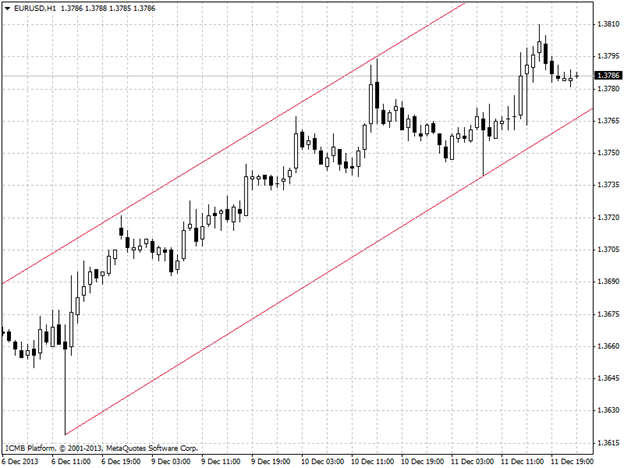

EUR/USD

The euro firmed against the dollar on Wednesday as investors avoided the greenback due to uncertainty over whether or not the Federal Reserve next week will announce plans to taper its USD85 billion in monthly bond purchases. Better-than-expected data out of the U.S. labor market rekindled expectations for some that the Federal Reserve may announce plans to begin tapering monthly asset purchases at its Dec. 17-18 policy meeting, especially with a budget deal in the U.S. Congress that could do away with fiscal uncertainties and speed up recovery. Elsewhere, Germany's consumer price index edged up 0.2% in November from October and up 1.3% on year, both figures in line with expectations. The euro continued to enjoy demand stemming from the European Central Bank's decision to hold off on rolling out new stimulus measures at its most recent policy meeting. The euro also saw support after European Union finance ministers moved closer to an agreement on a European banking union on Tuesday, a measure which is seen as key in fending off a repeat of the region’s financial crisis.

EUR/USD" width="624" height="468" style="font-size: 11px;">

EUR/USD" width="624" height="468" style="font-size: 11px;">

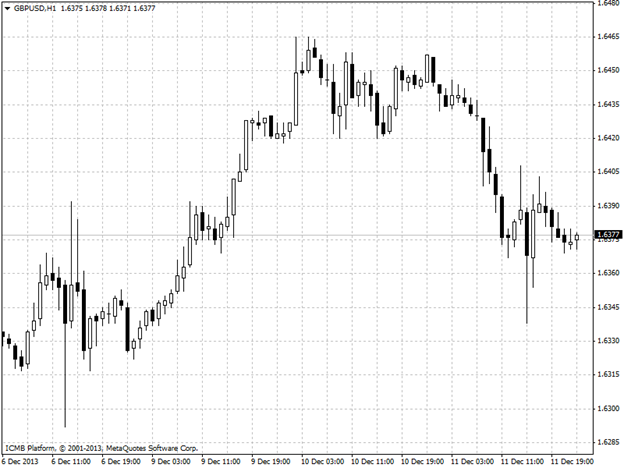

GBP/USD

The pound hit fresh session lows against the U.S. dollar on Wednesday, although losses were expected to remain limited amid mounting uncertainty over when the Federal Reserve will begin tapering its bond buying program. The dollar remained under pressure amid expectations that the Fed will hold off on tapering its USD85 billion-a-month asset purchase program at its upcoming policy meeting scheduled for December 17-18, despite last week’s stronger-than-forecast U.S. nonfarm payrolls report. the National Institute of Economic and Social Research said the U.K. economy grew by 0.8% in the three months to November, indicating that the pace of the recovery is continuing, after the economy grew by 0.8% in the third quarter. The single currency remained supported as expectations for further monetary easing by the European Central Bank dimmed after the bank held back from fresh rate cuts at last week’s policy meeting.

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="468">

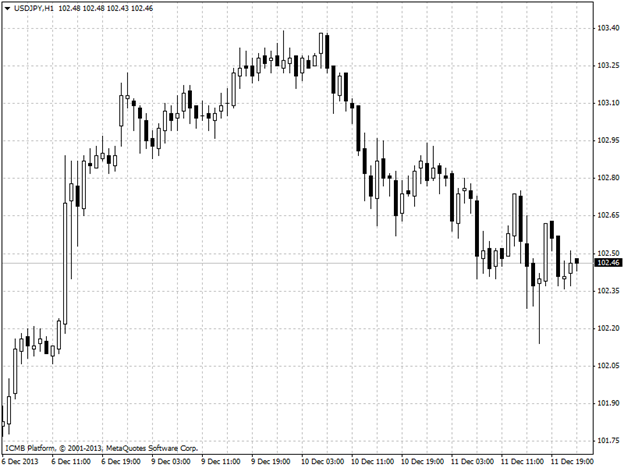

USD/JPY

The dollar fell against the yen on Wednesday as investors avoided the greenback ahead of the Federal Reserve's monetary policy meeting next week. A surprisingly strong November jobs report bolstered the dollar in recent sessions by fanning talk the Fed may announce plans to taper the pace of its USD85 billion in monthly bond purchases at its Dec. 17-18 monetary policy meeting. Elsewhere, lawmakers agreed on a way out of a budget impasse that could clear up U.S. fiscal uncertainties and convince the Fed it no longer needs to support the economy with monetary tools. Still, a general murkiness as to whether or not the U.S. central bank will wait until early 2014 after reviewing more economic indicators before deciding on tapering softened the greenback on Wednesday. The yen was up against the pound and up against the euro, with GBP/JPY down 0.63% and trading at 168.06 and EUR/JPY trading down 0.04% at 141.48. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="468">

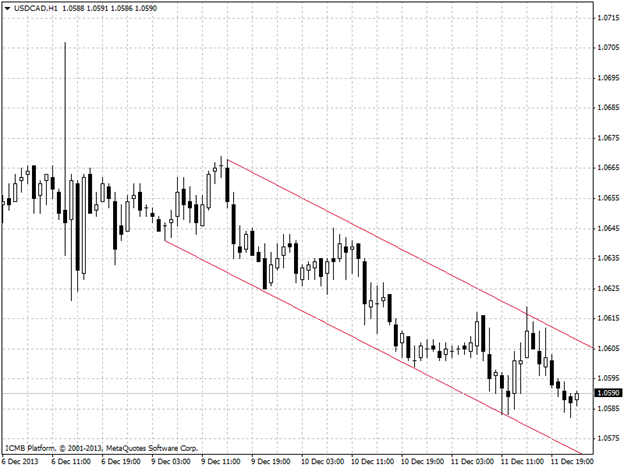

USD/CAD

The U.S. dollar slipped to the lowest level in eight days against the Canadian dollar in early U.S. trade on Wednesday amid growing uncertainty over the timing of a reduction in Federal Reserve stimulus. The dollar slipped amid fresh doubts over whether the Fed will taper its USD85 billion-a-month asset purchase program at its December 17-18 policy meeting, despite last week’s stronger-than-forecast U.S. nonfarm payrolls report for November. The Canadian dollar’s gains were capped by concerns that the subdued domestic inflation outlook may prompt the Bank of Canada to keep interest rates on hold for longer. Elsewhere, the loonie, as the Canadian dollar is also known, was lower against the euro, with EUR/CAD rising 0.21% to 1.4618. Demand for the shared currency continued to be underpinned as expectations for further monetary easing by the European Central Bank dimmed after the bank sounded less dovish than expected at last week’s policy meeting. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="468">