EUR/USD

The euro edged lower against the dollar on Tuesday after better-than-expected consumer confidence data sparked demand for the greenback amid hopes for U.S. recovery to gain steam in 2014. The Conference Board reported earlier that its index of U.S. consumer confidence improved to 78.1 in December from 72.0 in November, beating consensus forecasts for a 76.0 reading. Also Tuesday, the Standard & Poor’s/Case-Shiller 20-city home price index raised at an annualized rate of 13.6% in October from a year earlier, the strongest pace since February of 2006 and above forecasts for an increase of 13.0%. The data confirmed expectations for the Federal Reserve to continue winding down stimulus programs such as its USD75 billion in monthly bond purchases next year and let the economy stand on its own feet. Fed bond purchases tend to weaken the dollar by driving down interest rates to spur recovery. Capping the dollar's gains, however, were industry data revealing that the Chicago purchasing managers’ index fell to a seasonally adjusted 59.1 this month from 63.0 in November. Analysts had expected the index to decline to 61.0 in December. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="452" height="428">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="452" height="428">

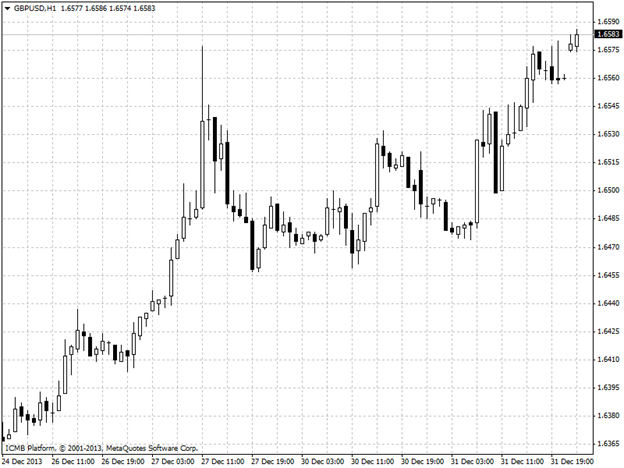

GBP/USD

The pound hit highs not seen since 2011 against the U.S. dollar in light trade on Tuesday amid market sentiment that the Bank of England may raise interest rates in the not-too-distant future. Trading volumes remained limited as many investors already closed books before the end of the year, reducing liquidity in the market, which helped exaggerate market moves. Demand for the pound was strong due to recent weeks of positive U.K. economic reports, which fueled expectations on Tuesday for the Bank of England to raise interest rates ahead of other central banks. Optimism for BoE policy shifts overshadowed solid U.S. consumer confidence data. The Conference Board reported earlier that its index of U.S. consumer confidence improved to 78.1 in December from 72.0 in November, beating consensus forecasts for a 76.0 reading. Also Tuesday, the Standard & Poor’s/Case-Shiller 20-city home price index rose at an annualized rate of 13.6% in October from a year earlier, the strongest pace since February of 2006 and above forecasts for an increase of 13.0%. GBP/USDb Hour Chart" title="GBP/USDb Hour Chart" width="452" height="428">

GBP/USDb Hour Chart" title="GBP/USDb Hour Chart" width="452" height="428">

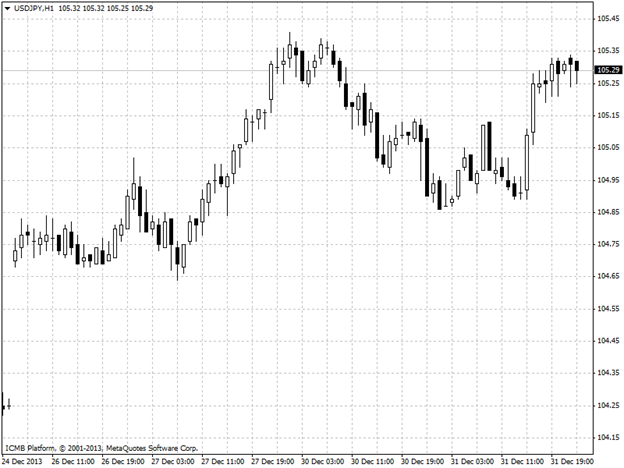

USD/JPY

The yen remained lower after its biggest annual decline since 1979 amid prospects the Bank of Japan will continue unprecedented stimulus measures to support the economy and end more than a decade of deflation. Japan’s currency extended losses as BOJ Governor Haruhiko Kuroda said, in an interview published yesterday in Yomiuri newspaper, that policy makers will continue stimulus until inflation stabilizes at 2 percent. Monetary policy in Japan is diverging from the U.S., where the Federal Reserve is expected to end bond purchases this year. Australia’s dollar weakened before a private survey that may show manufacturing growth moderated in China, the nation’s biggest trading partner. “The yen will depreciate further,” said Janu Chan, economist at St. George Bank Ltd. in Sydney. “There is still that prospect of the Bank of Japan stepping up their quantitative easing, meanwhile the U.S. is unwinding theirs.” USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="452" height="428">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="452" height="428">

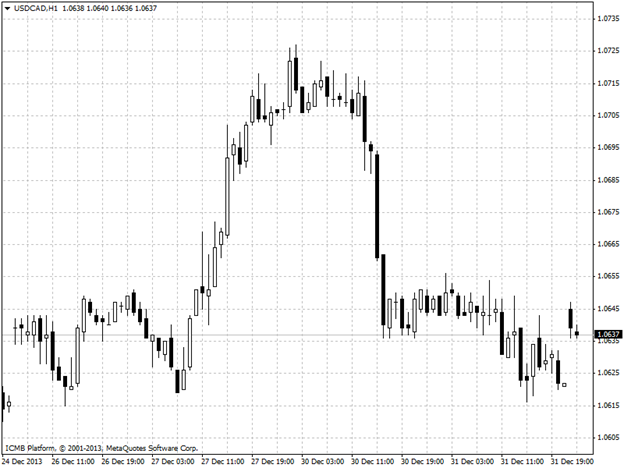

USD/CAD

Canada’s dollar posted its biggest decline in five years as accelerating economic growth in the U.S. convinced the Federal Reserve to slow monetary stimulus even as the Bank of Canada warned of deflationary risks. The currency rose yesterday versus its U.S. counterpart to trim its annual drop to 6.6 percent. Canada’s dollar declined this year against 11 of 16 major peers as inflation dipped below 1 percent after central-bank Governor Stephen Poloz called a 2 percent goal “sacrosanct.” The currency fell against the greenback in eight of 12 months as the Fed begins reducing the bond-buying that has helped cap borrowing costs.“Poloz would like our currency weaker, and for the most part he’s succeeded,” Blake Jespersen, managing director of foreign exchange at Bank of Montreal, said yesterday by phone from Toronto. “There’s a good chance, when we get back to normal, we may see some of this move retrace. The Canadian dollar does have more room to fall.” USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="452" height="428">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="452" height="428">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Majors Analysis: Canadian Dollar Posted Biggest Decline In 5 Years

Published 01/02/2014, 02:04 AM

Updated 04/25/2018, 04:40 AM

Majors Analysis: Canadian Dollar Posted Biggest Decline In 5 Years

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.