Last Wednesday, the Bank of Canada surprised the financial markets by stating that even if the key interest rate will eventually increase, rate hikes now were less imminent. Low inflation pressures and lower consumer debt levels were the main reasons for the Bank maintaining its expansionist policy. On Friday, the Consumer Price Index confirmed such analyses, as we learned that inflation fell 0.6% in December. This bad news hurt the loonie, which slipped close to 2% in 3 days. There was better news in the U.S., where Initial Jobless Claims figures continued to decline, coming in at close to 330,000 for a second consecutive week. Lastly, the Bank of Japan announced that its commitment to asset purchases was open-ended and that it was raising its inflation target from 0% to 2%. As a result, the yen was down on the week for the 11th week in a row. Have a good week!

The Loonie

“The soldier’s courage depends on the general’s carefulness” - Publilius Syrus

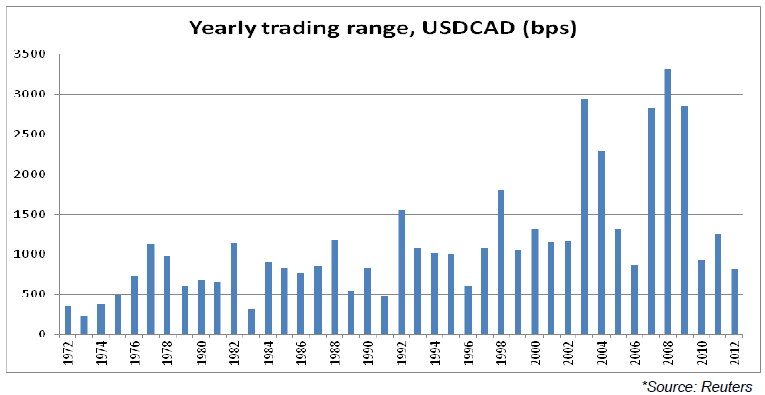

Our next webinar will look at whether volatility will return to the currency market. But how exactly does 2012 look compare to other years? We have updated our 40-year Yearly Trading Range chart to show changes in the range between maximum and minimum USD CAD rates for the year.

Our first observation is that the new millennium brought about a general increase in volatility. Then we can see that the range was very narrow in 2012. This 816-point range was the lowest observation since 1996 and much less than the median of 981, as well as the average, which was boosted to 1128 by the crisis in 2008. Our second observation is that we have indeed just been through a quiet period; there is no doubt that this has greatly limited the risk of unpleasant surprises over the last 12 months stemming from fluctuations in the loonie’s value.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

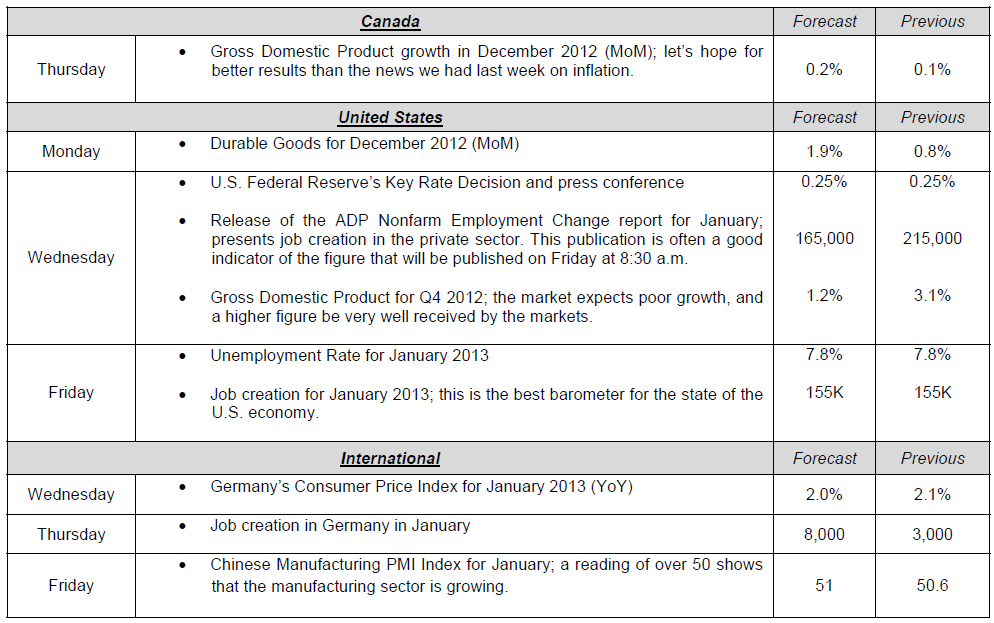

Major News This Week : January 28, 2013

Published 01/29/2013, 07:05 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : January 28, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.