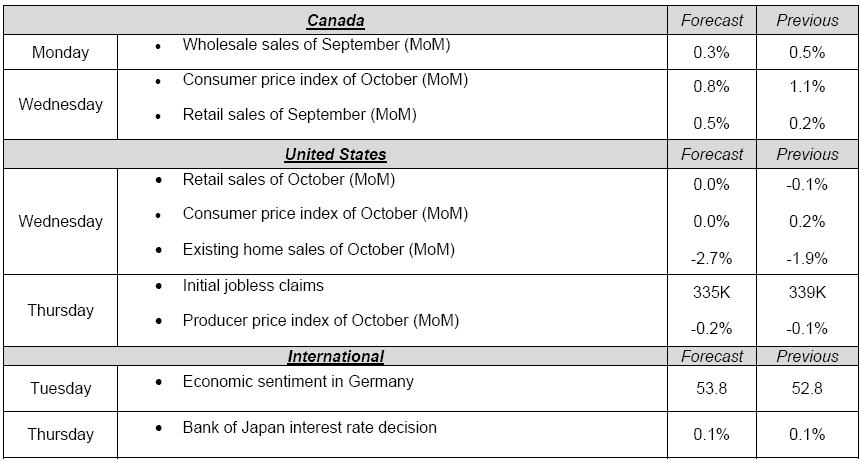

Last Friday, the publication of manufacturing sales in September was up 0.6% and this was 0.1% better than expected. The Canadian real estate seems to regain its strength; in fact, the Teranet National Bank index rose by 3.1% in October. On Thursday, at the hearing of Janet Yellen to the U.S congress, the future governor of the Federal Reserve said the Fed will keep in place its actual quantitative easing policy. This monthly injection of 85 billion dollars has pushed the S&P 500 to new heights and helped the recovery of the labor market. Although most economic figures last week in the United States were near expectations, it may be noted that industrial production released last Friday fell by -0.1% for the month of October. This was well short of expectations as the market was forecasting 0.2%. Last Thursday, the publication of the Euro-Zone GDP in the third quarter of 2013 confirmed that Europe is still in an economic downturn while the annual growth rate was confirmed at -0.4%.Have a good week!

The Loonie

Don't judge each day by the harvest you reap but by the seeds that you plant. Robert Louis Stevenson

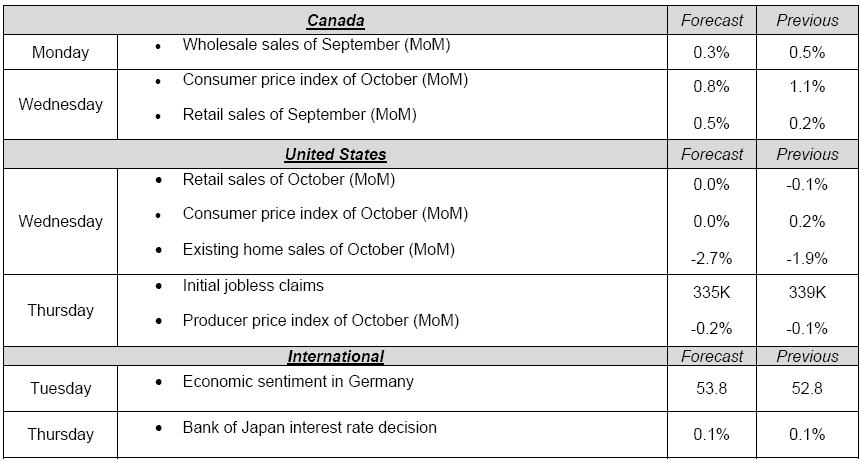

Lately, what has caught our attention is the Canadian oil which seems to be flowing through at full speed on the steam train to the United States. The amount of oil moved by rail is increasing, especially towards the Gulf of Mexico US refineries. The XL Keystone Pipeline project that would transport Canadian synthetic crude oil from the oil sands of Alberta towards mainly the Gulf Coast of Texas is an ongoing controversial debate. The main issue arises when considering the probabilities of an environmental disaster versus the economic benefits for both economies involved. This project, once approved, would indeed be direct competition to the railroads. For the time being, railroads are gearing up to respond to the increased demand. In fact, railroads have increased their loading capacity significantly as a response to an increased Canadian oil output. For the moment, even though costs are higher on a “per barrel” basis to move oil by rail versus pipeline, it is an acceptable temporary fix while waiting on a resolution for the major pipeline project. The July railroad tragedy of Lac Mégantic definitely brought security concerns over the long-term usage of railroads to move oil. Below is an interesting chart showing the evolution of Canadian oil exports to the United States.

To Read the Entire Report Please Click on the pdf File Below.

The Loonie

Don't judge each day by the harvest you reap but by the seeds that you plant. Robert Louis Stevenson

Lately, what has caught our attention is the Canadian oil which seems to be flowing through at full speed on the steam train to the United States. The amount of oil moved by rail is increasing, especially towards the Gulf of Mexico US refineries. The XL Keystone Pipeline project that would transport Canadian synthetic crude oil from the oil sands of Alberta towards mainly the Gulf Coast of Texas is an ongoing controversial debate. The main issue arises when considering the probabilities of an environmental disaster versus the economic benefits for both economies involved. This project, once approved, would indeed be direct competition to the railroads. For the time being, railroads are gearing up to respond to the increased demand. In fact, railroads have increased their loading capacity significantly as a response to an increased Canadian oil output. For the moment, even though costs are higher on a “per barrel” basis to move oil by rail versus pipeline, it is an acceptable temporary fix while waiting on a resolution for the major pipeline project. The July railroad tragedy of Lac Mégantic definitely brought security concerns over the long-term usage of railroads to move oil. Below is an interesting chart showing the evolution of Canadian oil exports to the United States.

To Read the Entire Report Please Click on the pdf File Below.