Last week the market went on a roller-coaster ride further to new fears about Spain. Indeed, between February and March Spanish banks increased their borrowing from the European Central Bank, from 152 to 227 billion euros. With the risks surrounding Spain creeping upwards, Spanish credit default swaps are at an historical high. Spain will issue bonds on Tuesday and Thursday, we will be closely following these events as they unfold.

Canada

This will be a major week in Canada, with the loonie at risk of being swept up in growing volatility. On Tuesday, Mr. Carney and the Bank of Canada will reveal their decision on Canada’s key interest rate. Even though analysts are expecting the rate to be unchanged, we will be paying close attention to what is said in the press release that will follow the meeting, particularly in light of the jump in employment revealed two weeks ago.

The quarterly report on monetary policy will be published on Wednesday. This should hold no surprises, given the previous day’s meeting. On Friday, we are awaiting Leading Indicators Index figures and the Consumer Price Index for the month of March.

United States

The flow of U.S. economic data will began on Monday with Retail Sales for March. Today, we will have data on Building Permits, which represents the first stage in the construction process. Many investors appear to believe that we are near a floor in the U.S. real estate market, and that the recovery should begin soon. Leading Indicators will be released on Thursday, and on Friday the G20 summit begins in Washington.

International

Last Wednesday Lucas Papademos, the Prime Minister of Greece, dissolved parliament and called an election for May 6. With severe austerity measures now in place, one of the fears is that a wave of extremist parties may win enough seats in parliament to deny one of the major parties a majority. It should be remembered that the bailout package granted to Greece required an agreement among the three major parties on the austerity measures dictated by the Troika.

Today, the eurozone will reveal the inflation rate for March and Germany will announce the results of its ZEW Economic Sentiment Index. We are keen to find out what the eurozone’s Consumer Confidence Index is, particularly in the wake of all the bad news from Spain. On Friday, Germany will reveal the important IFO Business Climate Index Figures on the current German business climate.

The Loonie

“If no one ever took risks, Michaelangelo would have painted the Sistine floor.” Neil Simon Last week, the International Monetary Fund (the IMF) published a report that expressed fears about the scarcity of so-called “risk-free” assets. As many governments have been seen their sovereign debt downgraded and several major currencies have become fragile, investors are having more and more difficulty finding “risk-free” investments. This dearth of choice creates a liquidity problem and accentuates the impact of swings in investor sentiment for the prices of financial assets.

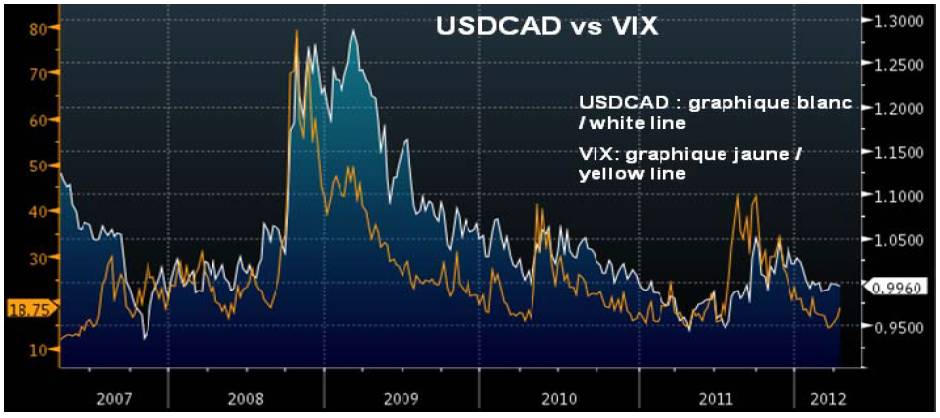

Analyses of market movements are increasingly based on investors’ attitudes toward risk taking. When fears grow, we can expect a stronger dollar (USD) and a stronger yen (JPN), as well as declines in stock markets and in certain cyclical currencies, like the Canadian dollar (CAD). Although this situation may appear normal, this has not always been the case. The following graph shows movements since 2007 in the USD/CAD and the VIX (an index of the volatility of stock market options that measures risk as perceived by investors). USD/CAD VS VIX" title="USD/CAD VS VIX" width="940" height="418">

USD/CAD VS VIX" title="USD/CAD VS VIX" width="940" height="418">

The relationship is undeniable: the degree of correlation between the USD and the VIX over the last year reached 72%, demonstrating a positive and very strong relationship between the degree of perceived risk and movements in the USD. In 2007, this correlation was less than 30%. In the current environment, poor economic news in the U.S. must be interpreted as increasing the likelihood that global financial markets will stumble. This feeds perceptions of risk and causes the USD to rise.

In another environment, poor economic news would be seen as a sign of a slowdown in the domestic economy, easing pressure on U.S. interest rates and making the U.S. dollar less attractive, leading to its depreciation. This “fear” effect should decline over time. However, given the current financial problems in Europe, the fragility of the U.S. recovery and the geopolitical uncertainties in the world, this “fear” effect will continue to play a predominant role.

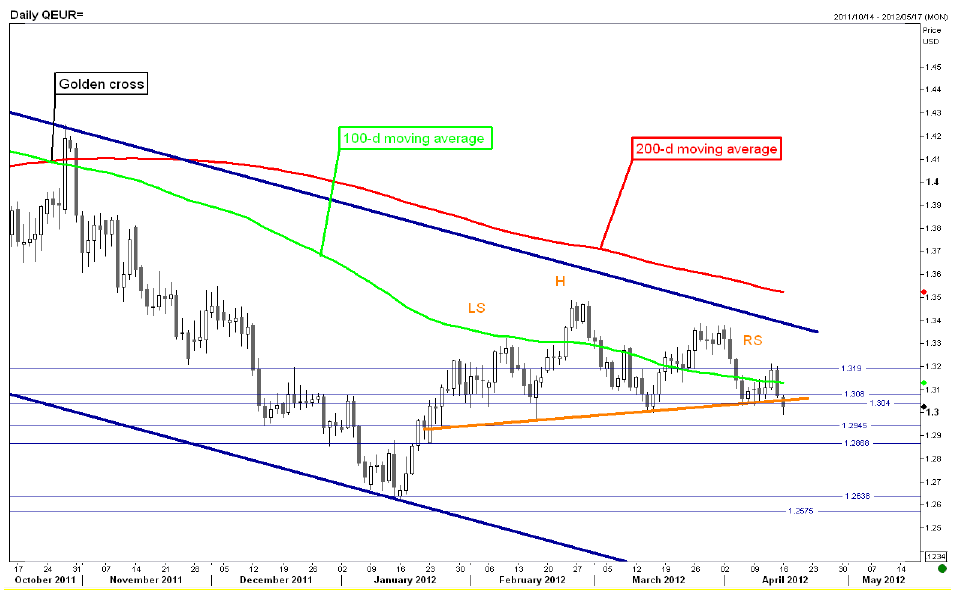

Technical Analysis: Signs of trend reversal (Monday, April 16, 2012, EURUSD in daily data).

EUR/USD: See chart below. Follow-up of last week’s analysis - the neckline (orange line) is now broken and 1.3040-10.3050 became resistance. The objective for the pair is at 1.2575.

S&P 500: The index broke its medium term uptrend channel to the downside.

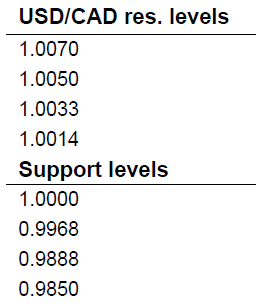

USD/CAD: 1.0050 is still the level to pass in order to see 1.0200. On the other side, 0.9968 and 0.9888 are the supports to watch. USD/CAD S&L" title="USD/CAD S&L" width="263" height="307">

USD/CAD S&L" title="USD/CAD S&L" width="263" height="307">

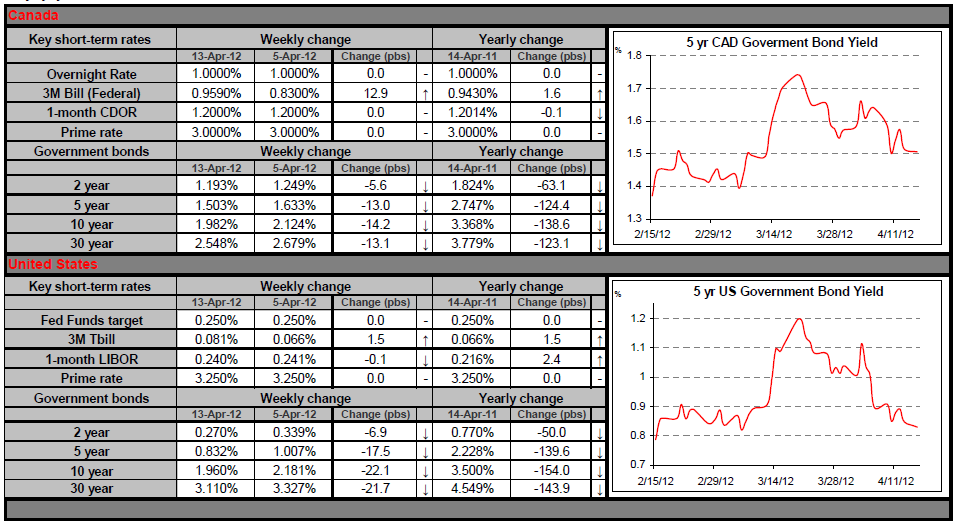

Fixed Income

Canadian yields fell last week at the reopening of markets after the Easter holidays.

Investors drove yields lower as they reacted to the bearish US employment figures published on Good Friday by buying bonds and various other safe assets.

Renewed concerns over Spain also pushed domestic yields lower, after the country’s 10-year bond yields reached 6%, a premium of over 4% relative to their German equivalent.

China’s year-over-year growth of 8.1% released on Thursday night was lower than the expected 8.3%, which also justified the safe-haven sentiment that prevailed on Friday. Both the U.S. and Canadian bond yields closed the week below the important 2% level.

Next week, the Bank of Canada announces its rate decision on Tuesday. Investors expect the rate to be kept unchanged, but the Bank of Canada might use a language that supports eventual rate increases since economic growth and inflation have come in a bit stronger than the bank’s most recent forecasts. Watch also for the releases of US home sales on Thursday, as well as fresh Canadian CPI data on Friday.

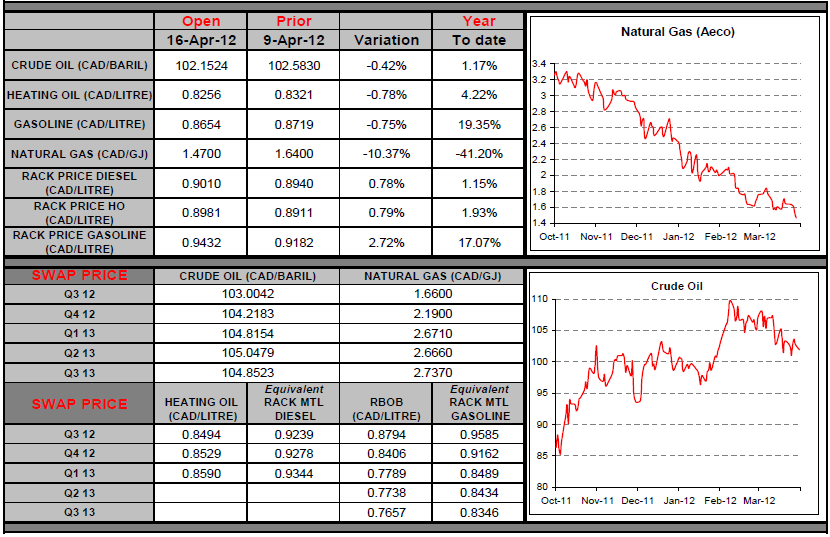

Commodities

The current high price of crude oil is bad news for Saudi Arabia, which fears that this will eventually reduce the demand for oil products by encouraging substitution with alternative energy sources. This is why Saudi Arabia would like to see the price of crude fall over the next few months. Ali Al-Naimi, the Saudi Arabian Minister of Petroleum and Mineral Resources has mentioned that the world has a sufficient supply of oil and that the recent rise in prices is unjustified.

Over the weekend, the agreement between Iran and the major Western powers in Turkey is the first step towards a solution to the Iranian nuclear crisis. Iran and the 5 +1 group (board member of the UN Security and Germany) have described the discussions as "positive" and decided to meet again on May 23, 2012 in Bagdad.

To free up international pressure, Iran will have to take concrete steps, which could include a decrease of its 20% uranium enrichment and to be cooperative in the process of inspections of its nuclear program. In order to avoid military strikes, the Iranian uranium enrichment is currently made underground at Fordo, in a facility constructed under a mountain.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News this Week: April 17, 2012

Published 04/17/2012, 04:22 AM

Updated 05/14/2017, 06:45 AM

Major News this Week: April 17, 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.