Much as was the case for the last few months, unfolding events in the U.S. have captured our attention, although this time it has not been the Federal Reserve influencing markets, but rather the recent conflicts in Washington. The U.S. government shut its doors last week, and the Republicans and Democrats have yet to reach an agreement that could pry them back open. The most likely scenario is that the politicians will put off the problem by raising the debt ceiling. The euro continued to gain strength as Mario Draghi, the President of the European Central Bank, declared that the eurozone economy was still fragile and the Bank would maintain its policy of monetary easing. On Friday the euro was trading 400 basis points higher than in September. Have a good week!

The Loonie

“The optimist sees the rose and not its thorns; the pessimist stares at the thorns, oblivious of the rose.” Kahlil Gibran

The euro moved up significantly this week, approaching its peak of last February by almost 65 basis points, representing a two-year high against the greenback. Clearly the problems in Washington over the last few days have something to do with it, but it would appear that the trend began in the middle of the summer, long before the political wrangling in the U.S. became apparent. The rally in the EUR/USD since July has been nothing short of a remarkable turn of events. The figure was below 1.2800, which was just above its lowest level for the year, when the wind suddenly changed direction, carrying the pair over 1.3600 this week.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

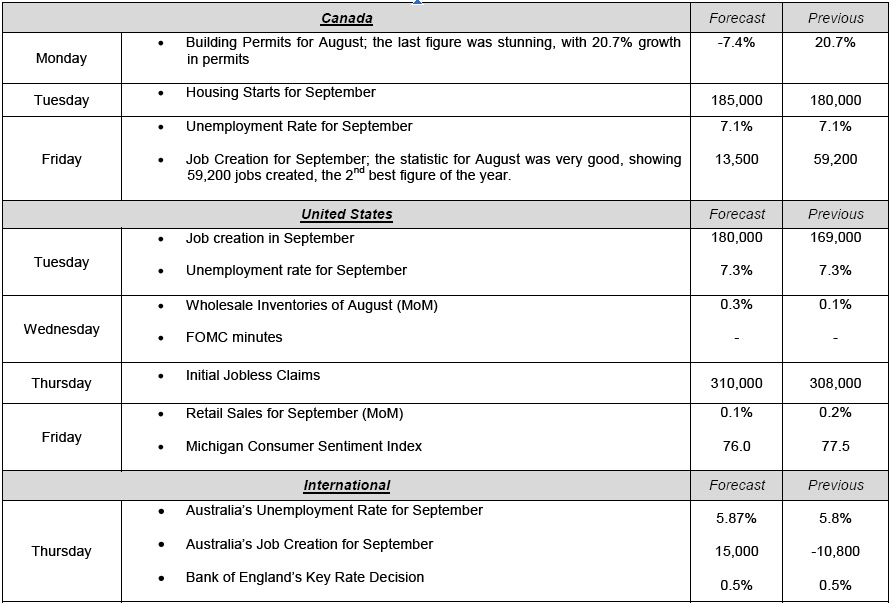

Major News This Week : October 07, 2013

Published 10/08/2013, 07:43 AM

Updated 05/14/2017, 06:45 AM

Major News This Week : October 07, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.