On Tuesday last week, the minutes of the March 13 FOMC Meeting were released, and they slightly contradicted Mr. Bernanke’s speech on March 26. Essentially, the minutes suggested that the U.S. economy was growing at an acceptable pace with the current measures in place. It also mentioned that no additional stimulus will be needed unless growth is compromised. On hearing this news, massive selling began in the stock markets, and the greenback benefited from the situation.

We are anxious to hear what will happen at the Fed’s 2-day meeting, to end on April 25, for a clearer reading of the Fed’s position. The favorable labor statistics published by Canada on Thursday pushed our dollar higher. Indeed, 82,000 jobs were created in Canada in March, while economists were expecting only a creation of 13,000 jobs. The same data out of the US were very disappointing, with 120,000 jobs published, which was well below expectations.

Canada

Little economic news is expected in Canada this week, but we will be interested in the results from the Business Outlook Survey, to be published on Monday, and Housing Starts for March, to be announced on Wednesday.

United States

This will be a busy week in U.S. economic news, beginning with Mr. Bernanke’s speech at the Stone Mountain conference. It will be important to pay close attention to this speech because remarks by the Chairman of the Fed can move markets, and this is even truer now, given the U.S. employment data released last Friday.

On Wednesday, the Beige Book will be released, providing a complete overview of the state of the U.S. economy. Thursday will be a busy day, with the release of the Trade Balance and the Producer Price Index. Lastly, the week in U.S. news ends on Friday with the release of the inflation rate and the Michigan Consumer Sentiment Index.

International

Many figures are expected out of China this week. On Monday, China’s Consumer Price Index will be released. On Tuesday, Japan will reveal its decision on its key interest rate and Germany and China will announce trade balance figures for March. Analysts are expecting a considerable improvement to China’s current account, from -31.48 billion to a deficit of 3.60 billion.

On Friday, China will announce its GDP for the first quarter. This figure is even more important this time around, given lower growth forecasts announced by the Prime Minister in March. Also on Friday, we will have China’s Retail Sales figure for March and Germany’s Consumer Price Index. As for the European crisis, the market is slowly focusing its attention on Spain, which faces a 24.3% unemployment rate and a 1.7% contraction of GDP in 2012.

The Loonie

“Only in our dreams are we free. The rest of the time we need wages.” -Terry Pratchett

Last Thursday morning, Statistics Canada surprised many observers with data on the health of Canada’s employment market. According to its economists, Canada’s employment sector performed very well in March; the government’s most recent report indicates that approximately 82,000 jobs were created, including 70,000 full-time jobs. It is worth noting that Canada’s best economists were projecting only 10,000 jobs created in this period. This extraordinary growth brought the national unemployment rate down to 7.2%, the lowest level since October 2010. This was very good news for the Canadian economy and the Canadian dollar, which rose over 60 basis points against the greenback.

This week we will be taking a closer look at the latest employment data. First, it is worth noting the surprising nature of this sudden increase in national employment. The creation of over 80,000 new jobs in a month is indeed newsworthy; there have only been six instances of job creation at this level since the early 1980s.

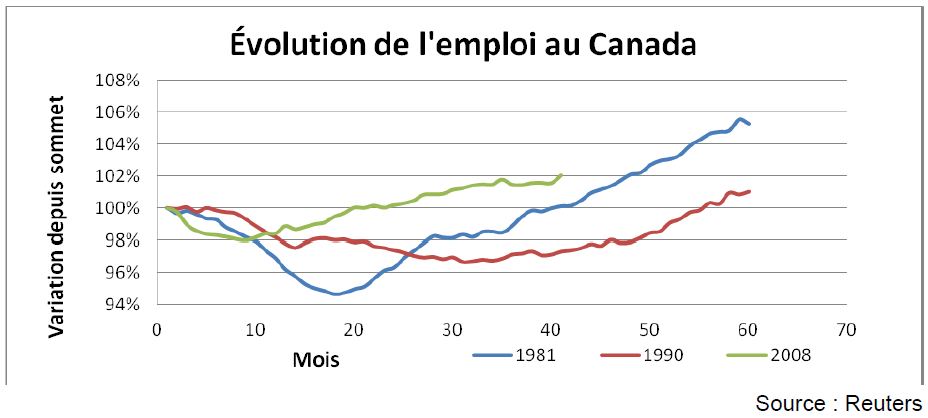

An interesting fact: job market performance in the month following such a jump tends to be disappointing, with the economy losing 3,250 jobs, on average. This suggests that such events may be more due to changes to statistical models than any spontaneous jump in employment. Second, we believe that this is a good time to compare the performance of the current employment market, coming out of the 2008 financial crisis, with performance during the last two major recessions.

As shown in the above graph, the job market contracted much less during the 2008 recession (the green line) than it did during the 1981 recession (the blue line) or the 1990 recession (the red line). The market has therefore recovered much more quickly this time, recapturing any ground lost in only 20 months. In the short term, it would not be surprising to see this renewed strength in the job market reflected in a stronger Canadian dollar.

Technical Analysis: (Monday, April 9, 2012, EURUSD in daily data)

EUR/USD

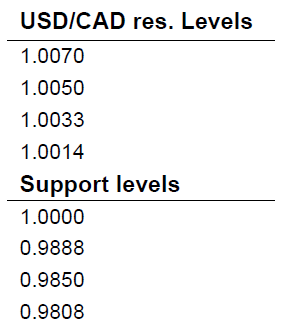

See chart below. Follow-up of last week’s analysis: the neckline at 1.3040 (orange line) has been tested but not yet broken in a significant way. A validation of this Head & Shoulder would set the target at 1.2575 and would sent the USD higher against the majors including the USD/CAD which could test its 200-day moving average at 1.0014.

Oil

Third consecutive day of rebound off its 100-day moving average at $101.16. The short term pressure remains to the downside.

Fixed Income

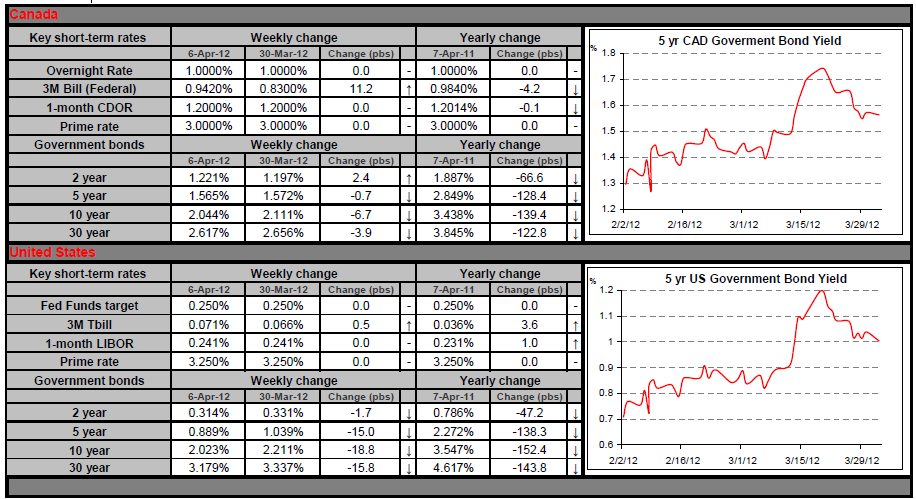

To the surprise of market participants, the FOMC minutes of the March 13 meeting showed that its members were not inclined to hold a third round of quantitative easing unless an unexpected event would derail the slow recovery of the U.S. economy. Upon this release, U.S. equities began to tumble and swap rates were pushed higher, investors betting on a premature rate hike.

Favorable employment data published out of Canada last Thursday gave ammunition to supporters of a rate hike. Indeed, expectations were exceeded by 69,000 jobs. This strong employment growth will certainly lead Mark Carney and the Bank of Canada to revise their growth forecasts and consequently their monetary policy.

U.S. jobs statistics released Friday were a huge disappointment. The low initial jobless claims week after week coupled with strong private sector employment data (ADP) had helped heighten our expectations. The American labor market has created 120,000 jobs in March, well below the 205,000 anticipated creations.

Several elements are likely to impact swap rates this week. Bernanke will hold a conference today at Stone Mountain. He will certainly comment on the employment statistics unveiled last Friday. Several members of the Federal Reserve will speak at various moments throughout the week and data on inflation in the United States will be published Friday.

Commodities

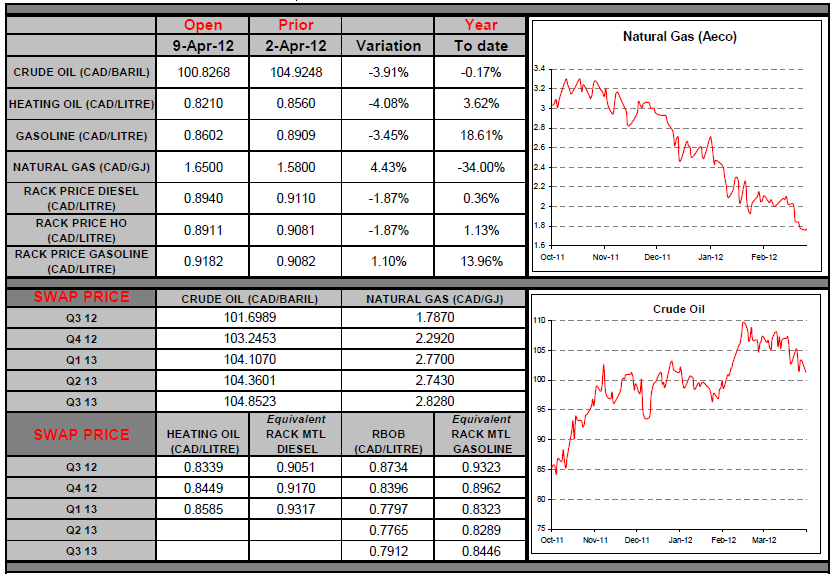

On Thursday afternoon, the price of oil was up almost 2%, with the encouraging news about Initial Jobless Claims in the U.S. The news drove up price for Light Sweet Crude (WTI) as the market can now expect the increase of demand in the U.S., which is the world’s largest energy consumer.

On Good Friday, even though 120,000 new jobs were created south of the border, we notice that a total of 635,000 jobs were created since the beginning of the year. The stability of good employment data is important for the continuation of the economic recovery and for energy price stability.

In conclusion, heating oil ended the week at CAD0.83/litre, the lowest price seen in almost two months. As a result, this would be a good time to hedge a position against the price of diesel.

Last Week At A Glance

CanadaIn March, job creation surprised even the most optimistic. According to the Labour Force Survey, 82.3K jobs were added. As result, the unemployment rate sank two ticks to 7.2%, its lowest mark since September of last year. The services sector rebounded after several weak months, adding 57.5K jobs on strong gains in the health care and social assistance sector and in the information, culture and recreation sector. It thus outperformed the goods sector for the first time in five months. This is not to say that employment in goods-producing industries was weak. On the contrary, the goods sector added almost 25K jobs, buoyed by manufacturing, construction and resources.

Youth employment bounced back as well. Fulltime employment soared 70K for a second straight increase. Part-time employment sprang 12K, making up for the prior month's decline. Private-sector employment advanced 43K and paid employment rose 64K. Even the details behind the strong headline were very encouraging. Regionally, Quebec and Ontario posted gains of 36.4K and 46.1K, respectively. The rebound in private-sector employment was great news.

The more reliable three-month average showed that Canada created 27,000 jobs per month, for the most part in the private sector. This was well above last year’s average. Hours worked rose 0.7% annualized in Q1, consistent with soft growth. On the bright side, it was definitely better than was the case in Q4 when hours worked pulled back a tad. In February, the total value of building permits grew 7.5% after shrinking 11.4% the previous month.

United States

In March, the ISM Manufacturing Index climbed a full point to 53.4, topping consensus expectations by four ticks. The production sub-index rose to a three-month high of 58.3 while the employment sub-index jumped three full points to 56.1, its highest reading in nine months. The new-orders sub-index slipped 4 ticks to 54.5. The largest absolute move was in export orders, which receded 5.5 points to 54.

Though this sub-index more than reversed its gain from the month before, at least it managed to stay well above the expansionary threshold of 50. In a separate report, the ISM Non-manufacturing Index was a bit softer than expected. It dropped to 56 from 57.3 in February. All told, the ISM reports remained consistent with decent GDP growth in 2012Q1, which we are pegging at 2% or so annualized.

In February, factory orders rose 1.3%, more than making up for January's 1.1% decline. Still, the gains were two ticks shy of consensus. Durable goods orders rose 2.4%, overshooting the initial estimate of 2.2% in the advance report. Non-defence capital goods orders excluding aircraft rose 1.7%, which was also better than the 1.2% increase initially reported. Total factory shipments eked up 0.1%, while shipments of non-defence capital goods ex-aircraft, a proxy for investment spending, progressed 1.4%, unchanged from the initial estimate.

February's gains in factory orders are encouraging for production going forward. The increase in shipments of non-defence capital goods ex-aircraft is also positive, although it is unlikely to be enough to prevent a moderation in overall business investment spending in Q1. All in all, the report was slightly softer than expected.

The US labour market added 120,000 jobs, the worst showing in five months. The unemployment rate dipped to a 38-month low at 8.2% but that was mainly due to an increase in the number of people leaving the labour force (the part-rate fell back to 63.8%). Though most of the industries remained in hiring mode in March (59.6% reported adding to headcounts), there were nonetheless some disturbing losses in key cyclical industries. For the first time since August 2009, both the temporary help-supply and retail industries lost jobs during the month.