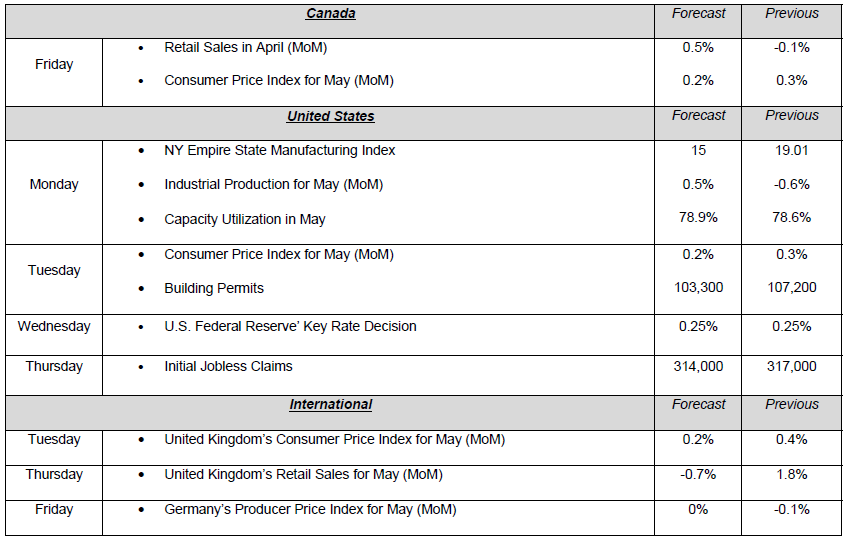

Last week the Bank of Canada published a review of the Canadian financial system. The report says that it remains robust, but identified three areas that need to monitored: imbalances in the housing market, an elevated level of household indebtedness, and exposure to potential external shocks. In the U.S., all the economic data released last week were disappointing. The University of Michigan Consumer Sentiment Index, Retail Sales and the Producer Price Index all fell below analysts’ expectations. On Thursday Mark Carney, the Governor of the Bank of England, mentioned that he may raise the key interest rate starting next month. In the Middle East, tension in Iraq rose a notch as Islamist insurgents continued to gain ground. We will be watching this conflict closely, since it may influence financial markets and, in particular, energy prices.

The Loonie

“I am going to make a prediction – it could go either way.” – Ron Atkinson

This week’s closely watched CPI data from the Eurozone, Canada, and the US should provide further clues into the economic health of the aforementioned economies. With central banks paying so much attention to the inflation data, it is not far fetched to expect increased volatility ahead of the news release. For those just tuning in, ECB’s negative deposit rate went into effect on June 11, 2014 in an attempt to provide further monetary easing to spur inflation. Eurozone’s CPI has been steadily declining, from the highs seen back in 2008 at 4% to the most recent print at 0.5%. Up until recently Canada’s inflation lagged as well, declining from 3.7% in May 2011 to just 0.4% in April of last year.

To Read the Entire Report Please Click on the pdf File Below