We saw a slight reprieve last week on the currency market volatility front compared to the last 4 weeks. Indeed, the events with high potential volatility that were expected last week, as the first rate decision of the incoming governor of the Bank of Canada and the two speeches delivered by Mr. Bernanke did nothing to disturb the slumber of the markets. In Canada, Mr. Stephen Poloz decided to maintain the course set by Mark Carney before his departure for London. In the U.S., Mr. Bernanke was eagerly questioned by the House of Representatives on Wednesday and the Senate on Thursday regarding the monetary policies employed at the Fed. Bernanke essentially reiterated the same points at his speech in Boston two weeks ago. The effect on the U.S. dollar was therefore muted. Have a good week!

The Loonie

“We cannot solve our problems with the same thinking we used when we created them.” - Albert Einstein

Recent positive data on Canadian securities transactions highlights the important role foreign purchases play when providing support for the Canadian dollar. Despite investor’s lack of appetite for equities, federal and corporate bonds have generated enough sales to bring net transactions for Q1 of 2013 to the highest level since Q3 of 2010 and were dominated by the corporate sector which sold $14.2 billion worth of paper to foreigners (a record amount for a first quarter)1.

Aside from negative headlines surrounding the potential economic downturn in Canada, geopolitical concerns provided support for oil, as prices have closed higher for three consecutive weeks. Given the reliance of the Canadian economy on the demand for commodities, foreigners continued their purchases of Canadian securities.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

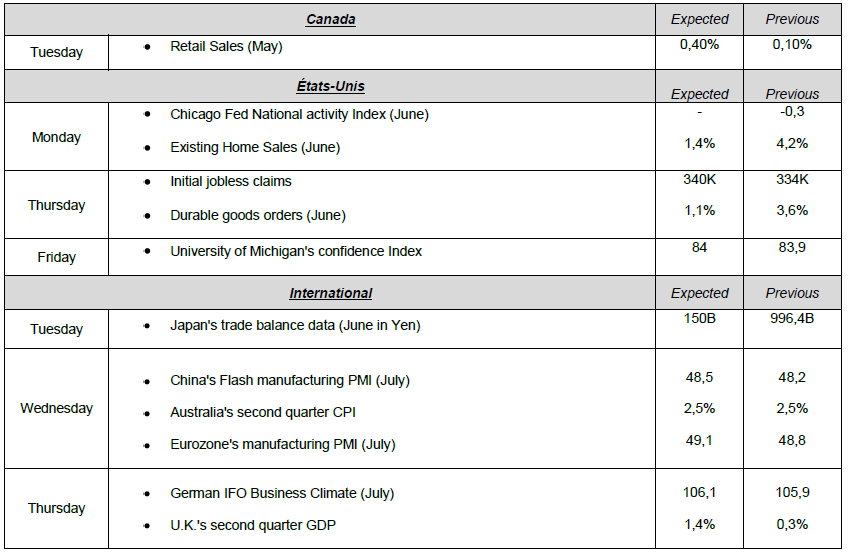

Major News This Week

Published 07/23/2013, 08:16 AM

Updated 05/14/2017, 06:45 AM

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.