Premium business services company, ManpowerGroup Inc. (NYSE:MAN) reported strong second-quarter 2017 results with healthy improvement in the labor market. Despite strong quarterly results, share price dropped about 9% to close at $108.18 post the earnings release as investors probably expected a bullish outlook.

Quarter in Details

GAAP earnings came in at $1.72 per share, up 7.5% year over year. The company reported net income of $117 million compared with $115.4 million in the year-ago quarter.

Adjusted earnings for the reported quarter were $1.82 per share, which comfortably beat the Zacks Consensus Estimate of $1.73.

Revenues

The company reported revenues of $5.17 billion, up 3% from the prior-year period. The top line exceeded the Zacks Consensus Estimate of $5.03 billion. The company reported strong business performance from a number of its markets including France, Italy, Mexico and Poland.

Segmental Performance

ManpowerGroup reports revenues in terms of five segments, primarily classified on a geographic basis.

Sales from Southern Europe comprised 41% of consolidated revenue in the second quarter. Sales from Southern Europe came in at $2.1 billion, up 13% year over year. Asia Pacific & Middle Eastern sales increased 5.2% year over year to $643.4 million during the quarter. Northern Europe revenues during the quarter were $1,281.7 million, up 2% year over year.

However, second-quarter 2017 revenues from Americas came in at $1,056.9 million, down 1.5% year over year. Also, Right Management sales decreased 19.8% year over year and came in at $57.1 million, due to the slowdown of career outplacement activity.

Margins

Gross profit margin during the quarter was 16.7%, down 40 basis points (bps) year over year. The staffing gross margin had an adverse impact on overall gross margin by 30 bps.

Balance Sheet and Cash Flow

Cash and cash equivalents were $573.1 million as of Jun 30, 2017 with long-term debt of $454.8 million.

Cash from operating activities was $148 million for the first half of 2017 compared with $262.1 million recorded in the year-ago period. Capital expenditure during the first six months of the year was $25.5 million compared with $30.8 million recorded in the prior-year period.

Outlook

ManpowerGroup anticipates that its European business would strengthen in the quarters ahead. The company is poised to grow on the back of productive workforce and sound restructuring initiatives.

The company anticipates earnings within the range of $1.90–$1.98 per share in third-quarter 2017 which includes a favorable impact from foreign currency of 2 cents per share.

Our Take

The company’s brand value, strong global network, service diversification and greater operational efficacy are expected to boost bottom-line performance for the company.

Notably, ManpowerGroup carries a Zacks Rank #2 (Buy). The attractiveness of this stock as a current investment choice is further accentuated by its favorable Value, Growth and Momentum Style Score ‘A’.

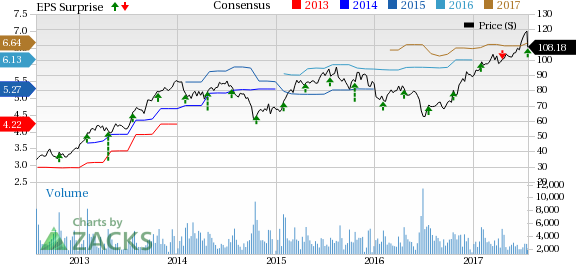

ManpowerGroup Price, Consensus and EPS Surprise

Other Stocks to Consider

Exponent, Inc. (NASDAQ:EXPO) carries a Zacks Rank #1 and has an Earnings ESP of +4.76%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

S&P Global Inc. (NYSE:SPGI) carries a Zacks Rank #2 and has an Earnings ESP of +1.28%.

Fiserv, Inc. (NASDAQ:FISV) carries a Zacks Rank #2 and has an Earnings ESP of +1.63%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

S&P Global Inc. (SPGI): Free Stock Analysis Report

Exponent, Inc. (EXPO): Free Stock Analysis Report

ManpowerGroup (MAN): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Original post

Zacks Investment Research