Manufacturing strength around the globe from has prompted a rally in the markets as investor focus was diverted from the European debt focus. Manufacturing data in the US grew at the fastest rate in seven months while manufacturing in the United Kingdom rose to an eight month high. Gauges of manufacturing in China also improved and manufacturing in Eu-rope contracted less than expected. Manufacturing in China showed a modest expansion beating market expectations of a contraction. The USD weakened across the board and Treasuries stopped a five day rise. with The EUR gained to trade at. 1.3160 while the GBP is currently trading at 1.5835

Further aiding the positive market sentiment is the expectation that the Greek private sector debt swap deal and the nation's second financing deal will be completed in the next few days. The strongest performers overnight were the risk currencies. The Australian dollar has surged past 1.0700 while the Canadian dollar is once again trading above parity against the USD.

Equity markets powered ahead spurred by signs of manufacturing strength globally. The S&P 500 has closed 0.9% higher at 1,394 with financial and commodity stocks leading the gains. Morgan Stanley rose more than 5% on news that it had won the lead manager role for the upcoming Facebook initial public offering. The appliance maker, Whirlpool, rose almost 20% as it projected higher than expected earnings. Earlier in Europe, bourses closed almost 2% higher on the global manufactur-ing outlook.

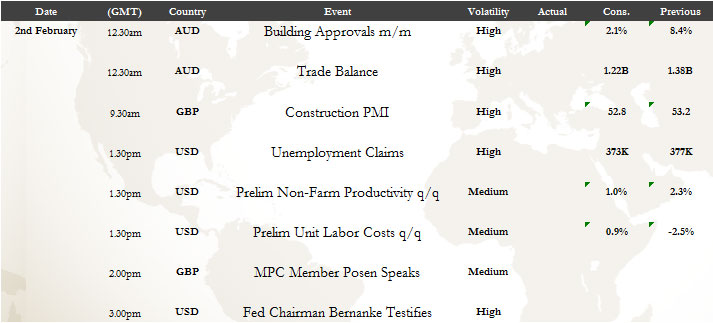

Commodity prices moved lower yesterday with the CRB index losing 0.78 points to 311.53 with strength in the equity mar-kets failing to spark a larger rally. WTI Crude fell more than 0.8% to $97.60, six week lows, after the US Energy Department reported higher than expected inventories and gasoline demand fell to a 10 year low. Precious metals consolidated with gold rising 0.4% to $1,748 while silver has gained 1.57% to $33.80. Soft commodities were mixed with cocoa losing more than 3%. Copper has risen 1.1% overnight. Today we have the release of the high impact Australia building approvals and trade balance, UK Construction PMI, US unemployment claims and testimony by Federal Reserve Chairman Bernanke.

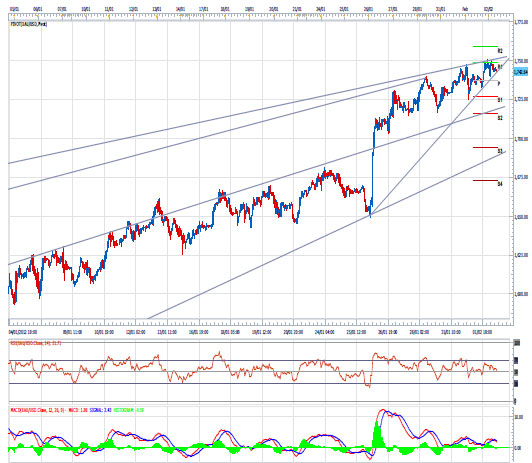

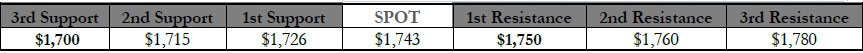

GOLD continues to show strong price consolidation to gain slightly to hold above $1,740. The range yesterday was $1,733 to $1,751. As we had expected gold had an attempt at the $1,750 resistance level a couple of times before easing back slightly to $1,743 this morning. The market is eyeing critical resistance just above $1,800 before a charge towards the all time high just above $1,900. Our end of second quarter target of USD2.000 on gold remains firmly in play. Gold is showing good price consolidation at the moment and a break out appears imminent. Nothing has happened overnight so we maintain our strongly bullish stance on gold in both the short and medium term,. We continue to hear of central bank diversification into the metal which continues to support and drive the price higher. Today, there will more than likely be a lull in liquidity and tightening of trading ranges as the market awaits tomorrow’s release of the US non farm payrolls data.

AUD/USD was the big winner on the back of the better than expected data over the last 24 hours with equity markets preforming well also. The break above 1.635 top during early Europe trigger weak stops which gave enough fuel to the fire for the price to bounce and takeout the recent 1.0685 resistance. The buoyant markets and the love of AUD on better risk sentiment took the price above the 1.0700 level briefly with the pair topping out at 1.0740. US afternoon profit taking and position squaring as we lead into the quiet period before Fridays US non-farm Payrolls has seen the price move back to 1.0700 to close out the eventful day. Building Approval and Trade Balance data will make for an interesting morning with both expected to be below the previous. The current level of the AUD will find early morning covering from Australian Importers and with the price already likely to be below 1.0700 the weaker data could see it return to 1.0600 or below quickly.

AUD/USD was the big winner on the back of the better than expected data over the last 24 hours with equity markets preforming well also. The break above 1.635 top during early Europe trigger weak stops which gave enough fuel to the fire for the price to bounce and takeout the recent 1.0685 resistance. The buoyant markets and the love of AUD on better risk sentiment took the price above the 1.0700 level briefly with the pair topping out at 1.0740. US afternoon profit taking and position squaring as we lead into the quiet period before Fridays US non-farm Payrolls has seen the price move back to 1.0700 to close out the eventful day. Building Approval and Trade Balance data will make for an interesting morning with both expected to be below the previous. The current level of the AUD will find early morning covering from Australian Importers and with the price already likely to be below 1.0700 the weaker data could see it return to 1.0600 or below quickly.

![]()

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Manufacturing Prompts Rally in the Markets

Published 02/02/2012, 11:11 AM

Updated 07/09/2023, 06:31 AM

Manufacturing Prompts Rally in the Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.