On a quarterly basis, 61% of companies tend to beat top-line revenue numbers. However, corporations are only beating expectations by a paltry 39% for Q1.

The revenue shortfall is not hard to explain. Multinational corporations are struggling to generate sales due to a slowdown in global growth, particularly in Europe and China. The modest achievement in earnings is not particularly difficult to explain either. Bottom line profit can be achieved by cutting costs, increasing worker responsibilities and implementing successful tax strategies. On the other hand, executives are less able to sweep revenue data under the proverbial rug.

Bulls don’t seem to be bothered by surging price-to-sales ratios or the associated questions concerning valuation. If central banks around the world are lowering target interest rates, or printing money to buy bonds to lower actual rates, they see the backstop as unconditionally positive for high-yielding assets and equities. What’s more, if a slight majority of companies are still beating profit expectations, where’s the price-to-earnings fire?

Bears are far less convinced. Simply stated, corporations will not ramp up their hiring if they don’t have more sales to justify new employee acquisition. It follows that if genuine job growth remains elusive, consumers cut back on their spending, businesses hold on to their capital and even the recovering real estate sector might stall.

Are the revenue “misses” contained to certain segments? Not really. The market has already seen top-line shrinkage from IBM, eBay, AT&T, Procter & Gamble, Wells Fargo, American Express, Dover and dozens of other global participants.

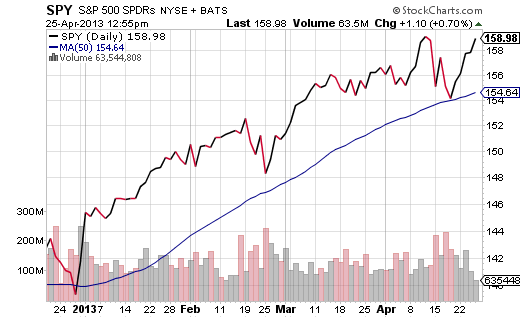

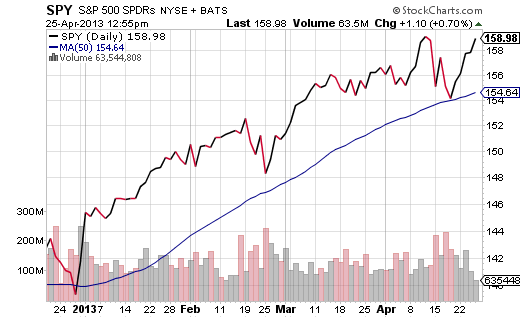

As it relates to exchange-traded fund investing, who will be correct in the weeks and months ahead? The bulls?

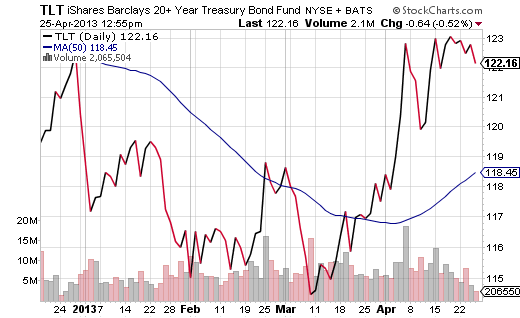

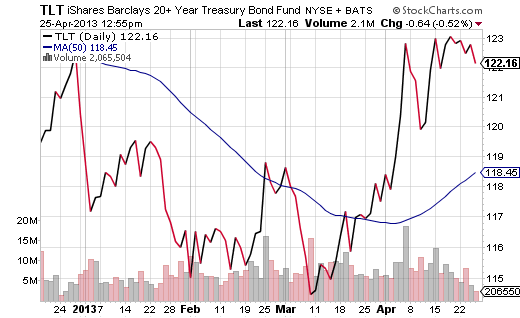

Or the safe-haven seeking, long-bond buying bears?

Perhaps ironically, neither camp may have an accurate grasp on what will happen going forward. The most likely scenario in the near-term? Stocks will pull back for any combination of reasons, though analysts will look backwards to explain the corrective activity. Profit-taking, revenue failure, euro-zone debt troubles, budget battles, seasonal patterns, deepening global recession, China manufacturing slowdown — pick your venom. At that time, of course, we will hear from the high-profile bears who make investors feel that the world itself is imploding.

Will the world implode? Will we see a repeat of 2008? Not this year. While the bears are mostly correct about the macro-economic picture and its adverse effect on the micro-economic revenue of corporations, they underestimate the coordinated determination of central banks around the globe. Not only do they have their collective act better together than they had during the systemic collapse of ‘08, but they’re willing to step in when corrections jeopardize their goals.

In other words, forget all of the talk about the Fed “pulling the punch bowl” or the euro-zone breaking into fragments in 2013. Granted, the summertime rhetoric may heat up and risk assets may very well tumble into correction territory. However, the central banks (e.g., People’s Bank of China, Bank of Japan, Bank of England, Federal Reserve, European Central Bank, etc.) will maintain or accelerate their stimulus. The consequence? Demand for risk assets will return.

Investors and traders are left to ponder the possibilities. A trader may be wise to “gamble” on the high probability of a correction by selling a large percentage of risky assets here… near the all-time market peak. The trader could purchase core index holdings at pre-set values that are %5, 10% or 15% below all-time intra-day highs. For example, a mid-cap enthusiast would look at iShares Core S&P Mid-Cap (IJH) for incremental purchases at 109.72, 103.95 and 98.18.

Perhaps ironically, neither camp may have an accurate grasp on what will happen going forward. The most likely scenario in the near-term? Stocks will pull back for any combination of reasons, though analysts will look backwards to explain the corrective activity. Profit-taking, revenue failure, euro-zone debt troubles, budget battles, seasonal patterns, deepening global recession, China manufacturing slowdown — pick your venom. At that time, of course, we will hear from the high-profile bears who make investors feel that the world itself is imploding.

Will the world implode? Will we see a repeat of 2008? Not this year. While the bears are mostly correct about the macro-economic picture and its adverse effect on the micro-economic revenue of corporations, they underestimate the coordinated determination of central banks around the globe. Not only do they have their collective act better together than they had during the systemic collapse of ‘08, but they’re willing to step in when corrections jeopardize their goals.

In other words, forget all of the talk about the Fed “pulling the punch bowl” or the euro-zone breaking into fragments in 2013. Granted, the summertime rhetoric may heat up and risk assets may very well tumble into correction territory. However, the central banks (e.g., People’s Bank of China, Bank of Japan, Bank of England, Federal Reserve, European Central Bank, etc.) will maintain or accelerate their stimulus. The consequence? Demand for risk assets will return.

Investors and traders are left to ponder the possibilities. A trader may be wise to “gamble” on the high probability of a correction by selling a large percentage of risky assets here… near the all-time market peak. The trader could purchase core index holdings at pre-set values that are %5, 10% or 15% below all-time intra-day highs. For example, a mid-cap enthusiast would look at iShares Core S&P Mid-Cap (IJH) for incremental purchases at 109.72, 103.95 and 98.18.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

The revenue shortfall is not hard to explain. Multinational corporations are struggling to generate sales due to a slowdown in global growth, particularly in Europe and China. The modest achievement in earnings is not particularly difficult to explain either. Bottom line profit can be achieved by cutting costs, increasing worker responsibilities and implementing successful tax strategies. On the other hand, executives are less able to sweep revenue data under the proverbial rug.

Bulls don’t seem to be bothered by surging price-to-sales ratios or the associated questions concerning valuation. If central banks around the world are lowering target interest rates, or printing money to buy bonds to lower actual rates, they see the backstop as unconditionally positive for high-yielding assets and equities. What’s more, if a slight majority of companies are still beating profit expectations, where’s the price-to-earnings fire?

Bears are far less convinced. Simply stated, corporations will not ramp up their hiring if they don’t have more sales to justify new employee acquisition. It follows that if genuine job growth remains elusive, consumers cut back on their spending, businesses hold on to their capital and even the recovering real estate sector might stall.

Are the revenue “misses” contained to certain segments? Not really. The market has already seen top-line shrinkage from IBM, eBay, AT&T, Procter & Gamble, Wells Fargo, American Express, Dover and dozens of other global participants.

As it relates to exchange-traded fund investing, who will be correct in the weeks and months ahead? The bulls?

Or the safe-haven seeking, long-bond buying bears?

Perhaps ironically, neither camp may have an accurate grasp on what will happen going forward. The most likely scenario in the near-term? Stocks will pull back for any combination of reasons, though analysts will look backwards to explain the corrective activity. Profit-taking, revenue failure, euro-zone debt troubles, budget battles, seasonal patterns, deepening global recession, China manufacturing slowdown — pick your venom. At that time, of course, we will hear from the high-profile bears who make investors feel that the world itself is imploding.

Will the world implode? Will we see a repeat of 2008? Not this year. While the bears are mostly correct about the macro-economic picture and its adverse effect on the micro-economic revenue of corporations, they underestimate the coordinated determination of central banks around the globe. Not only do they have their collective act better together than they had during the systemic collapse of ‘08, but they’re willing to step in when corrections jeopardize their goals.

In other words, forget all of the talk about the Fed “pulling the punch bowl” or the euro-zone breaking into fragments in 2013. Granted, the summertime rhetoric may heat up and risk assets may very well tumble into correction territory. However, the central banks (e.g., People’s Bank of China, Bank of Japan, Bank of England, Federal Reserve, European Central Bank, etc.) will maintain or accelerate their stimulus. The consequence? Demand for risk assets will return.

Investors and traders are left to ponder the possibilities. A trader may be wise to “gamble” on the high probability of a correction by selling a large percentage of risky assets here… near the all-time market peak. The trader could purchase core index holdings at pre-set values that are %5, 10% or 15% below all-time intra-day highs. For example, a mid-cap enthusiast would look at iShares Core S&P Mid-Cap (IJH) for incremental purchases at 109.72, 103.95 and 98.18.

Perhaps ironically, neither camp may have an accurate grasp on what will happen going forward. The most likely scenario in the near-term? Stocks will pull back for any combination of reasons, though analysts will look backwards to explain the corrective activity. Profit-taking, revenue failure, euro-zone debt troubles, budget battles, seasonal patterns, deepening global recession, China manufacturing slowdown — pick your venom. At that time, of course, we will hear from the high-profile bears who make investors feel that the world itself is imploding.

Will the world implode? Will we see a repeat of 2008? Not this year. While the bears are mostly correct about the macro-economic picture and its adverse effect on the micro-economic revenue of corporations, they underestimate the coordinated determination of central banks around the globe. Not only do they have their collective act better together than they had during the systemic collapse of ‘08, but they’re willing to step in when corrections jeopardize their goals.

In other words, forget all of the talk about the Fed “pulling the punch bowl” or the euro-zone breaking into fragments in 2013. Granted, the summertime rhetoric may heat up and risk assets may very well tumble into correction territory. However, the central banks (e.g., People’s Bank of China, Bank of Japan, Bank of England, Federal Reserve, European Central Bank, etc.) will maintain or accelerate their stimulus. The consequence? Demand for risk assets will return.

Investors and traders are left to ponder the possibilities. A trader may be wise to “gamble” on the high probability of a correction by selling a large percentage of risky assets here… near the all-time market peak. The trader could purchase core index holdings at pre-set values that are %5, 10% or 15% below all-time intra-day highs. For example, a mid-cap enthusiast would look at iShares Core S&P Mid-Cap (IJH) for incremental purchases at 109.72, 103.95 and 98.18.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.