The Manitowoc Company, Inc. (NYSE:MTW) posted fourth-quarter 2017 adjusted loss per share of 15 cents, narrower than the prior-year quarter’s loss of 94 cents. Results came in wider than the Zacks Consensus Estimate of a loss of 6 cents per share.

Manitowoc Company, Inc. (The) (MTW): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Original post

Zacks Investment Research

Including special items, the company posted earnings of 98 cents in the reported quarter. It had posted a loss of 92 cents per share in the year-ago quarter.

Manitowoc witnessed a 27% year-over-year improvement in sales to $482 million in the reported quarter. Higher demand, primarily in the United States and European markets drove revenues in the quarter. Approximately 40% of unit revenues in the quarter stemmed from new products introduced since becoming a stand-alone crane company. Additionally, revenues beat the Zacks Consensus Estimate of $423 million.

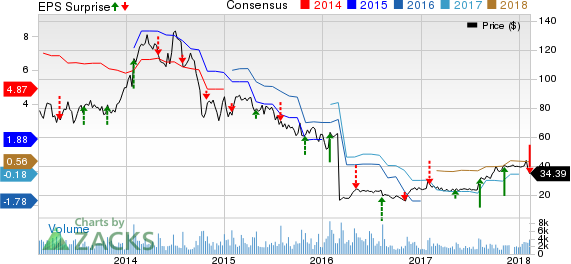

The Manitowoc Company, Inc. Price, Consensus and EPS Surprise

Financial Updates

Manitowoc ended 2017 with cash and temporary investments of $119.2 million compared with $69.9 million at year-end 2016. Long-term debt was $267 million as of Dec 31, 2017, compared with $269 million as of Dec 31, 2016. The company generated $78.5 million of cash in operating activities in 2017 compared with cash usage of $122.4 million recorded in the prior year.

Fiscal 2017 Performance

Manitowoc reported a loss of 26 cents per share in fiscal 2017 compared with a loss of $1.75 witnessed in the prior fiscal. The loss was wider than the Zacks Consensus Estimate of 17 cents per share.

Including one-time items, Manitowoc reported earnings per share of 28 cents against a loss of $10.70 per share in fiscal 2016.

Revenues declined 2% year over year to $1.58 billion, but surpassed the Zacks Consensus Estimate of $1.52 billion. However, the performance was better than expected as the company anticipated revenues to decline approximately 5-7% year over year in 2017.

Guidance

Manitowoc initiated full-year 2018 financial guidance. Adjusted EBITDA is anticipated to lie between $96 million and $116 million. Depreciation is projected at approximately $39 million. Capital expenditures are estimated at approximately $25-$30 million.

Share Price Performance

Over the past year, Manitowoc has underperformed the industry with respect to price performance. The stock gained around 53.2%, while the industry recorded growth of 37.4%.

Zacks Rank & Stocks to Consider

Currently, Manitowoc carries a Zacks Rank #4 (Sell).

Some better-ranked companies in the industrial product space include Applied Industrial Technologies, Inc. (NYSE:AIT) , H&E Equipment Services, Inc. (NASDAQ:HEES) and Dover Corporation (NYSE:DOV) . All these stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has an expected long-term growth of 12%. Its shares have surged 12% in the past year.

H&E Equipment Services has expected long-term growth of 18.6%. It shares have rallied 49% in a year’s time.

Dover has expected long-term growth of 13%. Over the past year, its shares have gone up 22%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

Manitowoc Company, Inc. (The) (MTW): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Original post

Zacks Investment Research