A speech by Mark Carney last night has driven the pound higher through the Asian session and into the European open. In what are the Bank of England Governor’s first, publicly hawkish comments he said that home owners and businesses should be prepared for interest rate rises and that the first of these “could happen sooner than markets currently expect”.

He went on to say that the “there is already great speculation around the exact timing of the first rate rise and that decision is becoming more balanced”. Whether this is a near term set up for some dissent against current low rates in next week’s Bank of England minutes we will have to wait for Wednesday to see although I would suggest that the odds of it happening have shortened dramatically. He continued to emphasise that the pace of rate increases, when they are forthcoming, will be gradual and that they will top out below pre-crisis levels of 5%. All in all, what it does mark is a departure from the softly, softly rhetoric of the most recent quarterly inflation report; only 4 weeks ago and will end the recent phenomenon of good UK data being unable to push sterling onwards.

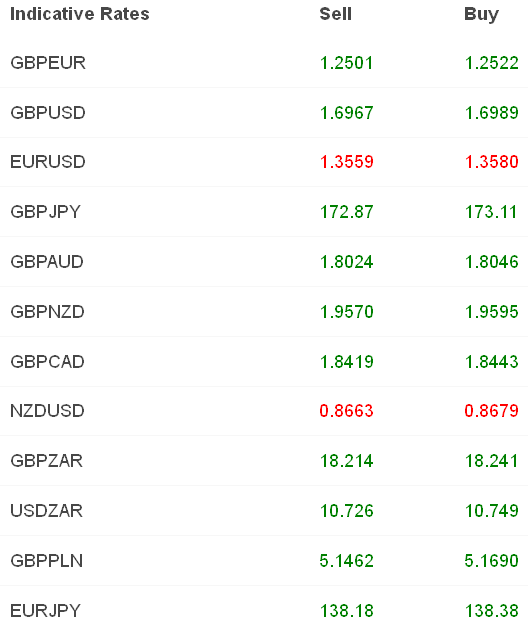

GBP is up around 1% on a trade weighted basis this morning following the comments and near-term targets will be around 1.2550 and above 1.70 in GBP/EUR and GBP/USD pairs respectively.

News from Iraq is starting to gain major media attention now with the oil price touching a 9 month high overnight following the bombing of Sunni rebels around the town of Mosul by the Shi’ite led Iraqi government. Fighting is taking place around refineries in the middle of the country and will continue recent moves higher across the energy complex.

Combined with a disappointing retail sales report from the USA and investors have decided that this equity rally may have gone far enough. Retail sales rose by 0.3% in May against an expected 0.6% as consumers seemed unwilling to spend despite recent increases in employment. A large fall in the USD was prevented by the previous month’s number being revised higher from 0.1% to 0.5% but we fully expect to see economists shave their Q2 GDP expectations in light of this news. The US economy is seeing a gradual improvement but gradual improvement is not quite good enough for the dollar bulls nor the Federal Reserve. If we continue to see improvements in the jobs market however then we can easily foresee a pick up in consumer spending.

Last night’s Japanese central bank meeting failed to alter policy or the yen dramatically as the Bank of Japan stood pat, increasingly more confident in its economic performance. Despite noting a forward loading of consumer spending before the April 1st tax increase, the BOJ seems to be in no doubt that the ensuing drop off in spending will not be large enough to warrant a policy response.

The inflation picture is the one to watch; the Bank of Japan have set themselves a target of 2% inflation – currently at 1.5% – and easily missed should consumer and investment spending remain low and the yen fails to decline further from current levels. We are still holding out for an increase in stimulus at some point this year but July is looking increasingly unlikely.

China’s retail sales rose 12.5 percent in May from a year ago versus the previous month’s 11.9 percent rise data showed this morning, exceceding the 12.0% expectation. AUD has rebounded well following yesterday’s jobs disappointment. Both it and the NZD are in demand for their yields and the subsequent carry trade returns.