Last Wednesday the Bank of Canada maintained its key interest rate at 1%. This came as no surprise, since the rate has not budged since September 2010. At the same time the Bank lowered its growth outlook, reducing its projection of real GDP growth from 1.8% to 1.6% in 2014 and from 2.7% to 2.3% in 2014. The Bank considers that maintaining the current monetary policy is appropriate, given the slower projected rates of economic growth. In the U.S., employment figures for September were finally released on Tuesday following a 20-day wait! The Unemployment Rate fell 0.1% to 7.2%, as only 148,000 positions were created during the month. This was 32,000 jobs short of analysts’ expectations. The loonie suffered this week, losing close to 2% of its value. Have a good week!

The Loonie

“If you do something, expect consequences.” - Larry King

The Governor of the Bank of Canada (BoC), Stephen Poloz, changed his position this week. For this edition of The Loonie, we will be taking a closer look at the press release that accompanied the BoC’s Key Interest Rate decision and analyzing the impacts of this change on the Canadian market. The BoC confirmed that it expected slightly slower growth in Canada over the next few years, reducing its projection of real GDP growth in 2014 from 2.7% to 2.3%, for example. This represents a dramatic change in the BoC’s position on Canada’s key interest rate. Previously, its press releases led us to believe that a rate increase was in the cards, which had the dual effect of preparing financial markets for rate increases and calming the real estate market, which seems to have benefited substantially from historically low rates. This therefore represents a major reversal on the Bank’s part. At the end of its October 23 report, it says that “the Bank judges that the substantial monetary policy stimulus currently in place remains appropriate.”

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

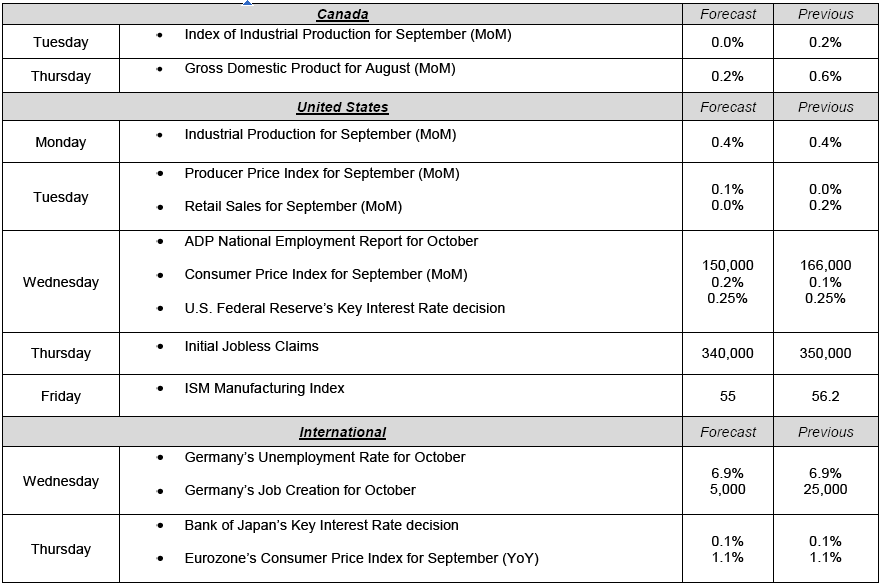

Major News This Week : October 28, 2013

Published 10/29/2013, 01:32 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : October 28, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.