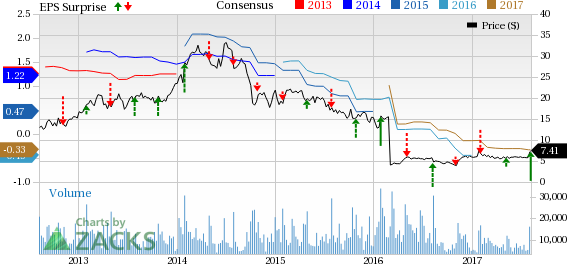

The Manitowoc Company, Inc. (NYSE:MTW) reported second-quarter 2017 adjusted earnings of 5 cents per share, up 67% from 3 cents reported in the year-ago quarter. The year-over-year improvement was mainly driven by focus on consolidating manufacturing footprint and reducing cost of organizational structure. Earnings also beat the Zacks Consensus Estimate of a loss of 3 cents per share.

Including special items, the company posted break-even results in the reported quarter. It had posted loss of 4 cents per share in the year-ago quarter.

Manitowoc witnessed a 13.8% year-over-year decline in sales to $394.6 million in the reported quarter, adversely affected by dismal crawler crane shipments in the Americas and lower rough-terrain crane shipments primarily in the Americas and the Middle East, primarily due to poor demand in the oil and gas market. In addition, revenues missed the Zacks Consensus Estimate of $401 million.

Operational Update

Cost of sales declined 14% to $318.3 million in the reported quarter from $370.4 million in the prior-year quarter. Gross profit dipped 12.6% year over year to $76.3 million. Gross margin expanded 30 basis points to 19.3%.

Engineering, selling and administrative expenses descended 17.7% year over year to $60.4 million. Adjusted operating income was $15.9 million compared to $13.9 million in the year-ago quarter.

Backlog

Backlog for the quarter came in at $491 million as of Jun 30, 2017, up 25% from $393.5 million in second-quarter 2016. Second-quarter orders of $379.5 million, which included the initial production order related to the U.S. Army contract, were up 9% from the comparable period in the last year.

Financial Updates

Manitowoc ended the quarter with cash and temporary investments of $26.3 million compared with $69.9 million at year-end 2016. Long-term debt was $278 million as of Jun 30, 2017, compared with $269 million as of Dec 31, 2016. The company recorded cash used for operating activities of $11.9 million in the reported quarter compared with cash usage of $15.4 million recorded in the year-ago quarter.

Guidance

Manitowoc updated its full-year 2017 financial guidance. The company now expects revenues to decline approximately 5–7% year over year in 2017. Adjusted EBITDA is anticipated to lie between $59 million and $69 million. Depreciation is projected at approximately $40 million. Capital expenditures are estimated at approximately $30 million.

Manitowoc remains cautiously optimistic in the near term as it continues to focus on delivering value through innovative products. The company anticipates to achieve its long-term target of double-digit operating margins by 2020 and becoming the leading global crane company as the market recovers.

Share Price Performance

Year to date, Manitowoc has outperformed the industry with respect to price performance. The stock gained around 23.91%, while the industry recorded growth of 21.18% over the same time frame.

Zacks Rank & Stocks to Consider

Currently, Manitowoc carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the sector include Caterpillar Inc. (NYSE:CAT) , Terex Corporation (NYSE:TEX) and AGCO Corporation (NYSE:AGCO) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has expected long-term growth rate of 9.50%.

Terex has expected long-term growth rate of 20.07%.

AGCO has expected long-term growth rate of 13.51%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Manitowoc Company, Inc. (The) (MTW): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research