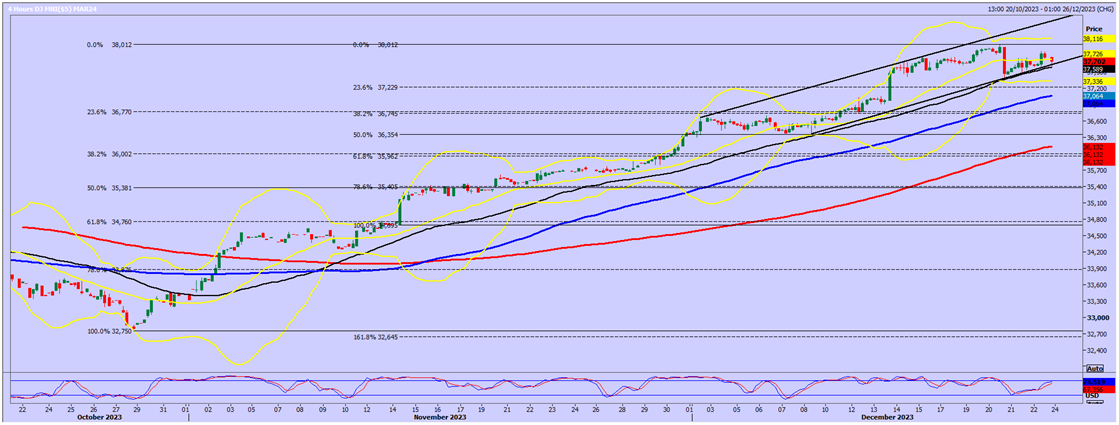

Emini S&P March futures I suggested selling a bounce to 4790/4800 with stop above 4830. I am looking for a double top if we hold below last week's high t confirm a negative outlook after the huge bearish engulfing candle.

However, a break above 4830 negates the bearish candle formation for a buy signal this week targeting 4835/38, 4843/45 and 4864/67.

First downside target is 4740/30 but we could fall as far as 4680/60.

I think it is worth trying a long at 4680/60 with stop below 4650.

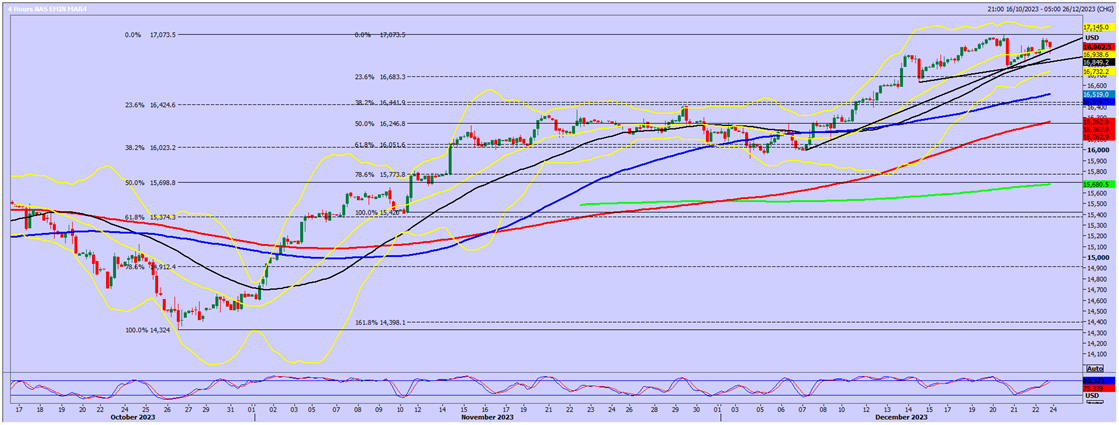

Nasdaq March futures bounced to resistance at 16900/950 and shorts need stops above last week's high at 17073. (We got close on Friday but held below). A break above 17100 however negates the bearish candle formation for a buy signal this week targeting 17200/240 and 17350/370, perhaps as far as 17440/460.

A break below 16895 (which just held on Friday) today could be taken as a sell signal targeting 16820/810, perhaps as far as 16770/750. A break below here (the low of the bearish engulfing candle targets minor support at 16700/680 for profit taking on any remaining shorts.

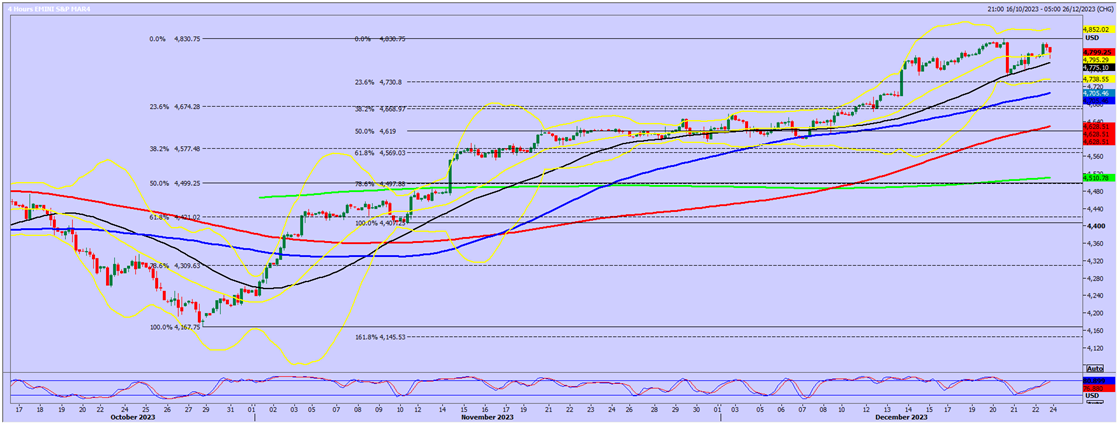

Emini Dow Jones March I suggested a short at 37700/800 (we reached 37878 on Friday) and stop above last week's high at 38012. A break higher targets 38150, 38230 and 38300.

A break below 37500 today is a sell signal and can retest last week's low at 37420/390. A break lower is a sell signal targeting minor support at 37250/200.