Market Notes

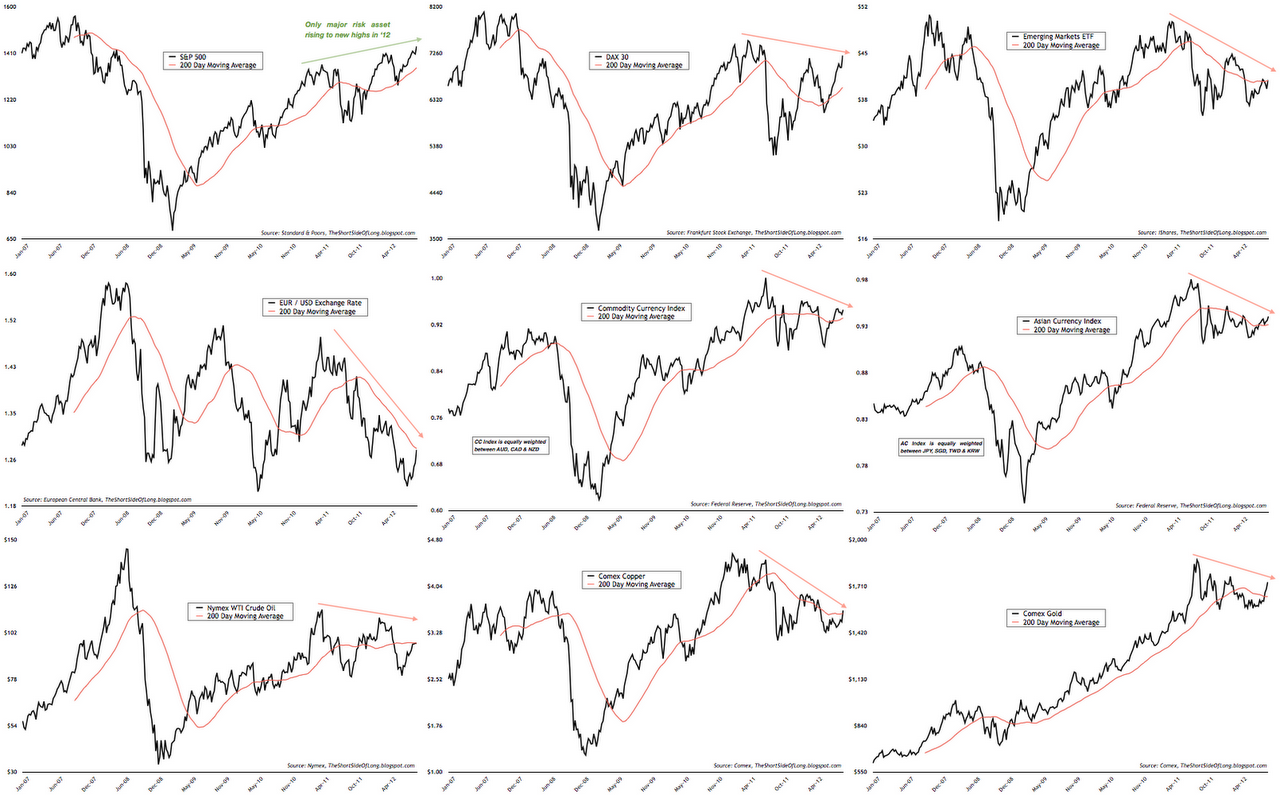

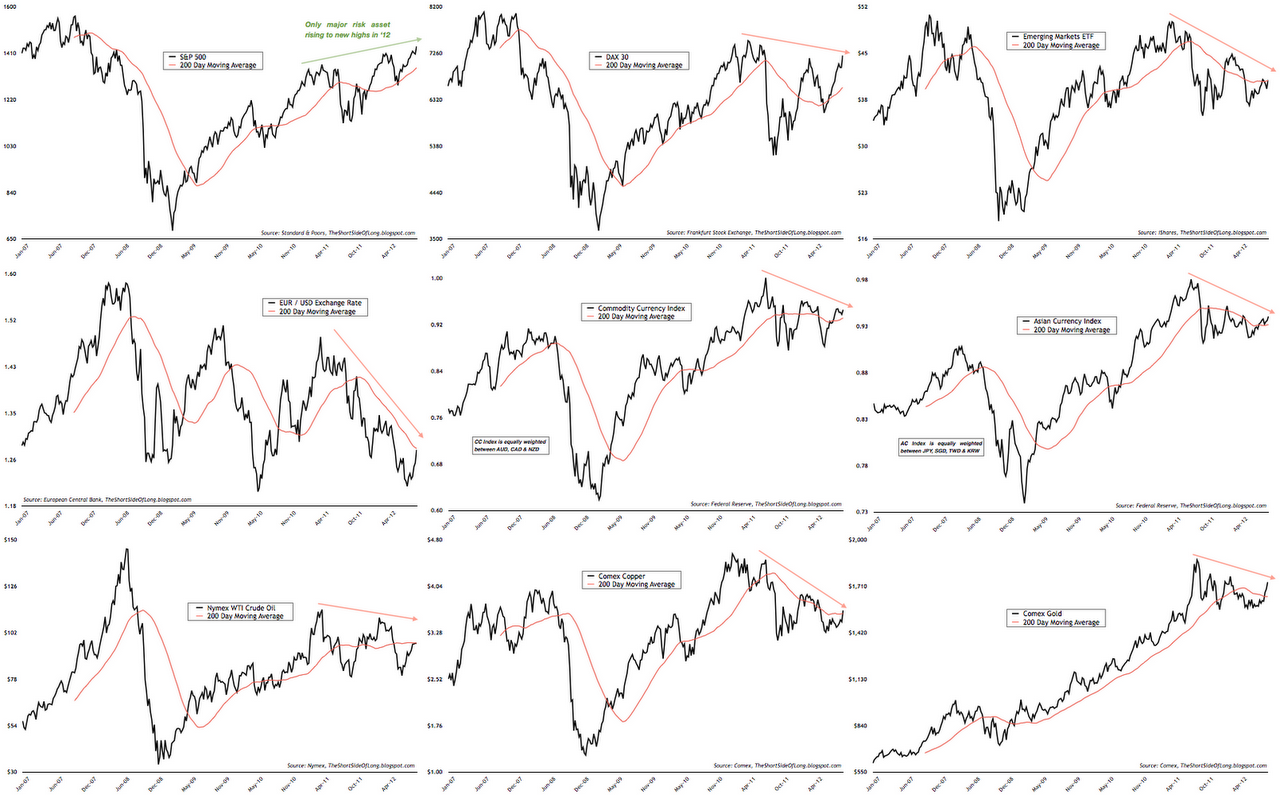

A week full of central bank intervention promises has pushed risk assets out of oversold levels. The euro has experienced a 7 cent rally from its previous bottom around $1.20. Copper, which tends to be an industrial economic indicator, is attempting to break above its 200 MA. However, Copper is far away from confirming the S&P's new highs in 2012. The Emerging Markets, saviour of global growth in the post Lehman recovery, continue to lag other equity indices indicating that not all is well with the BRICs. Currencies and precious metals have technically broken out to the upside, but the real test will come as volatility of global risk assets rise and if the US Dollar starts to rally again. Finally, the DAX is now moving almost vertically like a NASA rocket!

I believe that the current level of investor hope (easily found on blogs and forums throughout the net) is completely misguided and completely disconnected from fundamental conditions. Hope that the US will miss a recession, hope that central bank stimulus will revive economic growth, hope that China has a soft landing instead of a hard landing, and finally hope towards authorities finding a solution in the Eurozone crisis. There is a lot of hope out there, but from a contrarian point of view, I hold absolutely none. Personally, I believe a global recession is imminent as manufacturing is now entering a sustained contraction period. The printing of money cannot automatically revive manufacturing or global trade (if it could the Fed would have stopped every recession since 1913). Let us do a world tour starting with the US and finishing off here in Asia.

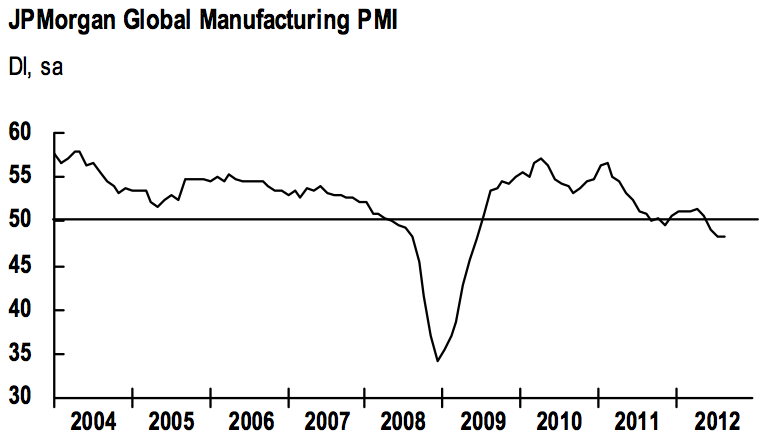

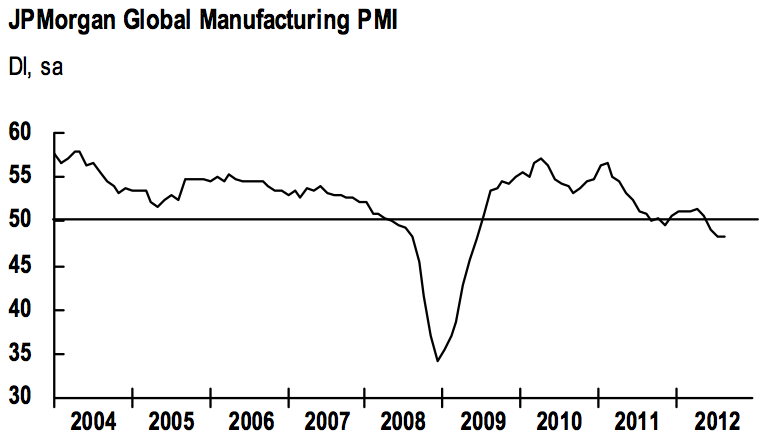

Global manufacturing activity, measured by JP Morgan PMI, continues to slow. We now have 80% of the world's PMIs in contraction territory, which removes the notion of economic de-coupling. Make no mistake about this, the world is in a synchronised slowdown. Commenting on the Global Manufacturing survey, David Hensley said:

"The August PMIs point to a further modest acceleration in the rate of contraction of global industry, as the sector is buffeted by rising headwinds in a number of key economic regions and falling levels of international trade. The labour market is still holding up better than the activity indicators, but this could be threatened as signs of excess capacity become more visible.”

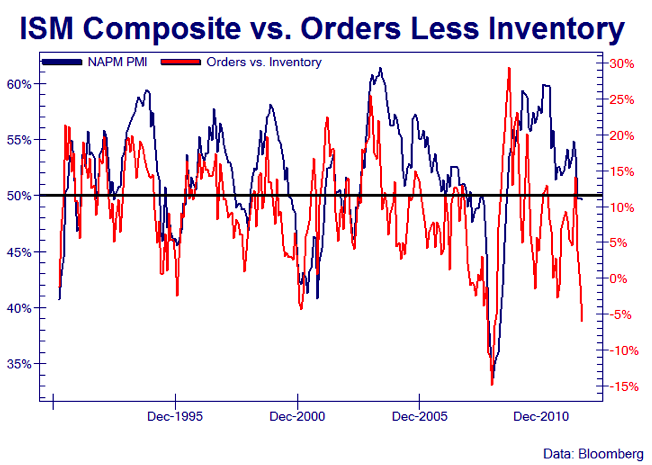

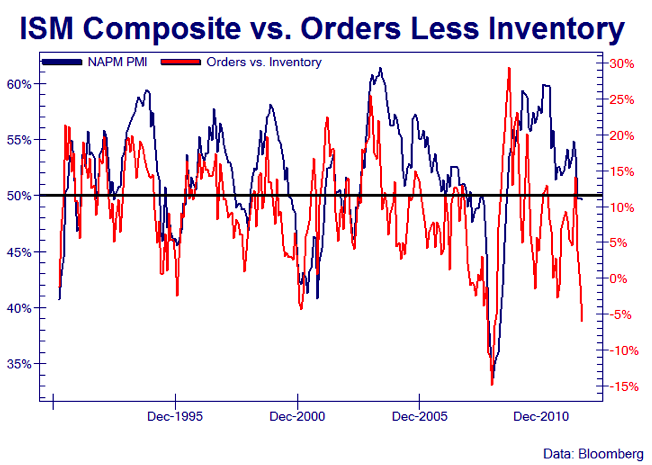

US Manufacturing readings, measured by NBER ISM data, came in below 50 for the third consecutive month. New Orders declined further into contraction territory, while inventory levels have built up to their highest level in 27 months. A combination of both, known as Orders less Inventory, came in at levels indicating recession territory similar to 2008. Commenting on the US Manufacturing survey, Bradley J. Holcomb said:

"The PMI registered 49.6 percent, a decrease of 0.2 percentage point from July's reading of 49.8 percent, indicating contraction in the manufacturing sector for the third consecutive month. This is also the lowest reading for the PMI™ since July 2009. The New Orders Index registered 47.1 percent, a decrease of 0.9 percentage point from July, indicating contraction in new orders for the third consecutive month. Comments from the panel generally reflect a slowdown in orders and demand, with continuing concern over the uncertain state of global economies."

Bob Pisani, over at the Trader Talk blog, summarised the ISM quite well too. He stated that this month's ISM report had a strong message with a key word - slowdown - appearing everywhere. He listed various reports from subcomponent industries out of the survey, where "slowdown" or something similar appear. Here is the list from his blog:

"Internal indicators and feedback from sales channels are indicating a SLOWDOWN in demand for capital equipment." (Machinery)

"Business continues to be very solid, but there is now a SLOWING of incoming orders." (Fabricated Metal Products)

"Incoming orders have SLOWED somewhat, but indications are that there will be a stronger fourth quarter." (Plastics & Rubber Products)

"Business is SLOW right now. Companies seem to be holding onto their money." (Computer & Electronic Products)

"We can sense, feel and see HEADWINDS with customer orders, especially Europe related." (Apparel, Leather & Allied Products)

"New orders and backlog remain FLAT." (Miscellaneous Manufacturing)

"Auto industry SLOWING a bit in the second half [of the year]." (Transportation Equipment)

"LACKLUSTER demand continues in all regions of the world, and is supporting much lower raw materials prices in the second half of 2012." (Chemical Products)

Confirming the slowdown in both the global as well as US manufacturing, was the recent slump in Durable Goods Orders. This indicator has an amazingly strong correlation with both the US GDP data as well as the S&P 500, as we can see in the chart above. In his recent September report, a well notable bear, Albert Edwards wrote:

"The metric which really stood out for me over recent weeks was a truly awful US durable goods report. For although the headline July data rose by over 4%, both mom and yoy, the core measure of new orders has slumped (core is capital goods orders excluding the volatile aircraft component). Core orders fell 4% in July mom and 6.2% yoy. July was not a one off. This is now the fourth month out of the last five that core new orders have fallen sharply and is entirely consistent with the rapidly deteriorating profits backdrop.

If as I suspect, this is further evidence that the US economy has already entered recession, it will not be long before the US equity market reacts. Certainly, the recent pop in the market above 1425 to a post-crisis high sits badly with the facts on the ground (see chart). Irrespective of any prospect of QE3, the market will not resist this recessionary data for long. The S&P will be led hand-in-hand by the economic cycle over a cliff into free- fall. That will be the third phase of this secular valuation bear market."

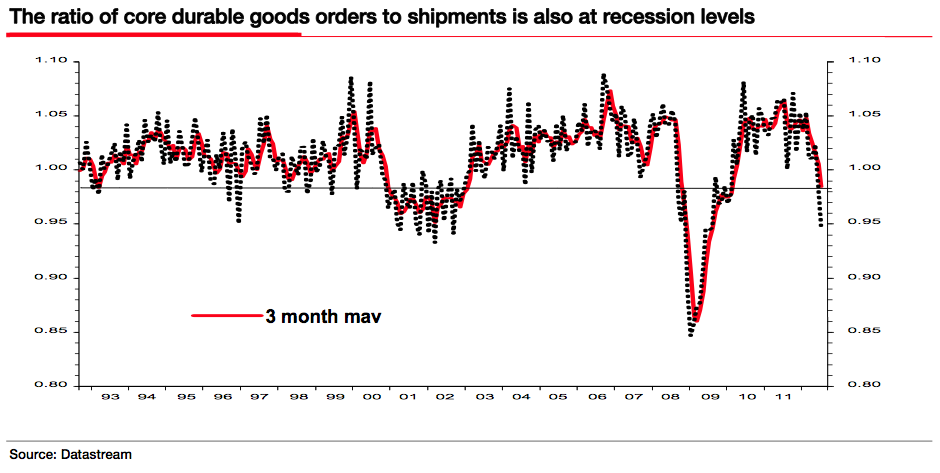

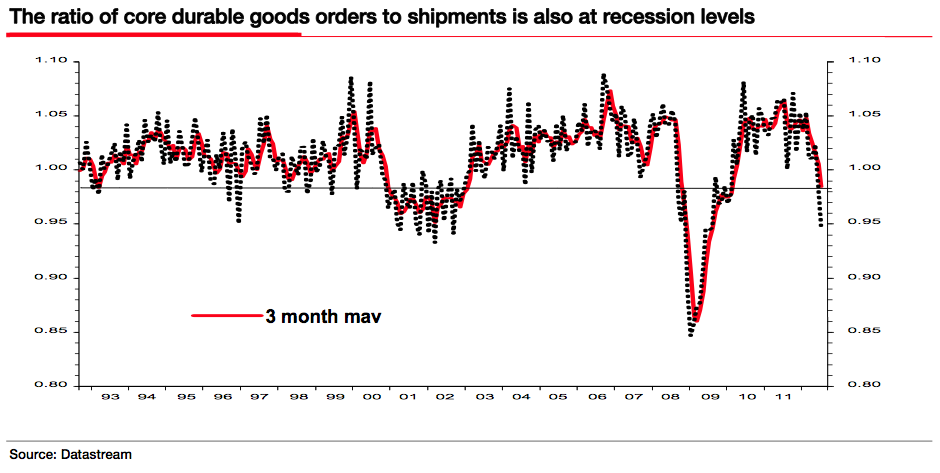

Recessions and economic contractions usually come about through inventory levels growing beyond demand, which forces companies to slash production and fire employees. For those not familiar with US GDP calculations, a point should be made that it is shipments that are included in the final readings, not new orders. That would mean current ratio between the two is signalling a recession (chart above). Albert summaries it perfectly:

"For it is capital goods shipments, not new orders, that go into the GDP data, as what is not shipped just piles up in inventories until capital goods producing companies bite the bullet and slash their own production schedules in line with the weak new order flow."

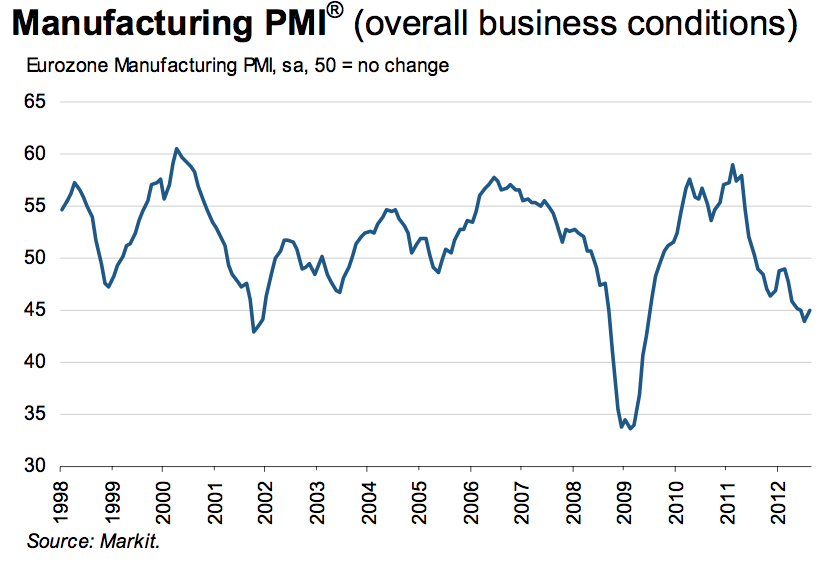

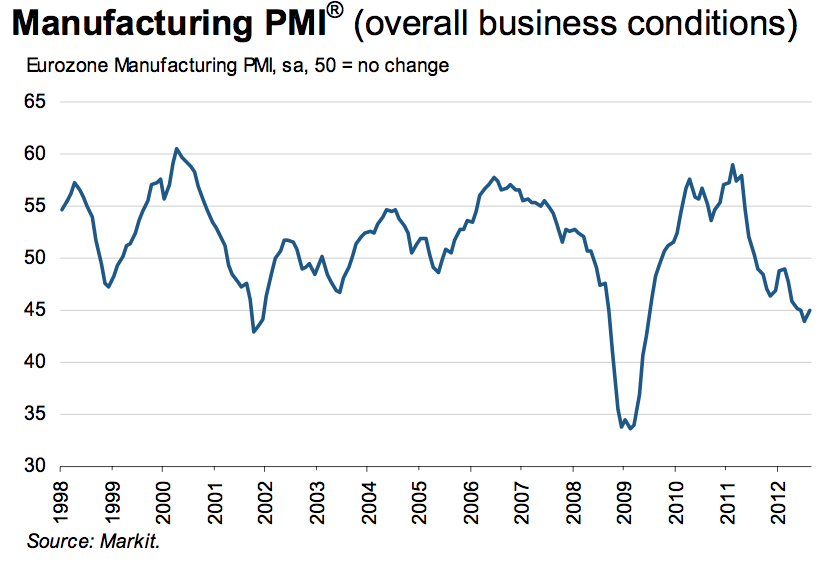

Eurozone Manufacturing, measured by Markit PMI, continued its theme of contraction, indicating that the Eurozone is entering a second recession within 3 years. Italy's PMI was at a 10 month low and Austria's at a 37 month low, while Spanish PMI was at a 5 month high and Netherlands at a 6 month high. Commenting on the Eurozone Manufacturing survey, Rob Dobson said:

“The final reading of the August PMI confirms that the Eurozone manufacturing sector remains firmly in contraction territory. The rate of decline was a little slower than in July, providing some heart that the manufacturing downturn may be easing, but the sector is on course to act as a drag on gross domestic product in the third quarter.

The national picture remains one of widespread contraction. Only Ireland saw manufacturing output rise, while larger nations like France and Germany remain in reverse gear. The situation in Italy is also becoming more of a cause for concern, as it falls further down the PMI league table."

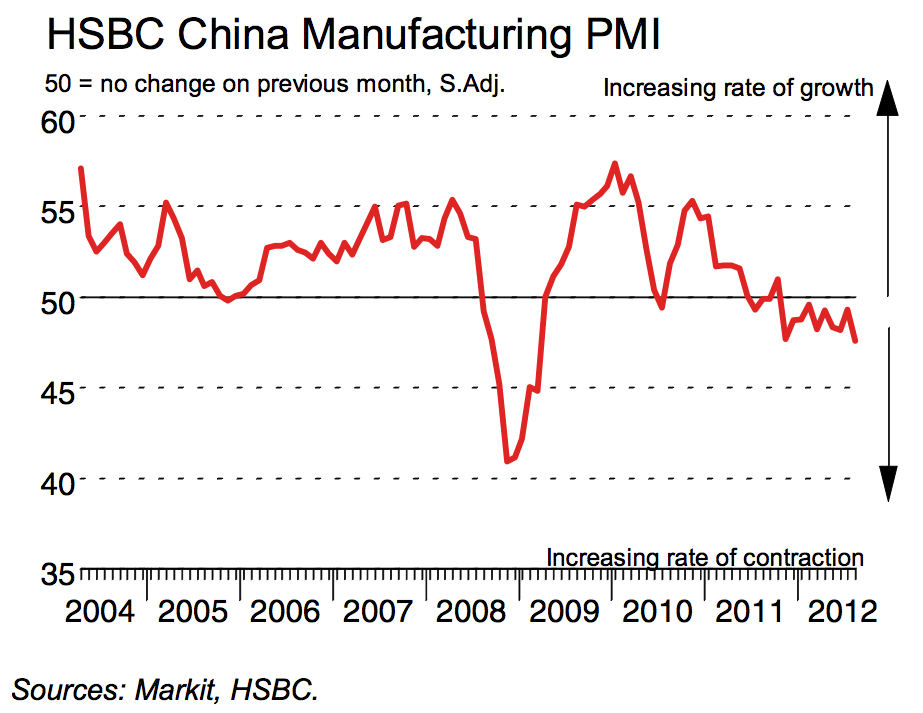

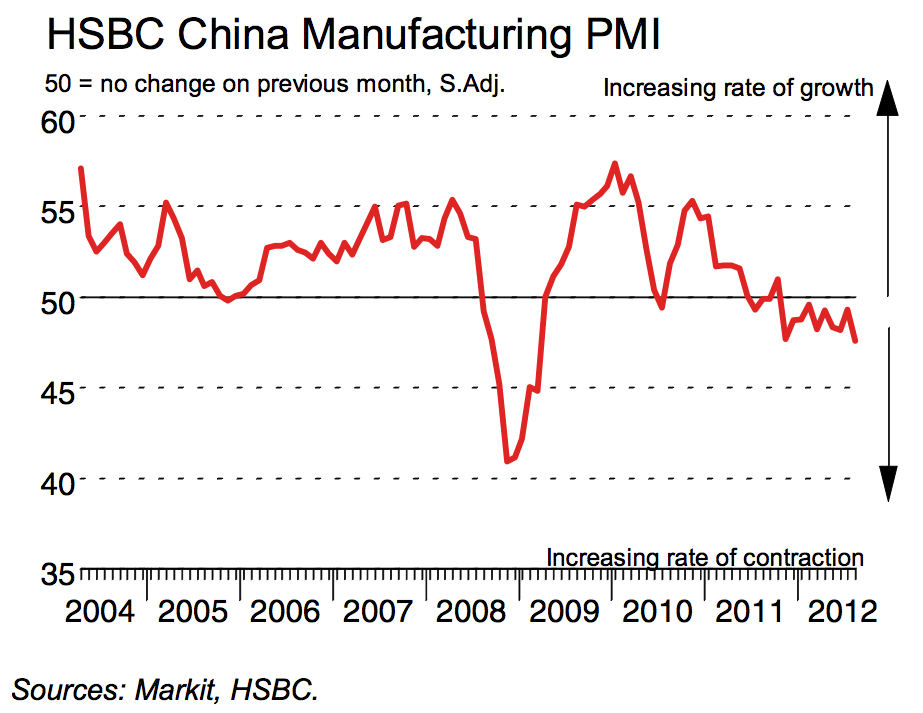

Chinese Manufacturing, measured by HSBC and Markit PMI, signalled a continued contraction in August. New orders came in at a 9 month low, which is a very worrying sign and confirms Asian export contraction. Let us not forget that many of these Asian economies are export reliant for growth and are now facing huge headwinds in the coming quarters. Commenting on the China Manufacturing survey, Hongbin Qu said:

“The final reading of the HSBC manufacturing PMI (August) confirmed that China's manufacturing sector still faces intensifying downward pressure. New export orders contracted at the fastest pace since March 2009, this, combined with a record high in stocks of finished goods sub-index, and a 41-month low employment index, suggests China's exporters are facing increasing difficulties amid stronger global headwinds.”

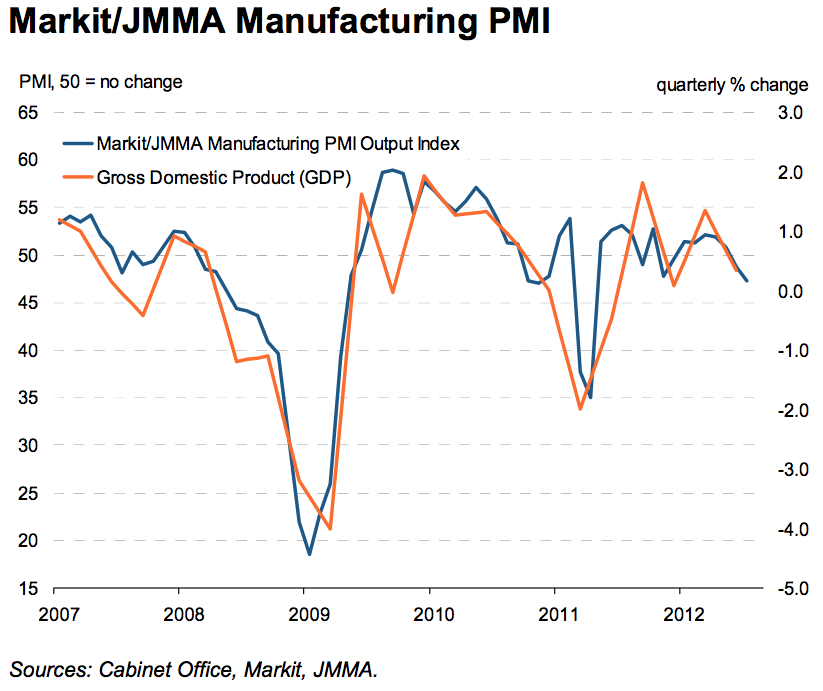

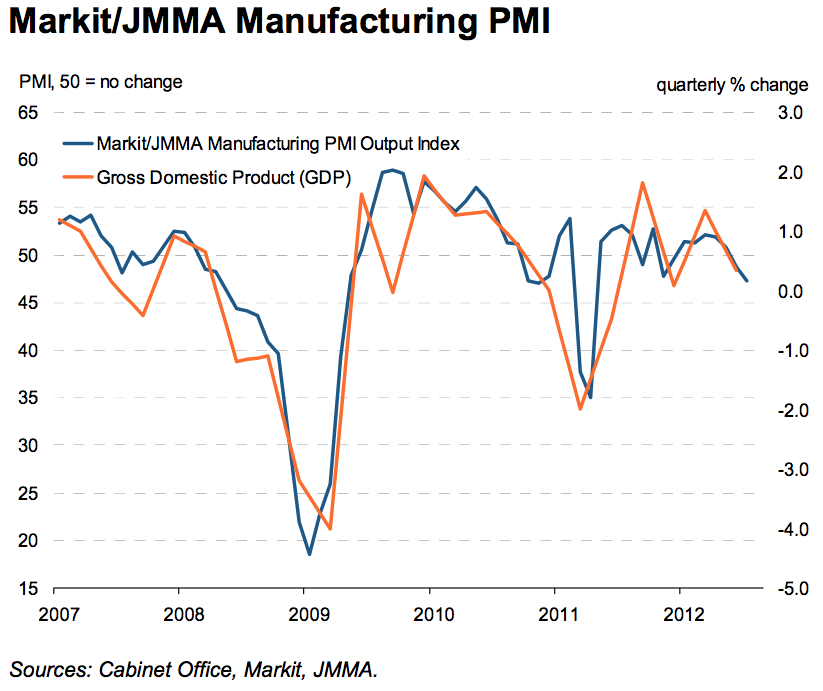

Japanese Manufacturing continues to slow at a more accelerated pace as well, with new orders down meaningfully in August. Production fell at the fastest rate in over 16 months, which is a sign that the post-earthquake economic rebound is now stalling. Commenting on the Japanese Manufacturing survey data, Alex Hamilton said:

“Japan’s manufacturing sector downturn continued in August, according to PMI survey findings. The data provide further evidence to suggest that growth in the world’s third largest economy is faltering in the face of weakening global demand conditions. Overall new business (exports plus domestic) declined at a solid rate, while the index measuring trends in factory output fell further over the month.

There was more deflationary news on the price front, with average input costs and output charges decreasing simultaneously for a third month running. Meanwhile, a muted labour market picture was signalled by the latest survey, with employment stagnating.”

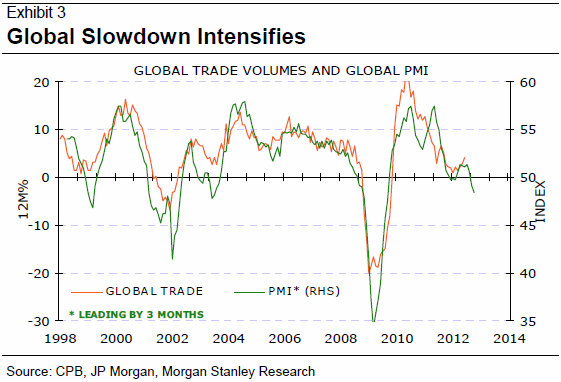

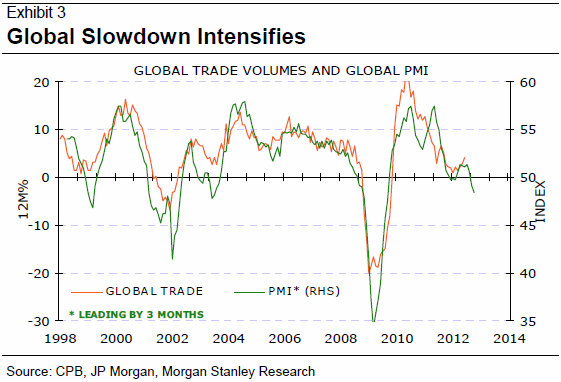

So what can we expect as global manufacturing continues to slow? In my opinion there are two answers: a basic quick answer and a more in-depth one. The quick answer is most likely linked to a global recession. The more in depth answer is seen in the chart below:

According to Morgan Stanley research, global manufacturing tends to lead global trade volumes by about three months. If we were to do basic mathematics, the indicator above implies that global trade volumes would start contracting by the end of Q4 of 2012 (post elections in the US). There is already evidence of a slowdown in certain trading hot spots around the world, like the Suez Canal where 8% of the worlds freight flows annually.

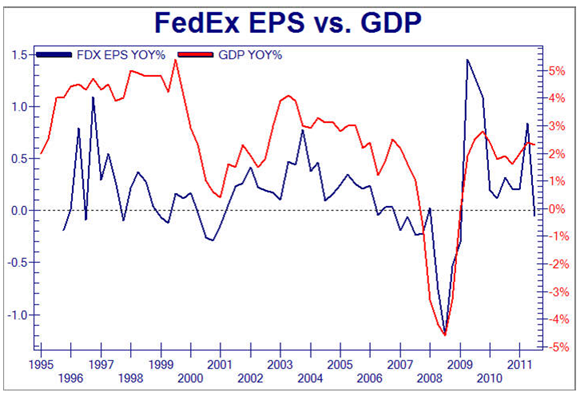

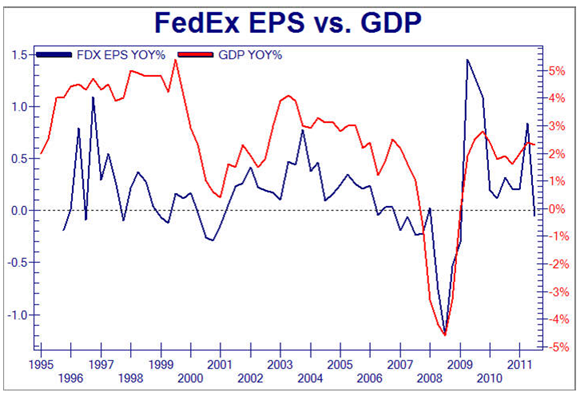

In this weeks news, FedEx confirmed that global air freight trade volumes are already starting to contract, as the company issued profit warnings (believe me more of them are about to come). Bloomberg writes:

"FedEx Corp. (FDX), operator of the world’s largest cargo airline, said quarterly earnings will fall short of its forecast after a weak global economy damped revenue from express shipments.

The cut in profit adds to evidence of how Europe’s economic slump and slowing growth in Asia are dragging on FedEx, which is seeking money-saving efforts such as buyouts for some employees. The company is considered an economic bellwether because it moves goods ranging from financial documents to pharmaceuticals."

The chart above shows how FedEx earnings tend to be a strong leading indication of the direction of the US GDP. It is only a matter of time until bullish economists realise that this is not just another summer slowdown viz-a-viz 2010 and 2011.

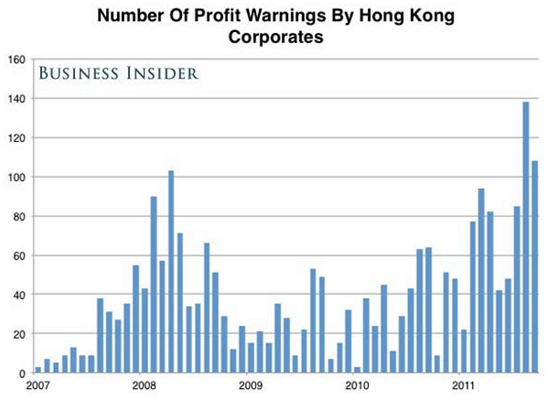

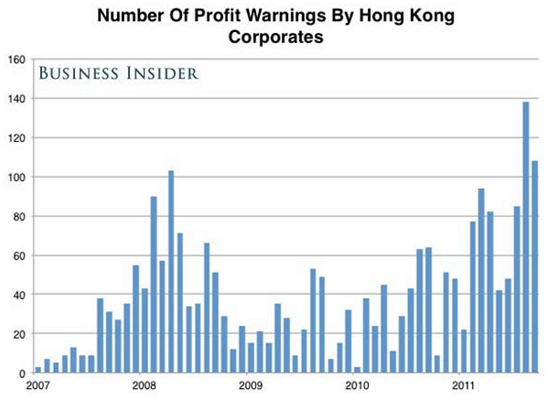

Further proof of global trade volumes moving towards contraction mode is the rising profit warnings out of Hong Kong based companies since the beginning of 2012, as we can see in the chart above thanks to the Business Insider website. The Hong Kong economy is one of the major trading ports of the world, so it should not come as a surprise that its private sector tends to suffer with serious consequences during periods of global economic contraction.

We are witnessing strength in the equity markets around the world, while global economic growth continues to deteriorate towards stall speed and a potential recession. If one was to ask me why I think the equity markets continue to turn a blind eye towards fundamentals, the obvious answer would point towards investor hope of further stimulus by the Fed and ECB. While investors have been locked in a debate over the last several months regarding whether central banks will ease or not, a much more important debate should center on whether the stimulus will work by creating economic activity. In my opinion, anyone who thinks the printing of money can create economic growth, quite frankly, must be living on planet Mars.reducing positions will be appropriate. Recommendation is to add on pullbacks. NAV long exposure is about 100%.

- S&P 500 has broken out to a 4 year high. Is it another trap? Dow Theory did not confirm the break out and neither did the Dow Jones on its own. The broadest measure of US stocks, the NYSE Composite Index, is quite far below its May 2011 high and also not confirming a breakout. All charts thanks to Acting Man blog.

- In 1982, a famous Time magazine cover titled "Interest Rate Anguish" portrayed the mood of the time. Paul Volcker was fighting rampant inflation with Long Bond rates as high as 14%. Over 30 years later (in sync with the Kondratiev Wave), the rates on the Long Bond are now down to 2.8% with a technical divergence giving us a sell signal. Is this the final bottom for rates?

- Euro has broken its technical downtrend this week and now finds itself testing the 200 day moving average. The move has been linked to Draghi's promises (without any action) that has driven a huge short covering rally for several weeks now. Bearish bets on the Euro have been reduced by over 50% from 214,418 contracts in June to 102,306 contracts as of Tuesday.

- Unlike the much loved US equities, one of the most hated and worst performing assets in the last 12 months has been Coffee (down over 40%). The recent COT report showed that hedge funds now hold the largest net short position in the Coffee market since 2004, when the price was below 70 cents. Bearish hedge fund positions usually present opportunities, so is this time different?

A week full of central bank intervention promises has pushed risk assets out of oversold levels. The euro has experienced a 7 cent rally from its previous bottom around $1.20. Copper, which tends to be an industrial economic indicator, is attempting to break above its 200 MA. However, Copper is far away from confirming the S&P's new highs in 2012. The Emerging Markets, saviour of global growth in the post Lehman recovery, continue to lag other equity indices indicating that not all is well with the BRICs. Currencies and precious metals have technically broken out to the upside, but the real test will come as volatility of global risk assets rise and if the US Dollar starts to rally again. Finally, the DAX is now moving almost vertically like a NASA rocket!

I believe that the current level of investor hope (easily found on blogs and forums throughout the net) is completely misguided and completely disconnected from fundamental conditions. Hope that the US will miss a recession, hope that central bank stimulus will revive economic growth, hope that China has a soft landing instead of a hard landing, and finally hope towards authorities finding a solution in the Eurozone crisis. There is a lot of hope out there, but from a contrarian point of view, I hold absolutely none. Personally, I believe a global recession is imminent as manufacturing is now entering a sustained contraction period. The printing of money cannot automatically revive manufacturing or global trade (if it could the Fed would have stopped every recession since 1913). Let us do a world tour starting with the US and finishing off here in Asia.

Global manufacturing activity, measured by JP Morgan PMI, continues to slow. We now have 80% of the world's PMIs in contraction territory, which removes the notion of economic de-coupling. Make no mistake about this, the world is in a synchronised slowdown. Commenting on the Global Manufacturing survey, David Hensley said:

"The August PMIs point to a further modest acceleration in the rate of contraction of global industry, as the sector is buffeted by rising headwinds in a number of key economic regions and falling levels of international trade. The labour market is still holding up better than the activity indicators, but this could be threatened as signs of excess capacity become more visible.”

US Manufacturing readings, measured by NBER ISM data, came in below 50 for the third consecutive month. New Orders declined further into contraction territory, while inventory levels have built up to their highest level in 27 months. A combination of both, known as Orders less Inventory, came in at levels indicating recession territory similar to 2008. Commenting on the US Manufacturing survey, Bradley J. Holcomb said:

"The PMI registered 49.6 percent, a decrease of 0.2 percentage point from July's reading of 49.8 percent, indicating contraction in the manufacturing sector for the third consecutive month. This is also the lowest reading for the PMI™ since July 2009. The New Orders Index registered 47.1 percent, a decrease of 0.9 percentage point from July, indicating contraction in new orders for the third consecutive month. Comments from the panel generally reflect a slowdown in orders and demand, with continuing concern over the uncertain state of global economies."

Bob Pisani, over at the Trader Talk blog, summarised the ISM quite well too. He stated that this month's ISM report had a strong message with a key word - slowdown - appearing everywhere. He listed various reports from subcomponent industries out of the survey, where "slowdown" or something similar appear. Here is the list from his blog:

"Internal indicators and feedback from sales channels are indicating a SLOWDOWN in demand for capital equipment." (Machinery)

"Business continues to be very solid, but there is now a SLOWING of incoming orders." (Fabricated Metal Products)

"Incoming orders have SLOWED somewhat, but indications are that there will be a stronger fourth quarter." (Plastics & Rubber Products)

"Business is SLOW right now. Companies seem to be holding onto their money." (Computer & Electronic Products)

"We can sense, feel and see HEADWINDS with customer orders, especially Europe related." (Apparel, Leather & Allied Products)

"New orders and backlog remain FLAT." (Miscellaneous Manufacturing)

"Auto industry SLOWING a bit in the second half [of the year]." (Transportation Equipment)

"LACKLUSTER demand continues in all regions of the world, and is supporting much lower raw materials prices in the second half of 2012." (Chemical Products)

Confirming the slowdown in both the global as well as US manufacturing, was the recent slump in Durable Goods Orders. This indicator has an amazingly strong correlation with both the US GDP data as well as the S&P 500, as we can see in the chart above. In his recent September report, a well notable bear, Albert Edwards wrote:

"The metric which really stood out for me over recent weeks was a truly awful US durable goods report. For although the headline July data rose by over 4%, both mom and yoy, the core measure of new orders has slumped (core is capital goods orders excluding the volatile aircraft component). Core orders fell 4% in July mom and 6.2% yoy. July was not a one off. This is now the fourth month out of the last five that core new orders have fallen sharply and is entirely consistent with the rapidly deteriorating profits backdrop.

If as I suspect, this is further evidence that the US economy has already entered recession, it will not be long before the US equity market reacts. Certainly, the recent pop in the market above 1425 to a post-crisis high sits badly with the facts on the ground (see chart). Irrespective of any prospect of QE3, the market will not resist this recessionary data for long. The S&P will be led hand-in-hand by the economic cycle over a cliff into free- fall. That will be the third phase of this secular valuation bear market."

Recessions and economic contractions usually come about through inventory levels growing beyond demand, which forces companies to slash production and fire employees. For those not familiar with US GDP calculations, a point should be made that it is shipments that are included in the final readings, not new orders. That would mean current ratio between the two is signalling a recession (chart above). Albert summaries it perfectly:

"For it is capital goods shipments, not new orders, that go into the GDP data, as what is not shipped just piles up in inventories until capital goods producing companies bite the bullet and slash their own production schedules in line with the weak new order flow."

Eurozone Manufacturing, measured by Markit PMI, continued its theme of contraction, indicating that the Eurozone is entering a second recession within 3 years. Italy's PMI was at a 10 month low and Austria's at a 37 month low, while Spanish PMI was at a 5 month high and Netherlands at a 6 month high. Commenting on the Eurozone Manufacturing survey, Rob Dobson said:

“The final reading of the August PMI confirms that the Eurozone manufacturing sector remains firmly in contraction territory. The rate of decline was a little slower than in July, providing some heart that the manufacturing downturn may be easing, but the sector is on course to act as a drag on gross domestic product in the third quarter.

The national picture remains one of widespread contraction. Only Ireland saw manufacturing output rise, while larger nations like France and Germany remain in reverse gear. The situation in Italy is also becoming more of a cause for concern, as it falls further down the PMI league table."

Chinese Manufacturing, measured by HSBC and Markit PMI, signalled a continued contraction in August. New orders came in at a 9 month low, which is a very worrying sign and confirms Asian export contraction. Let us not forget that many of these Asian economies are export reliant for growth and are now facing huge headwinds in the coming quarters. Commenting on the China Manufacturing survey, Hongbin Qu said:

“The final reading of the HSBC manufacturing PMI (August) confirmed that China's manufacturing sector still faces intensifying downward pressure. New export orders contracted at the fastest pace since March 2009, this, combined with a record high in stocks of finished goods sub-index, and a 41-month low employment index, suggests China's exporters are facing increasing difficulties amid stronger global headwinds.”

Japanese Manufacturing continues to slow at a more accelerated pace as well, with new orders down meaningfully in August. Production fell at the fastest rate in over 16 months, which is a sign that the post-earthquake economic rebound is now stalling. Commenting on the Japanese Manufacturing survey data, Alex Hamilton said:

“Japan’s manufacturing sector downturn continued in August, according to PMI survey findings. The data provide further evidence to suggest that growth in the world’s third largest economy is faltering in the face of weakening global demand conditions. Overall new business (exports plus domestic) declined at a solid rate, while the index measuring trends in factory output fell further over the month.

There was more deflationary news on the price front, with average input costs and output charges decreasing simultaneously for a third month running. Meanwhile, a muted labour market picture was signalled by the latest survey, with employment stagnating.”

So what can we expect as global manufacturing continues to slow? In my opinion there are two answers: a basic quick answer and a more in-depth one. The quick answer is most likely linked to a global recession. The more in depth answer is seen in the chart below:

According to Morgan Stanley research, global manufacturing tends to lead global trade volumes by about three months. If we were to do basic mathematics, the indicator above implies that global trade volumes would start contracting by the end of Q4 of 2012 (post elections in the US). There is already evidence of a slowdown in certain trading hot spots around the world, like the Suez Canal where 8% of the worlds freight flows annually.

In this weeks news, FedEx confirmed that global air freight trade volumes are already starting to contract, as the company issued profit warnings (believe me more of them are about to come). Bloomberg writes:

"FedEx Corp. (FDX), operator of the world’s largest cargo airline, said quarterly earnings will fall short of its forecast after a weak global economy damped revenue from express shipments.

The cut in profit adds to evidence of how Europe’s economic slump and slowing growth in Asia are dragging on FedEx, which is seeking money-saving efforts such as buyouts for some employees. The company is considered an economic bellwether because it moves goods ranging from financial documents to pharmaceuticals."

The chart above shows how FedEx earnings tend to be a strong leading indication of the direction of the US GDP. It is only a matter of time until bullish economists realise that this is not just another summer slowdown viz-a-viz 2010 and 2011.

Further proof of global trade volumes moving towards contraction mode is the rising profit warnings out of Hong Kong based companies since the beginning of 2012, as we can see in the chart above thanks to the Business Insider website. The Hong Kong economy is one of the major trading ports of the world, so it should not come as a surprise that its private sector tends to suffer with serious consequences during periods of global economic contraction.

We are witnessing strength in the equity markets around the world, while global economic growth continues to deteriorate towards stall speed and a potential recession. If one was to ask me why I think the equity markets continue to turn a blind eye towards fundamentals, the obvious answer would point towards investor hope of further stimulus by the Fed and ECB. While investors have been locked in a debate over the last several months regarding whether central banks will ease or not, a much more important debate should center on whether the stimulus will work by creating economic activity. In my opinion, anyone who thinks the printing of money can create economic growth, quite frankly, must be living on planet Mars.reducing positions will be appropriate. Recommendation is to add on pullbacks. NAV long exposure is about 100%.