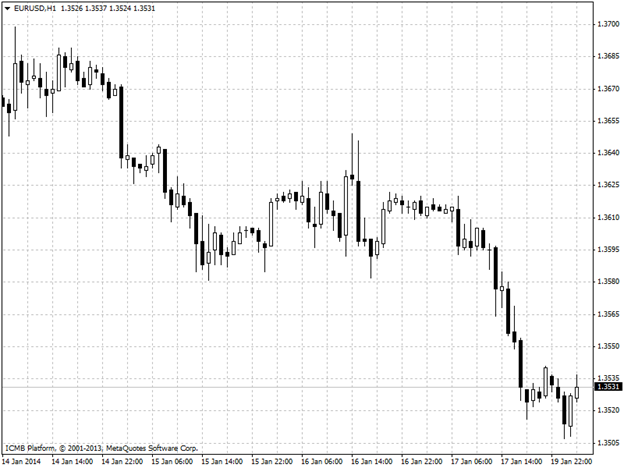

EUR/USD

The euro slid to two-month low against the dollar on Friday as U.S. data indicated that the Federal Reserve is likely to stick to its stimulus tapering plan, and concerns over the outlook for the euro zone economy weighed. Sentiment on the euro was hit by concerns that the subdued inflation outlook may prompt the European Central Bank to ease monetary policy in order to safeguard the fragile recovery in the region. In the U.S., data released on Friday showed that industrial production rose 0.3% in December, in line with expectations, rising for the fifth successive month. Another report showed that U.S. housing starts fell 9.8% last month, more than the 8.3% decline forecast by analysts. U.S. building permits rose less-than-expected in December, but remained close to November’s five year highs. In the week ahead, the euro zone is to produce preliminary data on manufacturing and service sector activity, as well as the closely watched ZEW German economic sentiment index. U.S. data on jobless claims and home sales will also be in focus. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

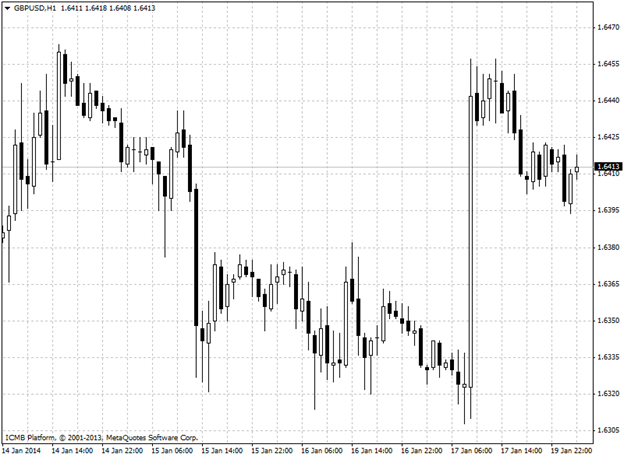

GBP/USD

The pound rose against the dollar on Friday after data showing that U.K. retail sales rose sharply in December bolstered the outlook on the economic recovery, fuelling expectations that the Bank of England may rise interest rates ahead of other central banks. Sterling strengthened after the Office for National Statistics said U.K. retail sales jumped 2.6% in December from a month earlier and were 5.3% higher than in the same month last year. Analysts had expected a monthly increase of 0.4% and an annual gain of 2.6%. In the U.S., data released on Friday showed that industrial production rose 0.3% in December, in line with expectations, rising for the fifth successive month. Another report showed that U.S. housing starts fell 9.8% last month, more than the 8.3% decline forecast by analysts. U.S. building permits rose less-than-expected in December, but remained close to November’s five year highs. Separately, data showed that the University of Michigan's consumer sentiment index ticked down to 80.4 in January from 82.5 in December. Analysts had expected the index to rise to 83.5. In the week ahead, U.K. data on the unemployment rate will be closely watched, while U.S. data on jobless claims and home sales will also be in focus. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="457">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="457">

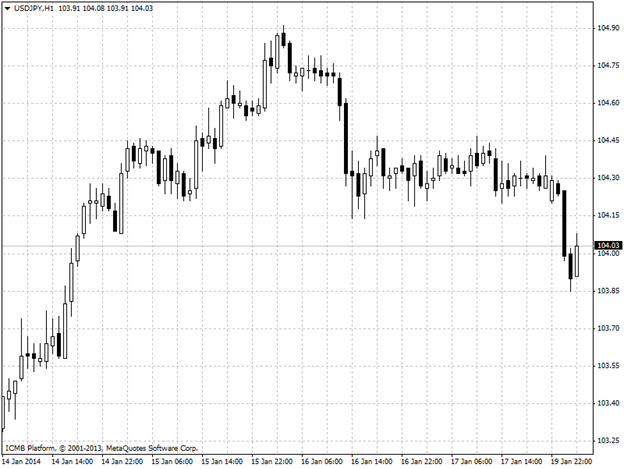

USD/JPY

The dollar ended the week higher against the yen on Friday, after U.S. economic data indicated that the recovery will continue to deepen going into this year, fuelling expectations that the Federal Reserve will continue to taper its stimulus program. Separately, data showed that the University of Michigan's consumer sentiment index ticked down to 80.4 in January from 82.5 in December. Analysts had expected the index to rise to 83.5. USD/JPY touched session lows of 104.20 on Friday and was last down just 0.02% to 104.31. For the week, the pair gained 1.17%. The pair was likely to find support at 103.75 and resistance at 105.00. Earlier in the week, data showed that U.S. retail sales posted a larger than expected gain in December. In the week ahead, Wednesday’s monetary policy decision by the Bank of Japan will be in focus, while U.S. data on jobless claims and home sales will also be closely watched. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

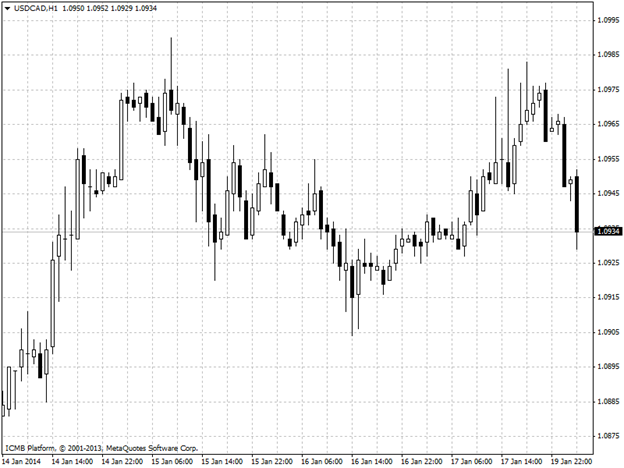

USD/CAD

The U.S. dollar ended the week close to four-year highs against the Canadian dollar on Friday as a raft of U.S. data indicated that the U.S. economic recovery is strong enough for the Federal Reserve to keep tapering its stimulus program. Data released on Friday showed that U.S. industrial production rose 0.3% in December, in line with expectations, rising for the fifth successive month. Another report showed that U.S. housing starts fell 9.8% last month, more than the 8.3% decline forecast by analysts. U.S. building permits rose less-than-expected in December, but remained close to November’s five year highs. In the week ahead, Wednesday’s rate statement by the BoC will be in focus, while U.S. data on jobless claims and home sales will also be closely watched. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs: Pound Rose Against Dollar

Published 01/20/2014, 02:39 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs: Pound Rose Against Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.