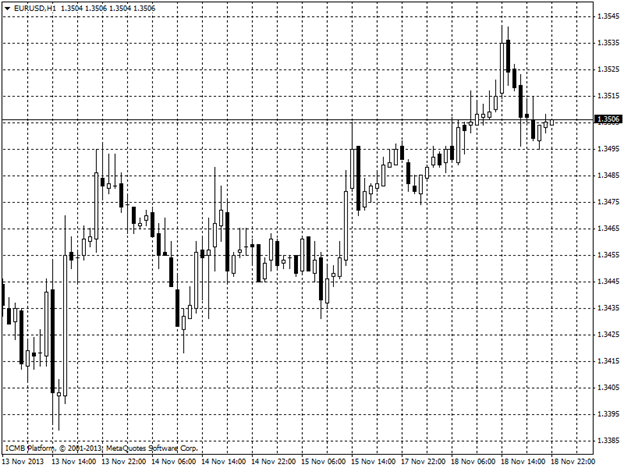

EUR/USD

Euro-zone economic prospects remain weak and inflationary pressures low; consequently, the ECB will remain under significant pressure to ease monetary policy again, although the ECB can still cut policy rates somewhat further and provide additional liquidity to the markets, we should be prepared for everything going forward. Inflation in the 17-nation euro area slowed to 0.7 percent in October, the lowest level in four years. The region’s economy came close to a halt in the third quarter as German growth slowed, France’s economy unexpectedly shrank and Italy extended its record recession, euro has little changed. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="468">

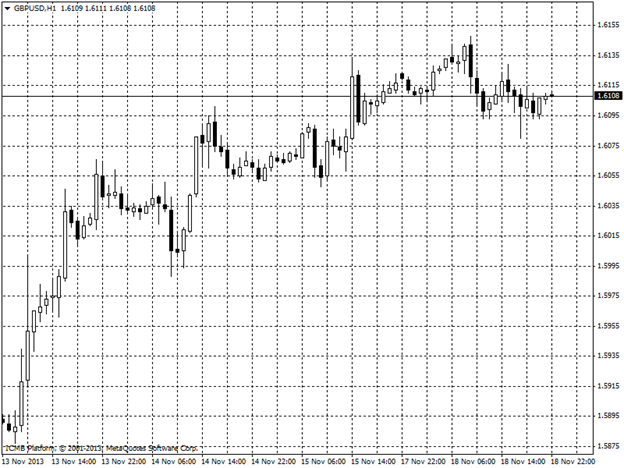

GBP/USD

The pound fell versus dollar as investors awaited publication this week of minutes of the Bank of England’s most recent policy meeting, Sterling slipped from a three-week high versus the dollar after an industry report showed U.K. house prices declined this month. London asking prices for homes fell in November after a 10 percent jump last month as government measures to boost demand failed to offset the seasonal pre-Christmas decline, Right move Plc (RMV) said. The U.K. currency gained 0.6 percent versus the dollar last week. The pound was little changed. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

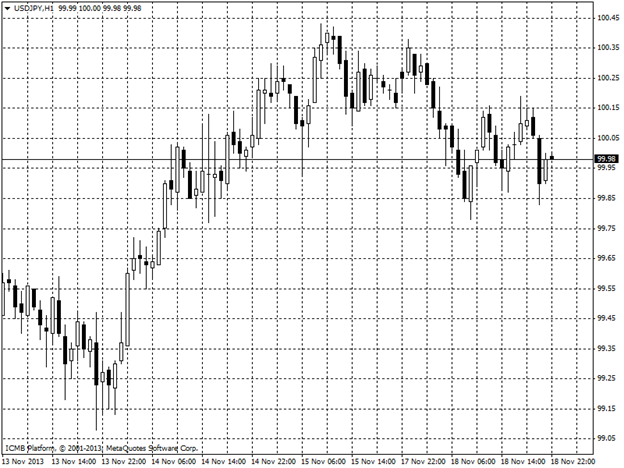

USD/JPY

The Bank of Japan, which holds a two-day meeting this week, has pledged to achieve 2 percent inflation in two years. A weaker yen boosts the value of overseas revenue for Japanese exporters. Of the companies on the Topix that have reported quarterly earnings this season, consumer lenders, insurers and banks were among the best-performing Topix subsectors. The yen weakened past 100 per dollar last week and traded at 99.90. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/CAD

The Canadian dollar rose to the strongest level in more than a week as the outlook for the nation’s commodity exports improved with China’s pledge to expand economic freedoms. The currency reached its high of the day against the U.S. dollar after a report showed total foreign investment in Canadian securities rose to the highest level in five months. Canada’s currency appreciated as much as 0.2 percent to 1.0415 per U.S. dollar, the strongest since Nov. 7. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">