Last week was once again very volatile on the currency market. The greenback was once again the big winner of the week with gains of 1.39%, 2.03, 0.83% against the EUR, GBP and CAD respectively. Last Thursday the ECB and the BoE both surprised markets by their pessimistic outlook on the state of their respective economies. Furthermore, Mark Carney (BOE governor) and Draghi (ECB governor) both decided to take a page out of Mr. Bernanke's book and use some type of forward guidance on the interest rates. Indeed, they both mentioned in their way that the current accommodative policy will be needed for an extended period of time. On this side of the pond, we were treated to the U.S. and Canadian jobs data last Friday. They both exceeded expectations with a loss of 0.4K (vs -7.5K expected) jobs in Canada and 195K creations (vs. 165k expected) in the United States.

The Loonie

“Those who fail to learn from history are doomed to repeat it.” - Winston Churchill

The political turmoil last week – the resignation of two key ministers in the Portuguese government responsible for implementing the country’s international assistance plan – sent European exchanges plunging. In addition, unemployment in Europe has reached a new record high (see Table 1); Greece and Spain are leading the way, with over one quarter of their active working populations currently unemployed. Will Europe be dusting off the 2012 Greek rescue plan? Europe’s leaders have not ruled out the possibility of contagion to other countries in the eurozone. There has been a series of quantitative easing programs and the European Central Bank (ECB) has kept its key interest rate near zero (0.50%, see Table 2), but this has not really helped spur growth and create jobs. Mario Draghi, President of the ECB, was clear at Thursday’s monetary policy meeting, confirming that he will be very comfortable keeping the key interest rate at its current level or reducing it even further for an extended period of time. This transparent statement was intended to encourage investment and consumption. Is it the right strategy? The BCE has very little latitude left. These statements caused markets to surge and made screens go from red to green. However, they also caused the euro to drop over 120 basis points, from 1.3015 to 1.2888.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

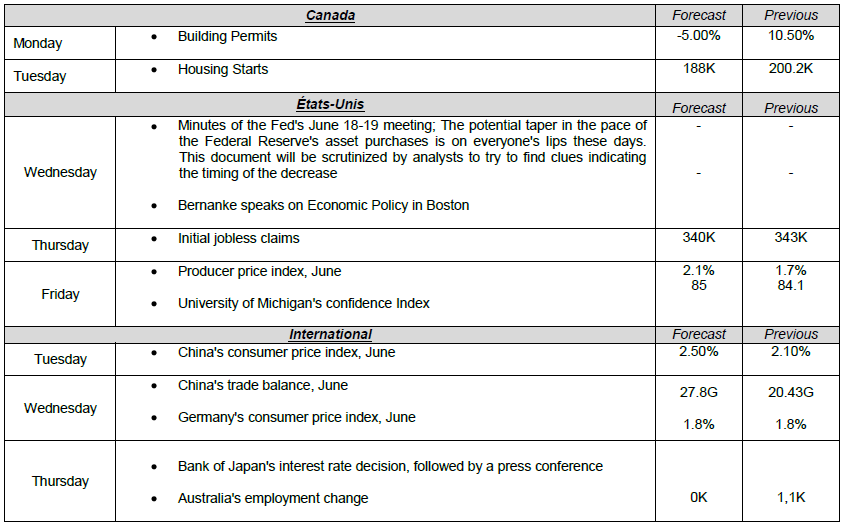

Major News This Week

Published 07/09/2013, 02:07 AM

Updated 05/14/2017, 06:45 AM

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.