It’s done: Super Mario has finally taken action! On Wednesday Mario Draghi, President of the European Central Bank, announced that he was implementing a bond buying program. This program consists of buying bonds issued by various eurozone countries, with a view to helping bring down the interest rates they are paying on their bonds.

The program is targeting bonds maturing within three years. In contrast with the Fed’s program, the ECB program will be sterilized, meaning that for each dollar of bonds bought, the central bank will remove the same notional amount from money in circulation, so this does not represent printing money. What is the goal? To control inflation.

On Friday we learned that only 96,000 jobs were created in August in the U.S.; economists had forecasted 130,000 new jobs. Canada generated 30,000 new jobs, while analysts had expected only 10,000. These three news items propelled markets, the Canadian dollar and the euro.

Canada

Few economic indicators will be released in Canada this week. The only figure we are waiting for is Housing Starts in August. It should give us an indication of the strength of the Canadian economy. Above all, it will give Mr. Carney an indication of whether Canadian households are reining in their spending.

United States

This will be another important week for economic news in the U.S. Tomorrow we will have Trade Balance data, followed by the Federal Reserve’s decision on its key interest rate on Thursday. This decision will be followed by the ever-important speech by Mr. Bernanke. Following the release of the disastrous nonfarm payrolls figure of 96,000, the market is positioned for another unconventional market intervention by the Fed.

Should this occur, the loonie may jump to levels not seen in over a year. On Friday we will know the Consumer Price Index and Retail Sales for August, as well as the University of Michigan’s Consumer Sentiment Index.

International

The week in international news begins on Wednesday with Germany’s Consumer Price Index and two very important results. The first is the German Constitutional Court’s decision on the legality of the European rescue fund called the European Stability Mechanism (ESM) as well as the fiscal pact.

The second vote is in the Netherlands, a country that decided to adopt the austerity measures proposed by Germany. The Dutch are going to the polls to elect their next government. On Friday, we will know the Consumer Price Index for the Eurozone as well as the Employment Change figure.

The Loonie

Someone is always better interested in public benefit when it actually matches his own. - Jean-Jacques Rousseau

Our publications regularly mention how the price of crude oil influences the value of the Canadian dollar. And with good reason, given that the correlation between the two has equaled 60% over the last two years and 68% over the last two months. But what is the actual weight of oil exports within total Canadian exports? And if rising oil prices drive up the Canadian dollar, how does this affect Canadian SMEs?

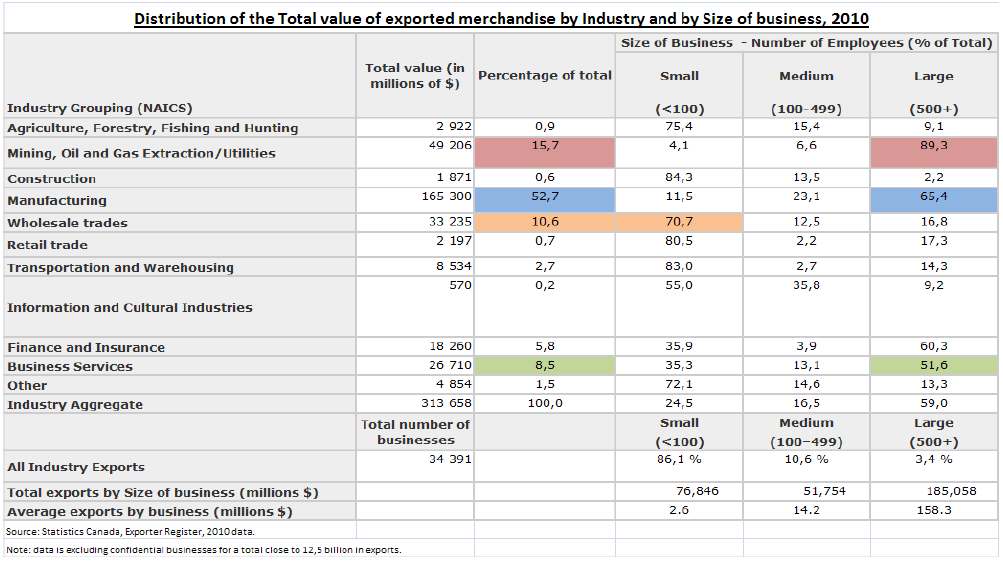

The following table lists Canadian exports by industrial group and export distribution by size of company. Mining, oil and gas account for $49.2 billion or 15.7% of total exports, and large companies dominate this sector (89.3%). In fact, this is the group of industries in which large corporations are most predominant.

The other industry groups with a major share of exports have a different profile. The proportion of large corporations in manufacturing (52.7% of total exports), wholesale trade (10.6%) and commercial services (8.5%) are 65.4%, 16.8% and 51.6%, respectively. It should be noted that small business accounts for 70.7% of the wholesale trade group.

When the value of the Canadian dollar is propelled by oil prices, this clearly has a positive impact on the large corporations in this industry. However, it also has a negative impact on the other exporting industries, where small and medium enterprises have a larger presence. Knowing that SMES are responsible for half of the jobs created in Canada, we should ponder what long-term benefits Canadians truly derive from higher oil prices.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News This Week: ECB Implements Unlimited Bond Buying Program

Published 09/12/2012, 12:55 AM

Updated 05/14/2017, 06:45 AM

Major News This Week: ECB Implements Unlimited Bond Buying Program

Major News this Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.