Last week was marked by fears of the U.S. staging a military attack on Syria. Currency, commodity, stock and bond markets may be volatile over next few months because of several factors: political tensions in the Middle East, the U.S. Federal Reserve should begin tapering its bond purchases over the next few weeks, the U.S. government’s debt ceiling and budget will be back in the news, and the massive devaluation of many emerging market currencies. Given this volatility looming ahead, you may want to take advantage of the end of the vacation period to place orders with your trader and review your hedging strategy. Have a good week! Philippe Shebib

The Loonie

“Every choice you make has an end result.” Zig Ziglar

In the next few months we will see the end of another chapter of history: on January 31, 2014 Ben Bernanke’s mandate will end, after eight tumultuous years at the head of the Federal Reserve. Within the next few weeks, President Obama will need to make the difficult choice of naming a new head of the U.S, Federal Reserve. Independent of who is chosen, one thing is certain: the new Chairman will take over the reins in a challenging environment in which the economy is struggling to reach pre-crisis levels and exceptional expansionary measures affecting all asset classes are supposed to be gradually withdrawn. At this time, two potential candidates have been identified to replace Dr. Bernanke: Janet Yellen and Lawrence Summers. Both are academic economists, and they offer slightly different track records that are equally impressive. Who best fits the bill depends on whose survey you consult, but a recent Bloomberg survey of 63 economists found that 65% favoured Ms. Yellen. Paddy Power, an online betting site, gives Mr. Summers 66.7% odds and Ms.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

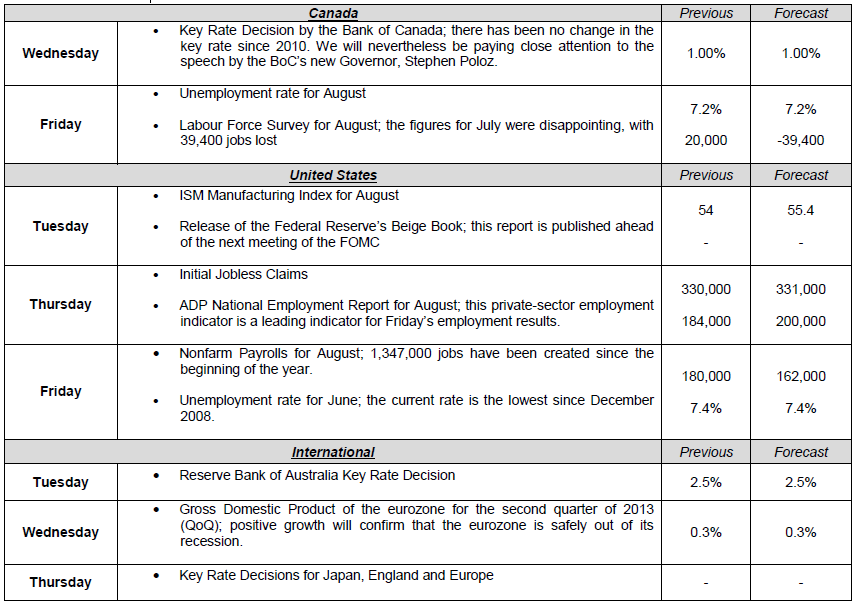

Major News this Week : September 03, 2013

Published 09/04/2013, 06:57 AM

Updated 05/14/2017, 06:45 AM

Major News this Week : September 03, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.