We were treated to some rather busy trading sessions last week. There was no shortage of economic news for investors to dissect. The two main news were the decision of the German constitutional court to validate the constitutionality of funding various aid mechanisms (ESM et al) by the country's parliament and the second news, and not least, was the disclosure by the U.S. Federal Reserve to implement a third round of quantitative easing (QE3). These two events seem to have reconciled investors with their appetite for risk; most asset classes were up sharply at the close of markets on Friday. We have the chance to deepen our analysis of the topic in our weekly Loonie article.

Canada

We begin the week with data on international financial transactions for the month of July. June had seen a balance of $-7.9B. The data on Monday could be part of the explanation for the strength of the Canadian dollar in recent weeks. Also on Monday, we expect sales levels of existing homes. The most important data will come on Friday with the publication of the level of inflation in consumer prices for the month of August. The market expects a stable inflation figure, keeping it unchanged from its previous level of 1.30%.

United States

After a volatile week, it will certainly be a little quieter on the American side. The first economic data will be released on Tuesday and is the current account balance. The market expects that the balance will be -$ 126.6B, while it was -$ 137.7 a month earlier. On Wednesday, we expect the news from the housing market with the release of housing starts expected at 765k, emissions from building permits expected at 795K, as well as existing home sales, expected at 4.56m. On Thursday, we will have the weekly publication of employment data. The market anticipates that some 370k applications have been filed compared to the 382K requests for the previous week. Also on Thursday, we are waiting for the economic indicator of the Federal Reserve Bank of Philadelphia. The market expects a slight improvement from the indicator at -3.3 in September from its August level of -7.1. Finally, it will be the leading indicators for the month of August, which will close the week in the US. The market expects a decrease of -0.1% in contrast to growth of 0.4% the previous month.

International

We are expecting at the end of the day, Monday, the minutes of the central banks of Japan and Australia. Tuesday, it will be England who will reveal the level of inflation of consumer prices for the month of August, expected at 2.5%. The Bank of Japan will also unveil the interest rate of the country, most likely unchanged at 0.1%. On Wednesday, the Bank of England will publish its minutes. Finally, it will be the index of producer prices in Germany that will end the week on Thursday.

The Loonie

“Let every nation know, whether it wishes us well or ill, that we shall pay any price, bear any burden, meet any hardship, support any friend, oppose any foe, in order to assure the survival and success of liberty.” John F. Kennedy

Last week markets reacted to two major events. The first, on Wednesday September 12, was the approval by the German Constitutional Court of the adoption of mechanisms to save the Euro, in the form of the ESM bailout fund (European Stability Mechanism). The judges set a limit for Germany’s liability to the fund at 190 billion Euros, out of a total of 700 billion Euros. So what exactly is the purpose of this fund? It will be used to buy government debt on the primary and secondary markets, in order to raise money for countries that have difficulty obtaining funding at better rates. This liquidity will also be used to directly recapitalize banks in difficulty. The fund has given European banks a new lease on life and will allow them to reorganize their activities and improve their balance sheets. The Court’s decision means that Germany will be able to better support the Eurozone to resolve the European crisis and, ultimately, ensure the survival of the Euro.

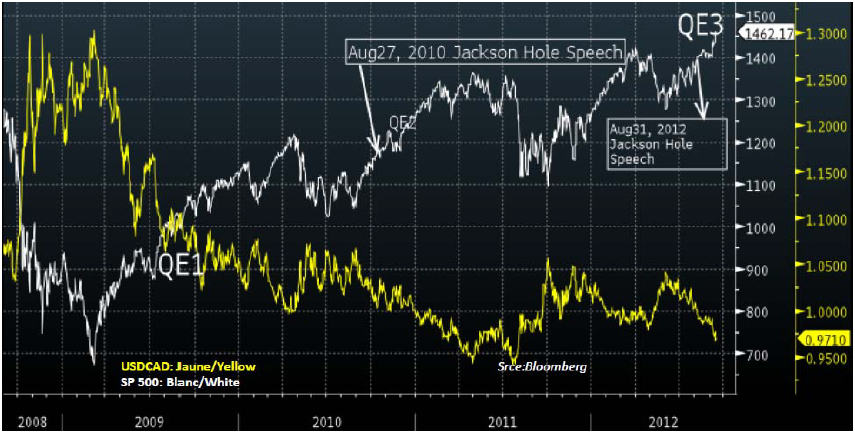

Second, on Thursday the Fed announced a new program to buy mortgage debt (QE3) at a rate of $40 billion per month and its intention to continue making such purchases until the outlook for the labour market improves. The Fed also extended bond purchasing, known as “Operation Twist”, to keep long-term interest rates low. The Fed also said that it now intends to keep its key rate near zero until mid-2015. By stimulating economic activity, it hopes to meet its first objective: job creation. In other words, the Fed is doing everything in its power to stimulate economic recovery.

As the above graph shows, this news had two immediate effects: the U.S. dollar fell against other currencies (the yellow line) and stock exchanges took off (the white line). In the longer term, these actions could boost commodity prices and, as a result, drive inflation around the world. The Canadian economy could then be caught between a rock and a hard place, with exports falling drastically due to higher input costs amplified by a strong currency vis-à-vis our trading partners. We may be seeing the beginning of a currency war, but that is for another column!

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News This Week

Published 09/19/2012, 07:22 AM

Updated 05/14/2017, 06:45 AM

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.