize here that a few bad quarters, or even a down year or two, may not indicate a permanent fundamental deterioration. Nor would a modest change in the company’s growth rate indicate permanent deterioration, especially if it was considered temporary.

However, there is a third reason that is out of my control. My next example, Heinz Co (HNZ) represents a stock that Warren Buffett and a consortium have purchased outright. Consequently, this decision is easy, I will simply either wait until I receive the cash as follows: “At the closing of the transaction, Heinz shareholders will receive $72.50 in cash for each share of common stock they own, in a transaction valued at $28 billion, including the assumption of Heinz’s outstanding debt.”

Heinz Co

Perhaps in sympathy with the Heinz transaction, Campbell Soup Co (CPB) has experienced a similar spike in valuation. Consequently, I have added Campbell Soup to my candidates-for-sell list. Thanks to the great recession, I was fortunate to have the opportunity to acquire this blue-chip at a discount to its fair value. However, at its current quotation I believe the stock’s valuation has become extended.

Campbell Soup Co

Potential Replacements for Heinz and Campbell Soup

Personally, I like to have a replacement in mind before I sell out of a holding. Since the Heinz transaction is outside of my control, I have begun researching prospective replacements. One company that has currently caught my eye is Emerson Electric (EMR). Although I’m not yet finished with my due diligence, replacing Heinz with Emerson Electric makes sense on several counts.

First of all, the current dividend yield on Emerson Electric is slightly higher than Heinz. Therefore, I will take no-hit on the income generation of the portfolio by replacing Heinz with Emerson Electric. Moreover, I feel that Emerson Electric is fairly valued and possesses the potential for more rapid growth in both earnings and dividends over the long run. I also like the fact that the debt to capital ratio on Emerson is approximately half of what it is on Heinz.

Currently my biggest dilemma is do I wait to get the Heinz cash, or bite the bullet and pay the commission to sell it in the open market? The risk of waiting for the cash would be that Emerson runs up in value before I get the cash, thereby moving out of fair valuation range. Consequently, although the decision to sell Heinz is more or less etched in stone, like the old Fram oil filter commercial, I have to decide whether I should “pay me now or pay me later.”

Emerson Electric (EMR)

As a potential replacement for Campbell Soup, I have begun researching Deere & Company (DE). The current yield on Deere & Company is about the same, each company’s debt to capital ratio is similar, but I also see more growth potential with Deere & Company. At this point it’s important to state that I am only utilizing Deere as an example of a potential replacement, because there are other companies I am also currently exploring that are at fair value with similar yields.

Deere & Company

Four Blue-Chip Holdings with Premium Historic Valuations

These next four examples present a real conundrum regarding what fair valuation might actually be. Each of these next four companies are recognized blue chips, and as such, each has a legacy where the market has historically been willing to apply a premium valuation to their shares (the dark blue line on the graphs). Personally, I accept that fact as revealed by the respective normal P/E ratios on the earnings and price correlated F.A.S.T. Graphs™ for each company.

Although the premium valuation normally applied by the market is undeniable, it’s up to the individual investor to decide whether they are willing to pay that premium or not. In my case, although I have long admired each of these companies, I patiently waited until the great recession afforded me the opportunity to purchase them at fair valuations. I do not like paying more for a company than I believe its fundamentals justify. However, now that I hold each at such a low cost basis, what should I do as each company is clearly moving back into their normal premium valuation ranges?

Do I consider them now overvalued, or do I acknowledge that they are trading at justified premiums due to the quality of each of these blue-chip stalwarts? In each of these four cases, I must accept that finding them at my strict definition of fair value is a very rare occurrence. But now that I have, do I count my blessings and hold on to them, or take my profits and run? I am not sure there is a right answer to this last question. In other words, the facts are what they are, leaving it up to each individual investor’s own judgment as to what to do. In my case, I’m holding on for now, but I am not willing to add new money at these levels either, but I would if they move back to fair value again.

McDonalds Corp (MCD)

Coca-Cola Co (KO)

Procter & Gamble Co (PG)

Johnson & Johnson (JNJ)

Two Great Companies Approaching Dangerous Overvaluation

Kimberly-Clark Corp (KMB) and Genuine Parts Company (GPC) are two examples of companies that have moved into moderate overvaluation territory. Consequently, both are currently on my candidates-for-sell-list. However, once a company apparently becomes overvalued, I only flag it for sell, and then continuously monitor the position. In other words, I am not fond of reacting, or you could say overreacting, to every little wiggle in stock price. As I will illustrate later, there are many levels of overvaluation, and numerous outcomes that can happen after it occurs.

Kimberly-Clark Corp

Genuine Parts Co

The Yield is Too High to Sell

Omega Healthcare (OHI) presents a real dilemma regarding its current valuation. Due to the company’s high-yield, which was my primary attraction to investing in this Healthcare REIT, I am reticent to sell it at its current moderate overvaluation. Instead, I am willing to accept some volatility in order to continue to be able to harvest its above-average and growing yield. For an additional point of clarification, look closely at the graph and the fair valuation metrics (note that when evaluating REITs, FFO is used in lieu of earnings). If Omega Healthcare’s price was to fall to its income justified valuation line (the pink line) by year-end, it would still be above my current cost basis (the yellow line).

Consequently, the current moderate overvaluation does not justify an outright sell, in my opinion. However, I would not be willing to make new purchases at these levels either. Some would argue that if a stock is not a buy, then it should be an outright sell. I disagree on the principle that a portfolio is like a bar soap, the more you handle it the smaller it gets. Later I will present examples of the potential pitfalls of acting too hastily regarding buy or sell decisions.

Omega Healthcare

Examples of Potential Undervalued or Fairly Valued Replacements

Even though the market has gone on such an incredible run recently, not all stocks have moved into overvaluation territory. The following is a representative list (not a complete list) of several companies that appear undervalued based on fundamentals that might be worthy of a more comprehensive due diligence effort. To be clear, I’m not representing these as buys, rather I am representing them as candidates for closer scrutiny. My point in showing them is to illustrate that even in this, what many believe to be an overheated market, there’s plenty of fair value to be found if you look closely enough.

Coach Inc (COH)

Lockheed Martin Corp (LMT)

Community Trust Bancorp Inc (CTBI)

Aflac Inc (AFL)

Air Products & Chemicals Inc (APD)

Lessons Learned (Maybe) From Past Behavior

One of the great advantages of possessing a powerful research tool like F.A.S.T. Graphs™ is the opportunity it provides to revisit past behaviors and actions. The premium version allows the user to mark past buy and sell decisions, and review them years later (the green and red dots on the graphs). In my own experience, I find it very useful to review past decisions with the objective of learning from my past. Although I’ve made many investing mistakes in the past, I regret none of them because I always did my homework and applied my best judgments given what I knew at the time.

EMC Corp (EMC)

Although not a dividend growth stock, I present EMC Corp as an example of dangerous overvaluation to the extreme, and as a classic picture of a true bubble valuation. Notice that I purchased the stock in August 1995 (the green dot) when price was aligned with fair value (touching the orange line). Approximately 2 and three-quarter years later, I sold what amounted to 1/5 of my position, which generated all of my original investment, plus a reasonable profit. Nevertheless, as it turned out, I was leaving more money than I thought possible on the table, even though the decision was sound long-term (note that by 2002 the price had fallen below my first sell).

At this point, I was playing with proverbial house money and I sold another 1/5 of my original position at a substantial profit. This second sell alone generated a pure profit which was almost 4 times my original investment. Now I was convinced that the stock had peaked and was poised to liquidate my remaining shares.

However, the appetite for tech remained at a fevered pitch, and I held on, only to watch the stock almost triple from my last sell. My third sell alone netted more than 10 times my original investment, and my fourth sell a similar number. My fifth and final sell culminated in total profits that were almost 35 times my original investment, and proved to be a very fortuitous decision as EMC’s stock price finally reverted to the mean and collapsed.

The important lessons to be learned here are that there is no telling how irrational the market can get. In my opinion, each and every one of my five unwindings of this position were done at what I believed were obvious and dangerous overvaluation levels. Interestingly, in the long run I was correct in each and every case. But the reader should understand that this was an extremely rare and unusual situation.

Furthermore, the only reason I was willing to hold on was because I was playing with house money after my initial sell. Although I consider every one of my decisions good ones, they were all far from perfect. Ascertaining overvaluation correctly is easier said than done to perfection, but it can, and should be done, when reason dictates.

Fiserv Inc (FISV)

My next example, Fiserv, is another non-dividend paying stock that I wanted to share because it tells a quintessential story where valuation works perfectly. I originally invested in this company in November 2004 when it was fairly valued, and subsequently sold out at the end of May 2007 at a tidy profit. I tend to be quicker to pull the trigger when there’s no dividend involved. I then repurchase the company in April 2010 again at fair value, and again I’m currently enjoying a nice profit. I do consider the stock only modestly overvalued, and I’m happy to continue holding it based on its impeccable long-term operating record.

Nike Inc (NKE)

My Nike example tells two important stories about buying and selling based on overvaluation. My original purchase was sound and my first two sells where appropriate, but not complete. Some 14 months later, Nike was trading substantially lower than I partially sold it for. However, I still had half of my original position, which I was now holding at a loss.

Then coming out of the recession Nike once again moved to a similar overvaluation level at which I sold my original half position. Learning my lesson, at least I thought I did, I was happy to liquidate my remaining shares. Approximately two years later Nike is trading at a significant premium to my final liquidating price. Since my final outcome was a substantial profit on all shares, I really can’t complain. However, Mr. Market has taught me that he is a very unreliable partner. Nevertheless, I consider Nike one of my favorite companies, but I continue to believe it is significantly overvalued.

Wal-Mart Stores Inc. (WMT)

My final example, Wal-Mart Stores, teaches another important iteration of the dangers of overvaluation. I originally bought Wal-Mart at a fair valuation in October 1995. Two years later I sold half my position, convinced that the stock can become overvalued. Approximately seven months later I liquidated the holding completely as I was then absolutely convinced that the price had risen as high as it possibly could. Of course, I was wrong as the stock advanced for approximately another 18 months before it hit a wall.

Then for approximately the next eight years Wal-Mart’s stock price, now completely disconnected from its earnings justified valuation, had nowhere to go but sideways, then down. Consequently, even though the company generated strong and consistent earnings growth, shareholders actually experienced losses due to the headwinds of extreme overvaluation. Wal-Mart did not fall quickly like EMC did, instead it went into a torturous decline spanning many years.

Summary and Conclusions

There is no doubt that the recent run-up in stock prices has created overvaluation in many stocks. On the other hand, there are still many stocks that are reasonably valued, and even some that are undervalued. So the important point that I am suggesting is to make your valuation decisions one company at a time.

If you do hold overvalued positions, I also suggest that you remember the principles that were cited by Warren Buffett earlier in the article. If you are buying businesses, then the ultimate strategy is to hold as long as the business remains strong, and valuations fluctuate within a reasonable range. I only recommend liquidating a position if the risk of owning it is too great to hold any longer, or if you come across a compelling alternative that improves your overall portfolio position.

With this article I attempted to illustrate that valuation comes in many sizes, shapes and flavors, and each will dictate the appropriate behavior and actions required or necessary to deal with it. Sometimes the best course of action is to simply hold tight. At other times it might make sense to partially liquidate a holding if the momentum is strong. This can be especially beneficial if you can de-risk your portfolio by taking all of your original cost or more out with a partial liquidation. In other times outright total sells makes the most sense.

Yet, at the end of the day, I believe investment decisions are best made once you have run all the numbers out to their logical conclusions. To be a successful long-term investor, you have to be willing to withstand a certain amount of volatility. However, if the risk gets too large, then taking appropriate action may be the best course. But the truth is, there is no perfect one answer that fits all occasions.

In each and every situation, the best answers to the questions raised in this article are the ones that make the most sense to the individual asking them. Finally, the goal is not to be perfectly right, because that is a virtual impossibility. Instead, the more rational objective is to make sound decisions that both protect your portfolio while simultaneously allowing it to continue to perform according to your long-term objectives. This is especially important for the dividend growth investor already in retirement. For more color on dealing with stock price volatility, you might want to follow this link to my previous article.

Disclosure: Long NEE, SCG, HNZ, KMB, KO, PG, CPB, JNJ, GPC, MCD, OHI, COH, LMT, BBL, AFL, DE, EMR, FISV, NKE at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Many Of My Dividend Growth Stocks Have Become Overvalued, What Do I Do

Published 04/26/2013, 08:07 AM

Updated 07/09/2023, 06:31 AM

Many Of My Dividend Growth Stocks Have Become Overvalued, What Do I Do

Introduction

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.