Last week was practically a washout in terms of any political news that could move the market. In the absence of news from Europe or much in the way of economic data, the Canadian dollar fluctuated in a narrow range, mirroring stock market movements. This was the case at least until Friday, when disastrous Canadian employment data were released. While the market was looking for the creation of 9,500 jobs, many were disappointed to hear that in fact 30,000 jobs had been lost. The loonie dropped about 40 basis points on this news. However, it would appear that foreign investments in Canadian assets are continuing unabated; market participants profited from the weakness of the Canadian dollar to add to their positions.

Canada

The only important news expected in Canada this week will be the release on Friday of the Consumer Price Index. Economists are expecting a figure of 2% for July, or the same as the last reading.

United States

This will be an important week for economic indicators south of the border. On Tuesday we will have the Producer Price Index as well as Retail Sales for the month of July. Analysts are forecasting retail sales to have increased 0.3% in July, 0.8% more than in June. On Wednesday we can expect the important inflation figure. Economists are expecting a reading of 1.5%. With the slow economic recovery taking place in the U.S., many market players are hoping that the Federal Reserve will introduce a new round of quantitative easing, and inflation numbers below 2% would certainly leave more room for the Fed to implement expansionary monetary policy. The week will end with results from the University of Michigan Consumer Sentiment Index.

International

The release of international economic data begins tomorrow with second-quarter GDP numbers for France, Germany and the Eurozone. Economists are expecting figures of -0.2%, 0.1% and -0.2%, respectively. Also on Tuesday, Germany will release its ZEW Economic Sentiment Index. On Thursday, Europe’s Consumer Price Index will be released. The market is expecting 2.4%, unchanged from the last reading. Have a good week!

The Loonie

“Shoot for the moon and if you miss, you will still be among the stars”. Les Brown

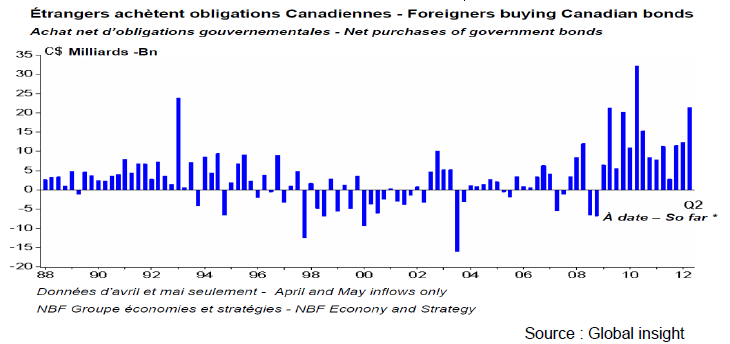

A little more than a year ago we looked at the possibility that the Canadian dollar could become a “safe haven.” Such a status would be founded on our great political stability and enviable financial position. However, the strong correlation between the Canadian and U.S. dollars makes the CAD less attractive. In addition, the cyclical nature of the Canadian economy (with its strong dependence on energy and raw material prices) produces uncertainty about the strength of our currency during recessions. In the end, we doubted that the CAD could acquire safe haven status. Independent of the strength of these arguments, foreigners have been quite fond of the CAD since the 2008- 09 financial crisis, due to the strength of Canadian banks in the face of market turmoil.

This confidence among foreign investors is seen in the massive purchases of Canadian bonds over the last few years. Even if the financial markets are not referring to the Canadian dollar as a safe haven, the value of our loonie benefits from foreigners’ enthusiasm. One thing is sure: as in politics, sometimes our greatest strength is the weakness of our adversaries; the uncertainties swirling around the Euro and the downgrade on U.S. government bonds have allowed the CAD to shine. At least part of this renewed confidence is due to the CAD’s good performance against the USD in a context of weak commodity prices.

So what does the future hold? The uncertainty over the survival of the Euro is not going away. It should intensify once a German court renders its decision (expected on September 12) on the constitutional legality of transferring additional powers (budgetary control) to pan-European organizations. In the U.S., growing electoral fever should harden positions in the two main parties, making the compromise needed to break through the U.S. fiscal deadlock unlikely. So even if the CAD does not glitter, its star should nevertheless remain highly visible in such a dark sky. Have a good week!

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major News This Week

Published 08/14/2012, 07:07 AM

Updated 05/14/2017, 06:45 AM

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.