A cold helplessness swept throughout the global economy as manufacturing PMI’s simultaneously disappointed, some in spectacular fashion. Manufacturing PMI data for China fell to 49.2 from 50.1 with Markit PMI falling to 47.6, (measures small cap manufacturing) the lowest levels since the global crisis began. The Chinese have not been slow to ease policy in the past but it would appear that merely cutting interest rates further isn’t enough. The PBOC will have to delve deeper into their box of tricks to turn things around.

European PMI figures all decorated in red, mostly showed a slowdown in contraction vs July’s figures but solid contraction none the less. Figures from the UK were a lot more palatable showing only slight decline, 49.5 vs 45.2 in July. Retail sales for August came in at -0.4% vs -0.5% (exp). The BoE is still in the middle of its asset purchasing scheme so the marginal benefits are yet to be fully realised on the books.

It begs the question, that amidst all the current political agenda which sees bond-buying, banking supervision and ESM leveraging at the fore front, where is the investment going to come from to help industrial and manufacturing output in the longer term? The above measures, while vitally important and worthy of being top of the agenda, (considering the very imminent contagion risk from Spain and Greece) are essentially liquidity measures for the struggling sovereigns. There needs to be vision beyond this put in place. Capital investment plans/incentives need to be initiated to boost growth. Yesterdays figures will spark debate as to the more long term vision of the ECB.

Labor day did remove the liquidity from the market and any real chance of any price movements. We saw a flicker of movement in EUR yesterday when word emerged that Mario Draghi was hard at work strategising how to best calm markets this upcoming Thursday. GBPEUR broke below 1.26, a level it has been flirting with recently, but as of yet with no degree of permanence. Plans to buy up 3 year bonds kicked off debate as to the legality of the ECB’s plans. As we know the ECB is currently unable to directly recapitalise banks as well as directly financing governments. The ECB confirmed that its proposed plan to purchase 3 year debt doesn’t constitute state aid and is not acting in violation of its mandate. Further debate is likely to ensue.

US markets will be keen to get their teeth into things today and US PMI and a sale of 3 and 6 month treasuries should hit the spot nicely. Median targets should see the sector expand but as we saw yesterday target setting was loose and inaccurate.

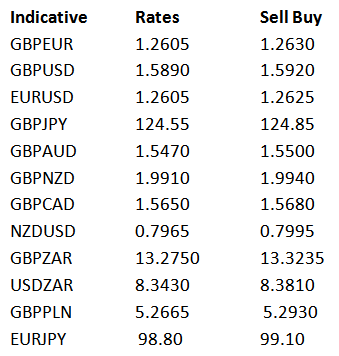

Latest exchange rates at time of writing:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Manufacturing Data Paints A Snapshot Of Struggling Global Economy

Published 09/04/2012, 06:25 AM

Updated 07/09/2023, 06:31 AM

Manufacturing Data Paints A Snapshot Of Struggling Global Economy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.