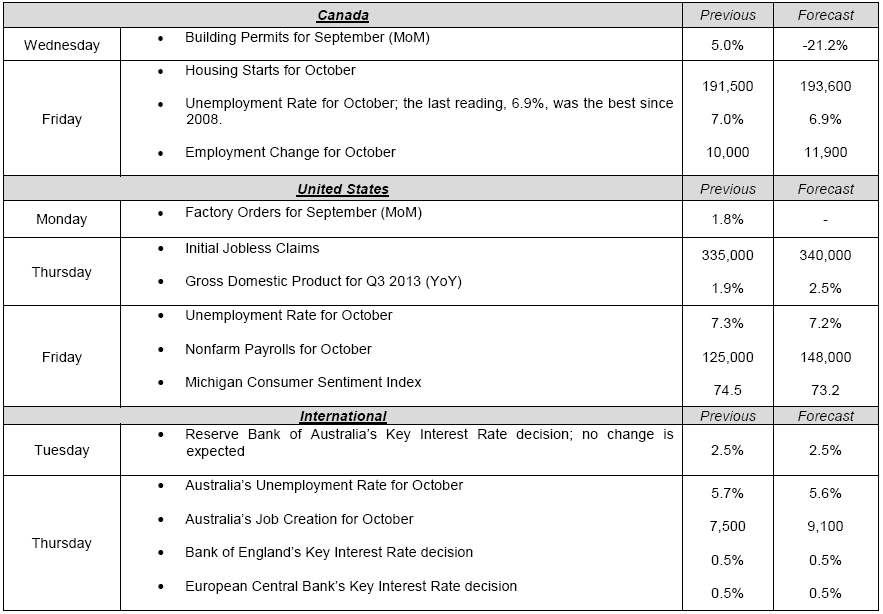

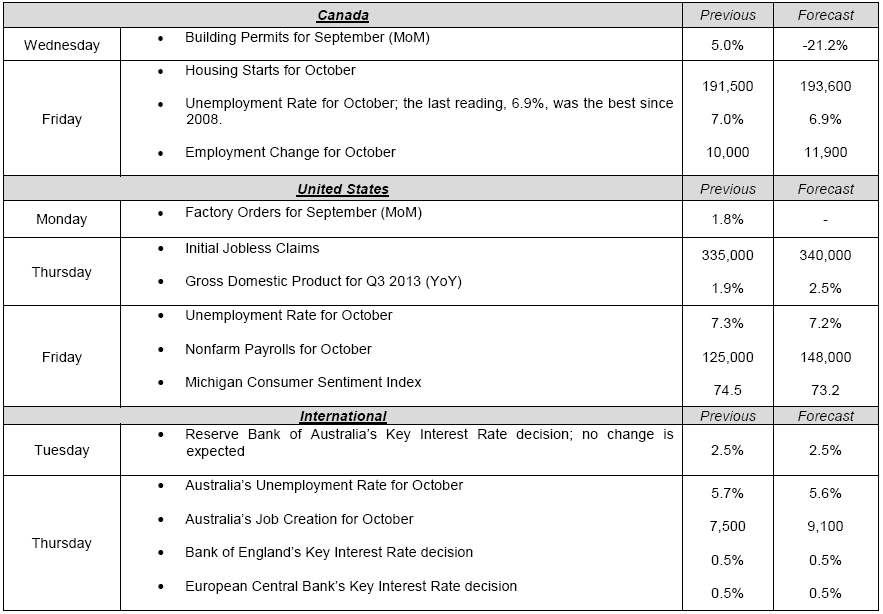

The growth in the Canadian economy reported on Thursday surprised analysts, with GDP up 0.3% in August, or 0.2% more than expected. South of the border, the markets were disappointed by several economic indicators released last week. Private sector job creation, Retail Sales and the CB Consumer Confidence Index were the main indicators falling short of expectations. It came as no surprise when the U.S. Federal Reserve announced last Wednesday that it was going to wait for more evidence that progress will be sustained before tapering the pace of its bond purchases. Turning to the eurozone, there was little news to take comfort in last week, as we learned that the unemployment rate had reached an all-time high of 12.2%. Furthermore, inflation has slowed to an annual growth rate of 0.7%. This news took its toll on the euro, which lost over 2% against the greenback in the space of a week. Have a good week!

The Loonie

“Most people do not really want freedom, because freedom involves responsibility, and most people are frightened of responsibility.” - Sigmund Freud

High unemployment, low or negative economic growth, falling consumer spending, confidence hitting new lows; these are just some of the headlines that have come to describe European economic downturn. Yet, EUR performance against G10 peers, including the Canadian dollar, has been nothing short of spectacular.

Over the past 14 months, YEN, Aussie, and CAD have sold off over 27%, 19%, and 15% respectively. In fact, every single major currency lost ground against the Euro. Inadvertently, this peculiar price action poses the question of whether the performance is driven by the overall improvement in the eurozone or weak economic growth prospects for the rest of the world.

To Read the Entire Report Please Click on the pdf File Below.

The Loonie

“Most people do not really want freedom, because freedom involves responsibility, and most people are frightened of responsibility.” - Sigmund Freud

High unemployment, low or negative economic growth, falling consumer spending, confidence hitting new lows; these are just some of the headlines that have come to describe European economic downturn. Yet, EUR performance against G10 peers, including the Canadian dollar, has been nothing short of spectacular.

Over the past 14 months, YEN, Aussie, and CAD have sold off over 27%, 19%, and 15% respectively. In fact, every single major currency lost ground against the Euro. Inadvertently, this peculiar price action poses the question of whether the performance is driven by the overall improvement in the eurozone or weak economic growth prospects for the rest of the world.

To Read the Entire Report Please Click on the pdf File Below.