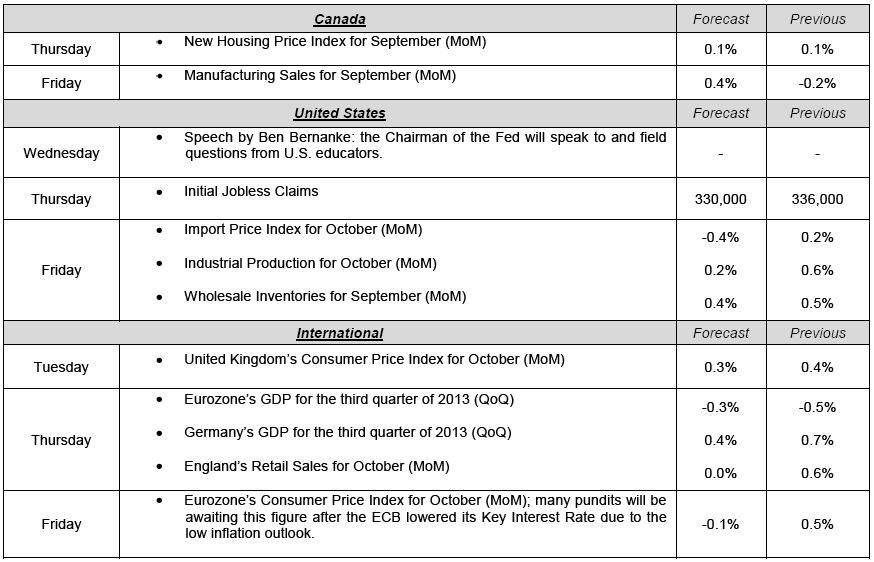

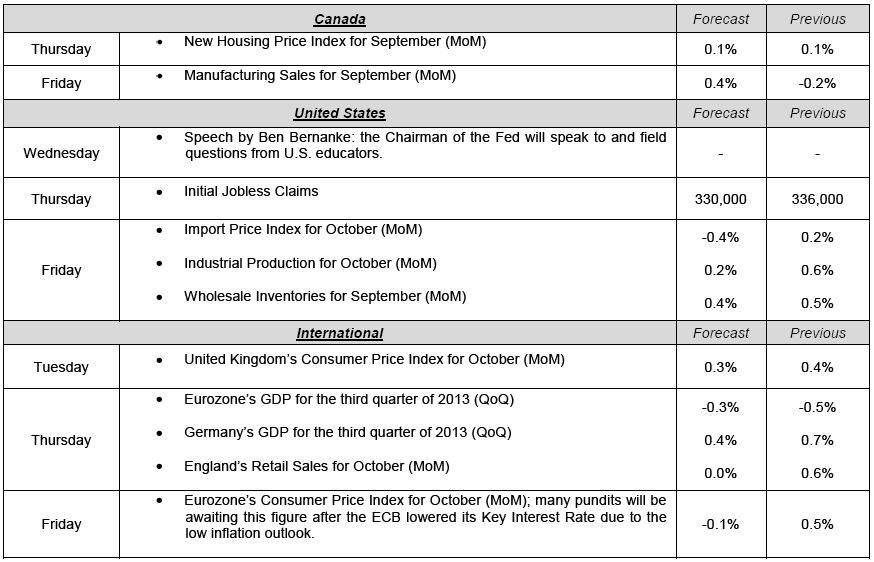

Canadian employment figures for September, released last Friday, were better than expected. The Unemployment Rate came in at 6.9%, 0.1% below the forecast, and the economy created 13,200 new jobs. The U.S. posted excellent figures last week! In the third quarter, GDP grew by an annualized rate of 2.8%, or 0.8% higher than the forecast. And on Friday we learned that the economy had created 64,000 more jobs than expected. The surprise of the week was undoubtedly the announcement that the ECB was trimming 25 basis points off its Key Interest Rate. Mario Draghi, President of the European Central Bank, caught a full 85% of the economists surveyed by Bloomberg off guard when he cut the rate to 0.25%. Mr. Draghi mentioned that Europe was currently experiencing a prolonged period of low inflation. Following the announcement, the euro fell close to 1.5% against the greenback.

The Loonie

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” - Warren Buffet

This column will focus on the eurozone again this week, due to its currency’s sizeable fluctuation in the FX markets last week. The following graph shows the euro’s rise against the greenback in mid-October, followed by a striking return to its starting point in just 10 days! Now we can forget any threat of an exploding eurozone and a return of national currencies such as the franc, the deutsche mark and the drachma. Furthermore, given the recent indicators measuring inflation, a dark cloud is now forming over Europe’s economy. Are we looking at the start of a deflationary period? This would indicate weakness in an already faltering and uneven economic recovery across the countries of the eurozone.

To Read the Entire Report Please Click on the pdf File Below.

The Loonie

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” - Warren Buffet

This column will focus on the eurozone again this week, due to its currency’s sizeable fluctuation in the FX markets last week. The following graph shows the euro’s rise against the greenback in mid-October, followed by a striking return to its starting point in just 10 days! Now we can forget any threat of an exploding eurozone and a return of national currencies such as the franc, the deutsche mark and the drachma. Furthermore, given the recent indicators measuring inflation, a dark cloud is now forming over Europe’s economy. Are we looking at the start of a deflationary period? This would indicate weakness in an already faltering and uneven economic recovery across the countries of the eurozone.

To Read the Entire Report Please Click on the pdf File Below.