Last week, the U.S. Federal Reserve surprised financial market pundits all around the world. While a median result of analysts expected Ben Bernanke to announce that the Fed would reduce bond purchases by $10 billion per month, instead he announced that it would continue the program at its current pace of $85 billion. The Fed has also reduced its growth forecast for the U.S. economy over the next three years. The statement that the quantitative easing program would continue unchanged allowed the S&P 500, the benchmark index in the U.S., to climb to a record high. This had a very strong effect on the U.S. dollar, which fell close to 1% against most international currencies. The news had less of an impact on Canadian markets, but on Friday we learned that inflation was growing 1.1% on an annual basis, or well below the Bank of Canada’s target rate of 2%. Have a good week!

The Loonie

“I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” - Albert Einstein

With conflict in Syria continuing to capture the headlines across the world, it is worth noting the affects previous geopolitical instability has had on the performance of the Canadian dollar.

Over the past month, the tug war between what action(s) should be taken in light of escalating civil unrest in Syria sent jitters amongst investors and caused significant volatility in asset prices across the globe. However uncertain markets may seem at the moment, if history is any indication, appreciation of equities may be in the cards in the not so distant future. Originally issued by Deutsche Bank and reprinted by The Telegraph, the diagram below (left) illustrates the impact historical conflicts have had on the S&P 500’s performance through out the 30 year time period.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

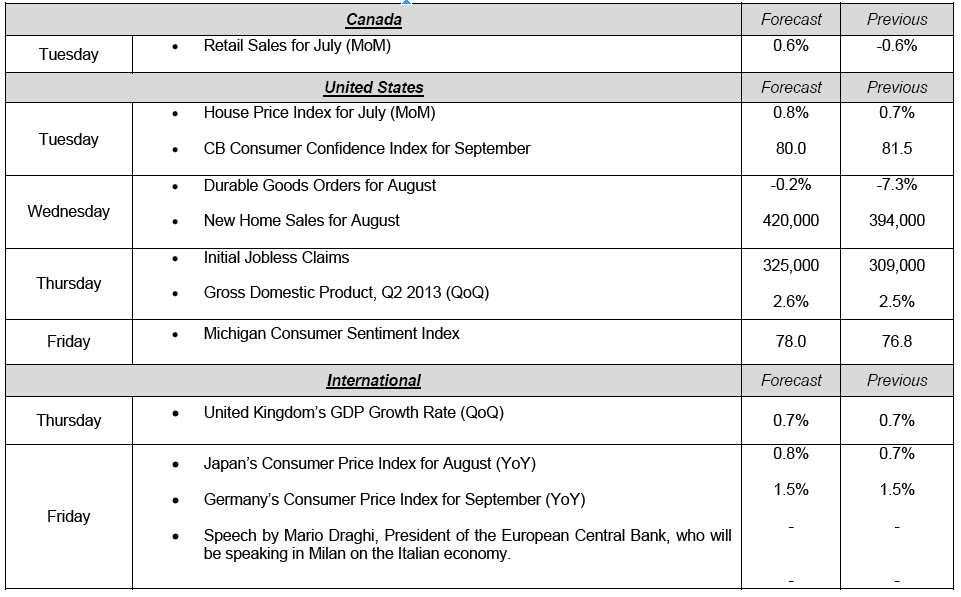

Major News This Week : September 23, 2013

Published 09/24/2013, 06:06 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : September 23, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.