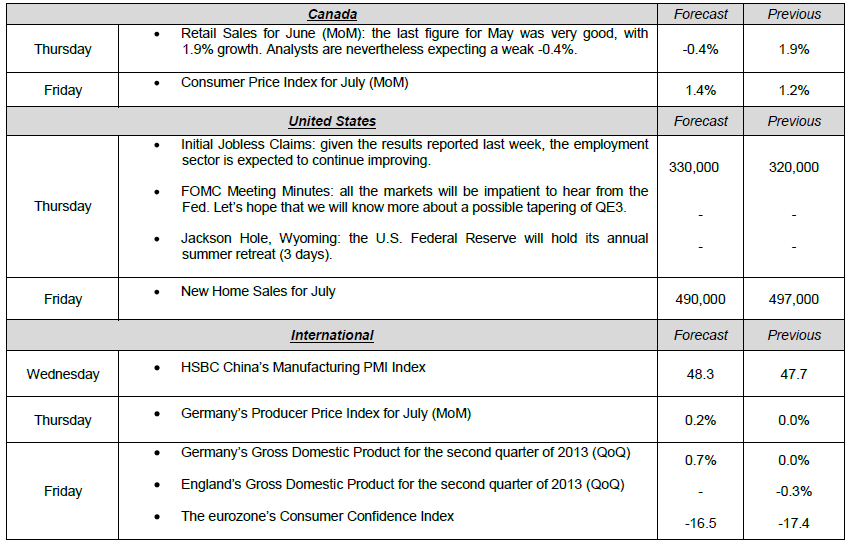

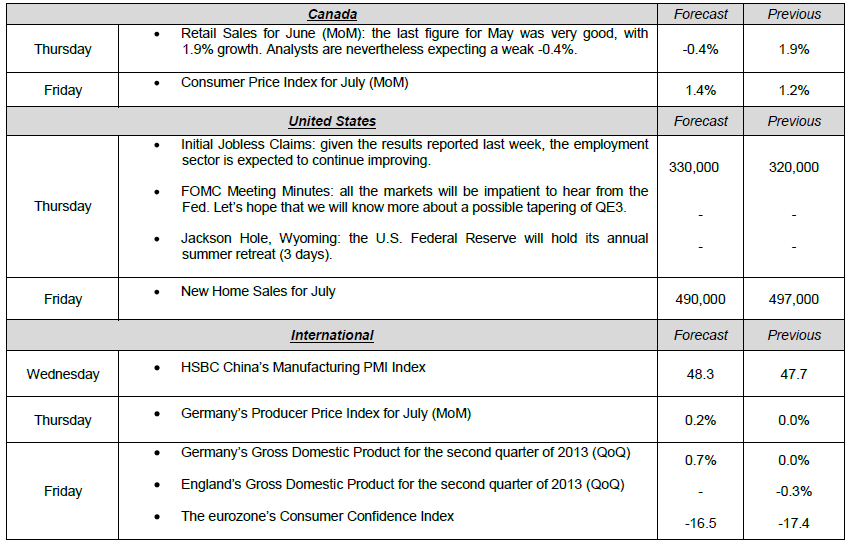

On Friday we learned that sales in Canada’s manufacturing sector fell -0.5% in June. This figure was well below the 0.3% increase expected by analysts. The decline in sales could result in negative GDP growth for June. The news out of the U.S. was mixed last week, where Initial Jobless Claims continued to improve with a low 320,000 announced. This was the best result since October 2007. On the other hand, analysts were disappointed with the Michigan Consumer Sentiment Index and the Producer Price Index. Canadian and U.S. bond yields continued to surge and have reached 2-year highs. The main reason is market speculation that the U.S. Federal Reserve may begin tapering its bond purchases beginning next month

The Loonie

“What is a cynic? A man who knows the price of everything and the value of nothing.” - Oscar Wilde

In tune with my previous commentary and in light of continuing evidence of “the great rotation” from bonds to equities, I’d like to continue the discussion on foreign investments and the impact it is having on FX markets. The January publication by “Business Insider” emphasized the signs of what many analysts on Wall Street have been anticipating, the rotation from bonds into equities in 2013. As, once again, the sentiment pendulum shifts towards higher risk taking, fixed income assets are attracting less and less interest from investors. Bank of America Merrill Lynch Chief Investment Strategist Michael Hartnett noted, that the past seven years have seen a Great Divergence in terms of fund flows as investors have poured $800bn into bond funds and redeemed $600bn from long- only equity funds.1 New data, however, suggests a clear shift in interest, away from fixed income. As of August 9th 2013, weekly flows registered $4 billion in redemptions from treasuries and bonds while developed market equities saw $10 billion in inflows – the most severe one-week flight out of bonds ever.2 Business Insider further notes significant outflows from BRIC’s equity funds (largest on record this past week) with Brazil funds losing 1.8% of assets under management, Russia 0.8%, India 0.4%, and China shedding 0.1%. Case and point - Norway's oil fund, which, as reported by Richard Milne at Financial Times, has now raised its equities holdings to a record 63.4% of its portfolio, against a record low in bonds of 35.7%, a reflection of Yngve Slyngstad’s (CEO) lack of enthusiasm for bond markets.

To Read the Entire Report Please Click on the pdf File Below.

The Loonie

“What is a cynic? A man who knows the price of everything and the value of nothing.” - Oscar Wilde

In tune with my previous commentary and in light of continuing evidence of “the great rotation” from bonds to equities, I’d like to continue the discussion on foreign investments and the impact it is having on FX markets. The January publication by “Business Insider” emphasized the signs of what many analysts on Wall Street have been anticipating, the rotation from bonds into equities in 2013. As, once again, the sentiment pendulum shifts towards higher risk taking, fixed income assets are attracting less and less interest from investors. Bank of America Merrill Lynch Chief Investment Strategist Michael Hartnett noted, that the past seven years have seen a Great Divergence in terms of fund flows as investors have poured $800bn into bond funds and redeemed $600bn from long- only equity funds.1 New data, however, suggests a clear shift in interest, away from fixed income. As of August 9th 2013, weekly flows registered $4 billion in redemptions from treasuries and bonds while developed market equities saw $10 billion in inflows – the most severe one-week flight out of bonds ever.2 Business Insider further notes significant outflows from BRIC’s equity funds (largest on record this past week) with Brazil funds losing 1.8% of assets under management, Russia 0.8%, India 0.4%, and China shedding 0.1%. Case and point - Norway's oil fund, which, as reported by Richard Milne at Financial Times, has now raised its equities holdings to a record 63.4% of its portfolio, against a record low in bonds of 35.7%, a reflection of Yngve Slyngstad’s (CEO) lack of enthusiasm for bond markets.

To Read the Entire Report Please Click on the pdf File Below.