Wall Street is experiencing a “rise of the robots.”

Maybe not quite in the way that Hollywood has imagined for us, but a robotic takeover, nonetheless.

Driven by the attraction of very low fees, smaller investors are rushing headlong into the realm of robo-advisors.

These “advisors” use a combination of investing-on-autopilot and a cookie-cutter approach. An investor plugs in their information, and using proprietary formulas, the robo-advisor will spit out an asset allocation using a number of index funds or ETFs.

To date, the industry has attracted $50 billion in assets, according to research group Aite Group LLC.

And that’s just the tip of the proverbial iceberg.

Over-Crowded and Over-Funded

Two of the biggest independent robo-companies are Betterment LLC and Wealthfront Inc. They currently have $4 billion and $3 billion under management, respectively.

But their growth path could be parabolic.

Consultant firm Deloitte forecasts that robots could be managing between $5 trillion and $7 trillion by 2025. That number has caught the attention of the large money managers. Consequently, the Wall Street big boys are making quick efforts to catch up to the market.

The world’s largest fund manager – BlackRock Inc (NYSE:BLK) – bought robo-advisor FutureAdvisor last August. Fund manager Invesco bought another robo-advisor, Jemstep, in January. Brokerage and fund giant Fidelity is testing a similar service.

Their rival, Charles Schwab (NYSE:SCHW), rolled out its version of the service last March and now has $5.3 billion under management with its robo-advisory.

Even the Merrill Lynch unit of the Bank of America Corp (NYSE:BAC) is coming out with its version of a robo-advisor later in 2016.

Despite initial enthusiasm however, in the beginning stages of such a new industry, there are still countless unknowns. One question stands out in my mind: Can robo-advisors survive an inevitable bear market?

Human Touch Needed

After two decades in the business as a financial advisor, my guess is a qualified “yes,” robo-advisors could withstand an eventual bear market.

Of course, any firm that’s comprised of 100% robots will not survive. Those that will endure will likely have a hybrid model, offering human interaction in conjunction with an automated robotic service. This is the model currently used by mutual fund giant Vanguard.

My prediction is based on the brief stock market downdrafts from last August and at the start of this year.

The largest robo-advisor firms saw major jumps in logins to accounts by customers, keeping a close eye on their investments. These firms were proactive in attempting to reassure their clientele that the system wouldn’t lose them much money.

They sent messages to their clients explaining that volatility was normal in stock markets – even including articles that suggested staying calm.

But this did little to reassure many of their patrons.

Clients actually wanted to talk to someone – a financial professional, a human one – about this change in regime. And this is the case in most instances of market unrest.

During the market turmoil earlier this year, Schwab saw a one-third increase in call volumes. It had to ask staff to work longer hours in order to answer all the calls.

It is, therefore, necessary to maintain a strong employee base with robo-advisors as supplements, in order to retain clients and preserve their confidence.

A Robotic Investing Future

Ignoring the specifics that go into every individual seeking investment advice simply wouldn’t produce the best yields. Time horizons, for instance, would greatly affect the recommendations for a person approaching retirement in a vastly different manner than for someone at the start of their portfolio.

In fact, in a recent article, I laid out the best plan of action for a soon-to-be retiree. This advice required analysis and research that a robot simply cannot conduct. (Not yet, at least.)

Each individual is unique and requires customized financial guidance. Robots, on the other hand, remain just that – robots. Without a human touch, it seems impossible for a machine to best predict which investments are really the best match for each unique portfolio.

The rise of the robots is occurring in an age where the world’s central banks have flooded stock markets with boatloads of liquidity.

This has lifted indices, making index funds appear to be great opportunities for profit. Stock-picking against that tide of money is like spitting in the wind. The big cap index stocks have all the money – no matter whether the individual stocks are any good, or if they’re an absolute disaster.

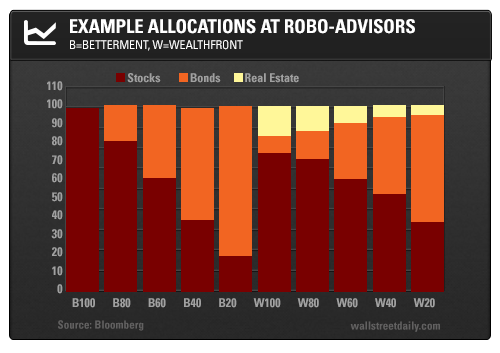

Take a look at the typical allocation of the two big independent robo-advisory firms:

Most of the funds allocated to stocks are put into stock index funds.

Guess what happens to index funds when a real bear market hits? They sink like they were tethered to a cement block – straight to the bottom.

These portfolios – in the cold, steely hands of robo-advisor firms, will be destroyed.

And what will happen to the people who are currently flocking to the counsel of robo-advisors? Based on past bear markets, my guess is that they’ll hang in there… until the losses reach 25% or so. Then they’ll panic and sell at just the wrong time.

That’s why getting advice from a seasoned market pro would’ve been far more beneficial than following the calculations of a robot.

The robot simply cannot care if a client makes or loses money. It just continues spitting out allocations based on a cookie-cutter formula that’s designed to fit an imaginary client without a personal identity. In short, robo-advisors are hardwired to advise only other robots.

Good investing,