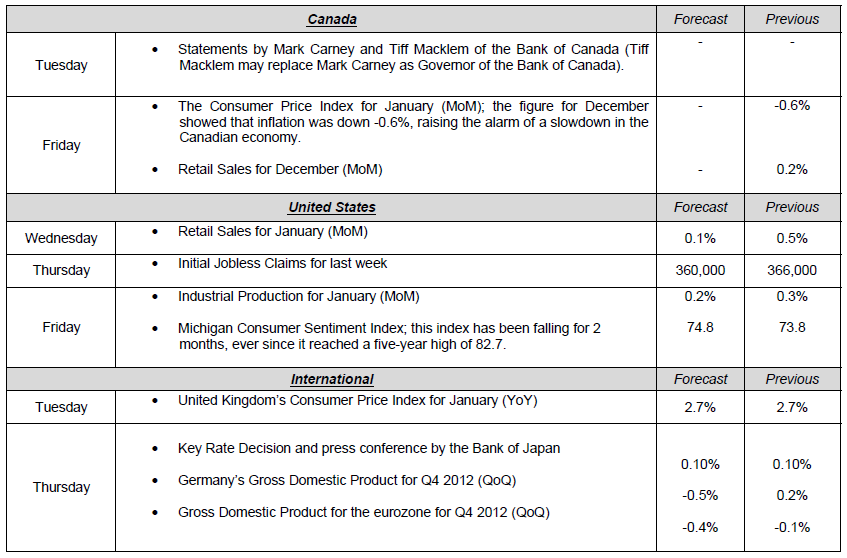

Last week saw the release of more economic indicators suggesting that the Canadian economy is losing momentum. On Thursday, we learned that housing starts for December 2012 had slipped 30,000 from 198,000 in November and that building permits had dropped 11.2% over the same period. The worst news came on Friday, when we learned that the economy had lost 21,900 jobs in January. This drove the loonie down 0.50%. These two key indicators of the health of the economy will need to be monitored closely. If real estate and employment continue to slip, we can expect a change in the tone of Bank of Canada announcements. On Thursday Mario Draghi, President of the European Central Bank, warned that continuing strength of the euro could affect economic growth in Europe. As a result, the euro fell by over 1%. Wishing you a great week.

The Loonie

“In the long run we shall have to pay our debts at a time that may be very inconvenient for our survival.”

- Norbert Wiener

Recent appreciation of equity indices across the board calls for further examination of the potential implication of valuation reductions in the months ahead. To understand the reasons for concern, let’s decompose the cause behind the recent rally and identify its possible affect on the Foreign Exchange market, particularly the Canadian dollar.

S&P 500 and Dow Jones Industrial indices have both risen to the highest level since 2007. “Risk on” sentiment has also helped CAD along the way, as it continued to trade below parity for the better part of January. Not surprisingly, capital inflows into equity markets coincided with rising levels of hedge-fund leverage, as measured by the Bloomberg Margin Index. In fact, as Bloomberg reported last month, “leverage climbed to the highest level to start any year since at least 2004" and Margin debt at NYSE firms rose in November of 2012 to the most since February 2008. USD/CAD Chart" title="USD/CAD Chart" width="838" height="331">

USD/CAD Chart" title="USD/CAD Chart" width="838" height="331">

As the chart above (left) illustrates, there is a negative relationship between the level of debt and USD/CAD rate. This correlation has been particularly evident after the first tech bust in the U.S. and, assuming the relationship will continue to hold, calls into question the sustainability of the debt at the level observed at the moment. Should any of the problems lingering on everyone’s mind (i.e. European debt problems, Middle East turmoil, China/Japan conflict) deteriorate, tipped sentiment scale, along with margin calls, can propel the USD back up above parity. Regardless of the potential outcome, erring on a side of caution and safeguarding your bottom line via hedging strategies is the prudent thing to do.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News This Week: NBC

Published 02/12/2013, 05:34 AM

Updated 05/14/2017, 06:45 AM

Major News This Week: NBC

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.