Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

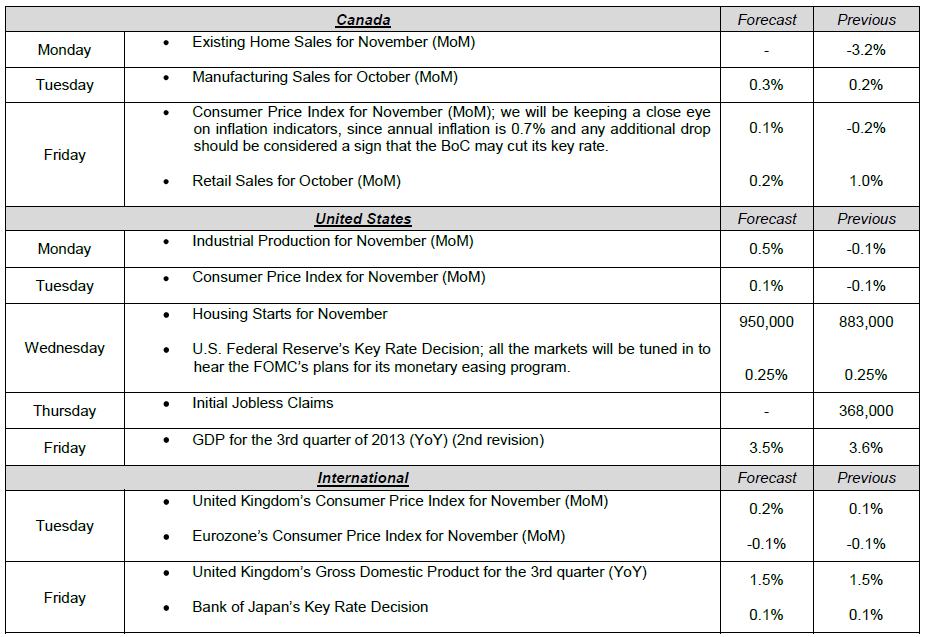

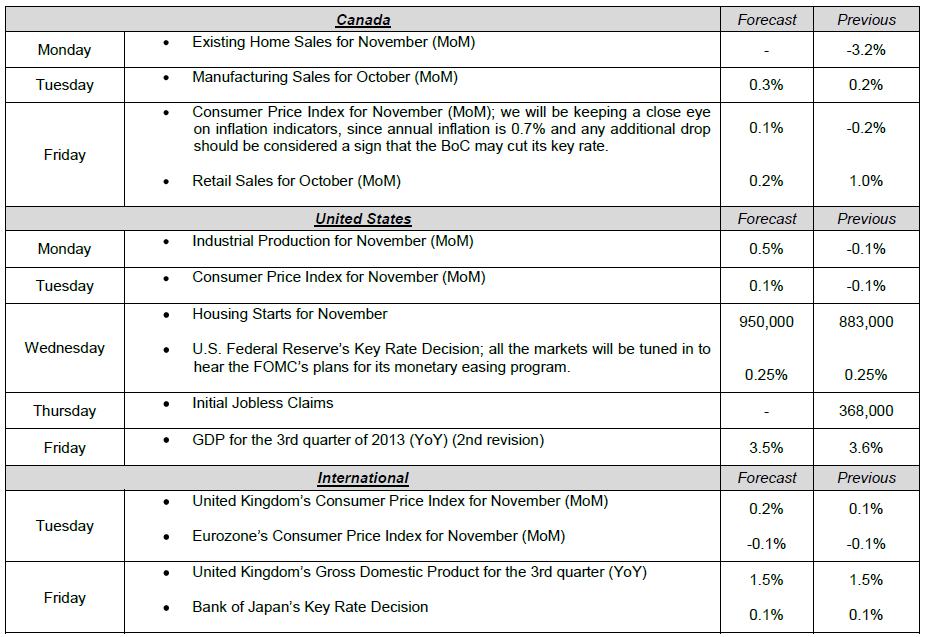

Last Tuesday in the U.S., the Republicans and the Democrats agreed on a federal budget for the next two years. Several concessions were made by each side, with the Republicans agreeing to increases in several taxes, including on airline passengers, while the Democrats gave ground on unemployment benefits. This agreement will prevent another government shutdown like the one that took place last fall. The U.S. Retail Sales figure released on Thursday caught many by surprise, posting 0.7% growth in November, or 0.1% more than expected. Other, more disappointing figures were also released, including 368,000 initial jobless claims, a surprising jump of 70,000 from the previous week

The Loonie

“Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.” - George Soros

While the loonie remains the main topic for this commentary, our focus today will deviate towards what may potentially become a rival to paper currency, Bitcoin. A recent spike in volatility along with increasing public scrutiny, calls into question the viability and vulnerability of what may become an alternative to the traditional payment method. What was originally built by individual(s) under the pseudonym of Satoshi Nakamoto as means for enabling a low-cost payment solution without government oversight1 quickly became one of the most talked about topics in the media. Individuals and governments alike have become captivated by the meteoric rise in public acceptance and terrified by the transactions Bitcoin was able to facilitate on the black market (as was the case with the website Silk Road where Bitcoins were used to pay for illegal services and products)2. Ultimately, what most wonder is whether this recent spike in popularity and subsequent appreciation in value of the cryptocurrency is the foreshadowing of the end of government controlled paper currencies as we know it or just a gimmick, reminiscent of yet another bubble.

To Read the Entire Report Please Click on the pdf File Below.

The Loonie

“Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.” - George Soros

While the loonie remains the main topic for this commentary, our focus today will deviate towards what may potentially become a rival to paper currency, Bitcoin. A recent spike in volatility along with increasing public scrutiny, calls into question the viability and vulnerability of what may become an alternative to the traditional payment method. What was originally built by individual(s) under the pseudonym of Satoshi Nakamoto as means for enabling a low-cost payment solution without government oversight1 quickly became one of the most talked about topics in the media. Individuals and governments alike have become captivated by the meteoric rise in public acceptance and terrified by the transactions Bitcoin was able to facilitate on the black market (as was the case with the website Silk Road where Bitcoins were used to pay for illegal services and products)2. Ultimately, what most wonder is whether this recent spike in popularity and subsequent appreciation in value of the cryptocurrency is the foreshadowing of the end of government controlled paper currencies as we know it or just a gimmick, reminiscent of yet another bubble.

To Read the Entire Report Please Click on the pdf File Below.