Major News this Week

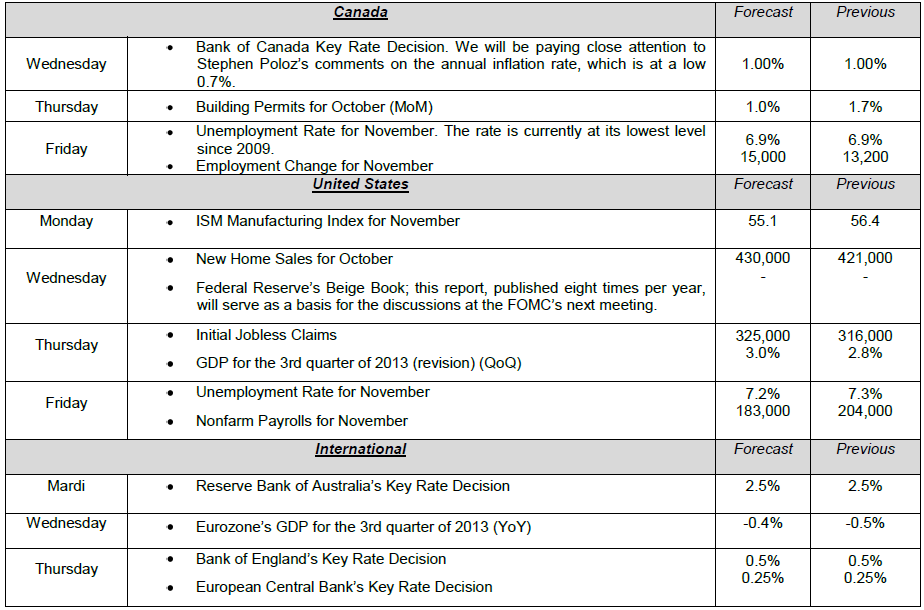

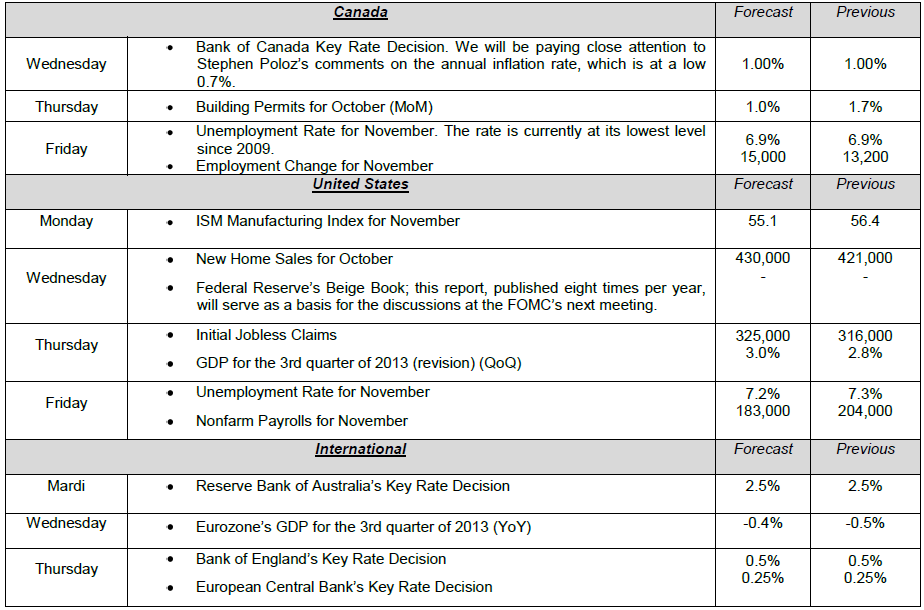

The release of Canadian GDP data for the 3rd quarter of 2013 came as a surprise, showing a 2.7% jump, or 0.2% over economists’ projections. This encouraging economic news did not prevent the loonie from slipping close to 1% in the last week. Last Friday the eurozone released its latest employment figures, and although the 12.1% unemployment rate was still high, it was nevertheless down 0.1% from one month earlier. Japan released its latest inflation indicator, and analysts were surprised to see an annual increase of 0.9% (forecasts had pegged it at 0.7%). The Bank of Japan’s bond purchases are slowly beginning to have an impact, with the value of goods gradually improving in the Land of the Rising Sun. Inflation hasn’t been this high since 2009. Have a good day!

The Loonie

“Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.” - George Soros

Recent rate drop by the ECB resulted in a sharp sell off in EURCAD, albeit a relatively short lived one. Despite continuing worries over the future of the Euro currency, investors continued to bet on recovery as they bid up EURCAD shortly after the surprise cut in the benchmark rate. Notwithstanding the overall lag in fundamentals in the Eurozone, it was the lack of inflation that sparked renewed concerns over the future economic growth. Perhaps, it was not the so distant memory of Japan’s decades old deflation plague that forced the ECB President Mario Draghi to finally take action.

To Read the Entire Report Please Click on the pdf File Below.

The release of Canadian GDP data for the 3rd quarter of 2013 came as a surprise, showing a 2.7% jump, or 0.2% over economists’ projections. This encouraging economic news did not prevent the loonie from slipping close to 1% in the last week. Last Friday the eurozone released its latest employment figures, and although the 12.1% unemployment rate was still high, it was nevertheless down 0.1% from one month earlier. Japan released its latest inflation indicator, and analysts were surprised to see an annual increase of 0.9% (forecasts had pegged it at 0.7%). The Bank of Japan’s bond purchases are slowly beginning to have an impact, with the value of goods gradually improving in the Land of the Rising Sun. Inflation hasn’t been this high since 2009. Have a good day!

The Loonie

“Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.” - George Soros

Recent rate drop by the ECB resulted in a sharp sell off in EURCAD, albeit a relatively short lived one. Despite continuing worries over the future of the Euro currency, investors continued to bet on recovery as they bid up EURCAD shortly after the surprise cut in the benchmark rate. Notwithstanding the overall lag in fundamentals in the Eurozone, it was the lack of inflation that sparked renewed concerns over the future economic growth. Perhaps, it was not the so distant memory of Japan’s decades old deflation plague that forced the ECB President Mario Draghi to finally take action.

To Read the Entire Report Please Click on the pdf File Below.