The U.S Federal Reserve report, published last week, had the expected results in terms of volatility on the overall markets on Wednesday afternoon. Several members of the FOMC have suggested that bond purchases should decline by the end of 2013. This injection of capital in the economy is currently at 85 billion per month. Retail sales in Canada fell at 0.6% in June. The economic slowdown in Canada and the strengthening of the U.S. dollar against most currencies had a negative impact on the loonie. In fact, our currency lost nearly 2% in a week. Last Thursday, the PMI manufacturing in China was reassuring with a level of 50.1 instead of 48.2 expected by the analysts. Have a good week!

The Loonie

“A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.” John C. Maxwell

The growing tensions in Egypt and the Middle East are sure to sow doubts regarding the functioning of the oil supply in the region. Egypt is not a major exporter but it controls the Suez Canal, a major pipeline network and is located in the heart of the flow of crude oil from Africa and the Gulf. Since the beginning of this crisis, the price of Brent crude oil (oil from the North Sea) and WTI (light sweet crude) remain at relatively high levels. Since July, the price of our WTI continues to catch up with those of Brent in reducing the gap between the two (See graph). The new light crude transport infrastructures by pipeline, from Canada and the northern U.S., to refineries in the Gulf of Mexico have been operating at high levels for several months and have helped in reducing Brent demand and increasing WTI prices. If the trend continues, knowing that the U.S is the second largest country consumer of oil (18M barrels per day, China is the first with a consumption of 18.7m / B day), the price of our WTI will continue its momentum.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

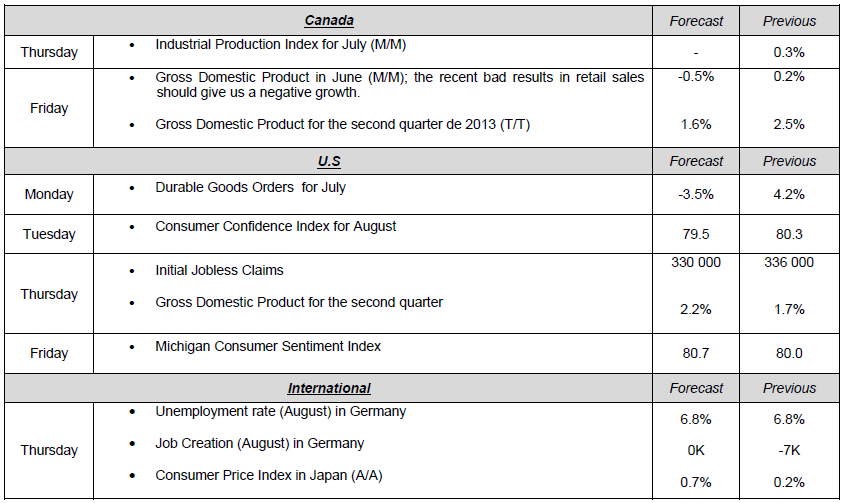

Major News This Week : August 26th, 2013

Published 08/28/2013, 02:18 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : August 26th, 2013

Major News this Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.