Street Calls of the Week

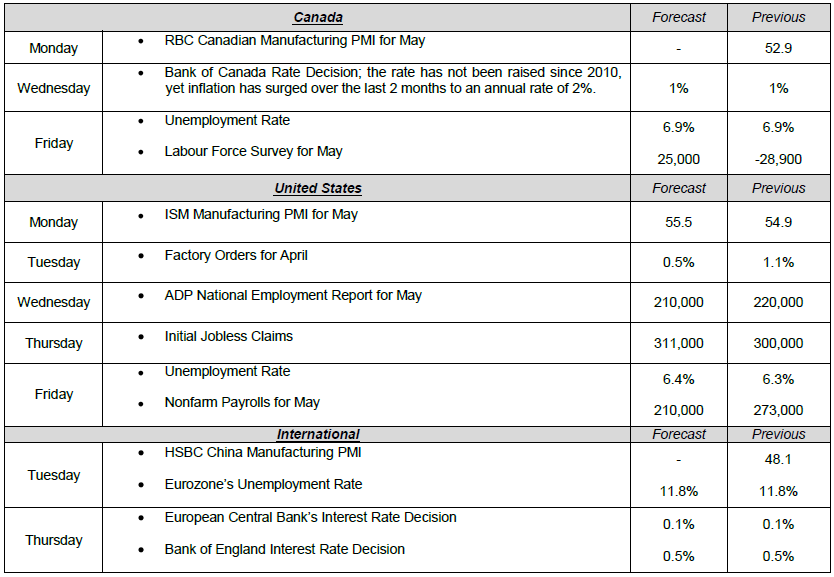

Economists were disappointed by the Canadian GDP figures released last Friday. The economy grew only 1.2% in the first quarter of 2014, or 0.6% less than expected. In the U.S., Durable Goods Orders and Initial Jobless Claims outstripped analysts’ expectations, while Personal Spending and the University of Michigan Consumer Sentiment Index were lower than expected. We should also mention that the revised U.S. GDP for Q1 2014, released on Thursday, was down 1% (annual rate). However, there is no need for panic, since this weak figure was due to poor weather conditions this past winter. In closing, the S&P 500, the flagship index for the U.S. economy, closed the week at an all-time high. Have a good week!

“Economic wounds must be healed by the action of the cells of the economic body - the producers and consumers themselves.” Herbert Hoover

In Q1 2014 the U.S. economy contracted for the first time since 2011, shrinking 1.0% on an annualized basis. The most popular explanation among economists for this unexpected drop is the delay in building inventories, which has been weaker than expected. Inventories grew by only $49 billion, compared to a forecast of $87.4 billion. However, it should be remembered that many very encouraging economic indicators were released during the first quarter, which leads us to believe that this weakness will only be temporary. The economy created over 190,000 jobs in Q1 2014, retail sales grew by 1.0% and industrial production was up 2.1%. As a result, we will probably see the U.S. economy rally sharply in the second half of the year, much as it did in 2011.

To Read the Entire Report Please Click on the pdf File Below