Several news items captured our attention last week. On Wednesday the Bank of Canada surprised no one when it announced that its key interest rate would stay at 1%. In the press release, the Bank said that "as long as there is significant slack in the Canadian economy, the inflation outlook remains muted, and imbalances in the household sector continue to evolve constructively, the considerable monetary policy stimulus currently in place will remain appropriate." Canada and the U.S. released radically different employment figures on Friday. The Canadian economy created 59,200 jobs in August, or 39,200 more than expected. The U.S. economy created 169,000 jobs in August, or 11,000 less than expected, but it was also announced that July’s figure had been revised downward by 58,000 jobs. This news allowed the loonie to rise by close to 1% on Friday. Have a good week!

The Loonie

“Action is the foundational key to all success.” - Pablo Picasso

In its latest announcement, the Bank of Canada’s last press release mentioned greater financial volatility in the economies of several emerging countries, and this adds some uncertainty to Canada’s growth outlook. Not too long ago, we were counting on their strength to lift our struggling global economy. What happened? In order to revive their anemic economies, the developed countries implemented unconventional monetary policies, and the resulting massive injection of liquidity created an unprecedented flow of capital to the emerging countries. A favourable credit environment in the developed countries encouraged investors to take advantage of the lower interest rates and make investments in emerging areas. The result was a sharp appreciation of several exotic currencies, including Brazil’s real and India’s rupee. Developing countries were able to finance large current account deficits while generating good growth that pushed deep structural problems out of the limelight. Last May, the financial community was shaken when the leaders of the U.S. Federal Reserve expressed a willingness to change the Fed’s monetary policy in the very short term.

The FOMC's next meeting—on September 17 and 18—will probably be followed by a statement that its bond purchases will be cut by $20 billion or from $85 billion to $65 billion, per month. The anticipated tightening of liquidity has immediately stoked fears for the future growth of emerging countries. They now find themselves on the flip side of the coin, and reality is hitting them hard. Fear has gripped foreign investors, who have been taking back their marbles, leaving India, Brazil and Turkey in very precarious situations, although China and Russia have fared somewhat better. The following graph shows how three currencies have fallen against the U.S. dollar since early May. This weakness reflects a recent exodus of foreign capital. According to Morgan Stanley, some $760 million worth of assets were liquidated in just one week.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

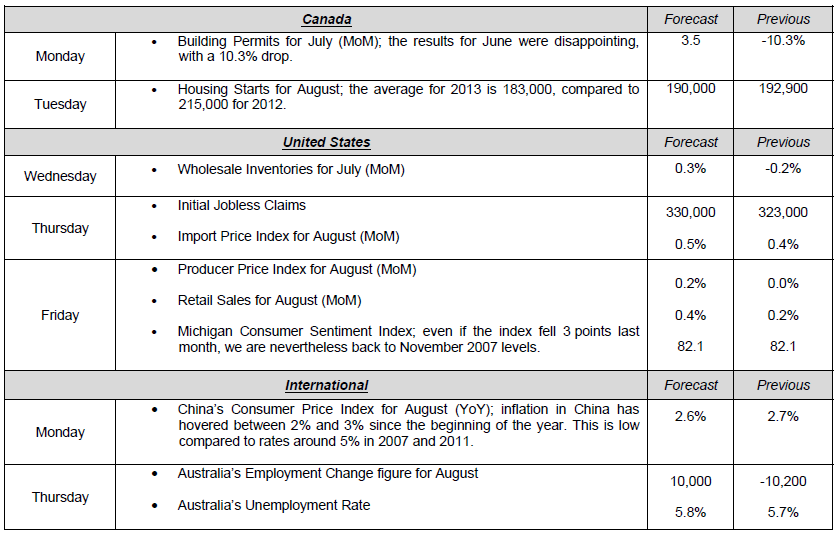

Major News This Week : September 09, 2013

Published 09/10/2013, 07:11 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : September 09, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.