Last week’s FOMC meeting raised a ruckus in the markets. Its Chairman, Ben Bernanke, tried to explain as clearly as possible that any change in current monetary policy would depend on future conditions. According to the current economic forecast, this would suggest a gradual tapering of QE3 between now and the end of 2013, with bond purchases ending in 2014. He also confirmed that the key interest rate would remain between 0% and 0.25% as long as the unemployment rate stays above 6.5%. Despite his explanations, bond rates continued to climb, prices for equities plummeted around the world, and the U.S. dollar rose against almost all other currencies. Friday did not bring good news for the loonie, as Retail Sales and inflation figures were disappointing. We recommend that you take advantage of the high volatility and call your trader to place orders. Have a good week.

The Loonie

Markets were shaken last week by a speech from Ben Bernanke, Chairman of the Federal Reserve. He mentioned that the unemployment rate may fall close to 6.5% next year, and this is the Fed’s stated objective for ending its monetary easing measures. This signal is very important, and it was heard: last week saw capital moving out of the bond markets, particularly out of long-term bonds. Lower demand for government bonds provoked a marked increase in returns sought by investors. The following graph shows the yields currently demanded on various terms on the US government debt (the green curve): short-term Treasuries are near zero, while 10-year Treasuries yield 2.50% and 30-year Treasuries yield 3.50%. The yellow curve shows where yields were 12 months ago, underscoring a marked change in long-term yields. The Fed has been using security purchases to keep short-term rates very low, but investors want protection from higher inflation in the longer term.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

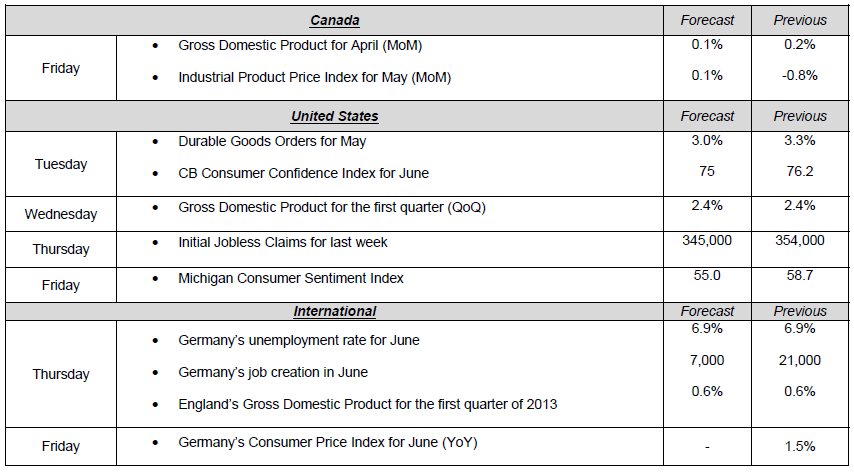

Major News This Week

Published 06/26/2013, 07:47 AM

Updated 05/14/2017, 06:45 AM

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.