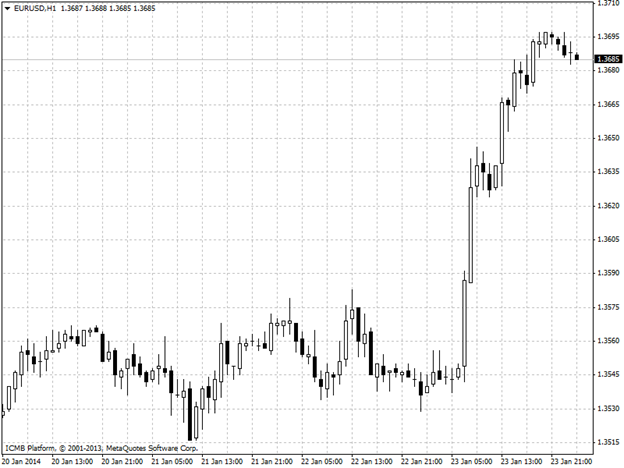

EUR/USD

The euro extended gains against the dollar on Thursday following the release of a flurry of U.S. data, as expectations for further monetary easing by the European Central Bank diminished after stronger-than-expected data on euro zone private sector activity. The common currency was boosted after a larger than expected increase in euro zone private sector activity this month indicated that the recovery in the euro area is strengthening. Markit said the euro zone’s composite output index rose to a 31-month high of 53.2 in January, up from a final reading of 52.1 in December, as growth picked up in Germany and the rate of decline eased in France. Manufacturing activity in Germany expanded at the fastest pace since May 2011 this month. In the U.S., data on Thursday showed that initial jobless claims rose in line with expectations last week, but the number of continuing jobless claims remained above the three million mark for the second successive week. The number of people who filed for unemployment assistance in the U.S. last week rose to 326,000, the Labor Department said, up from the previous week’s revised total of 325,000..

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="474" height="242">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="474" height="242">

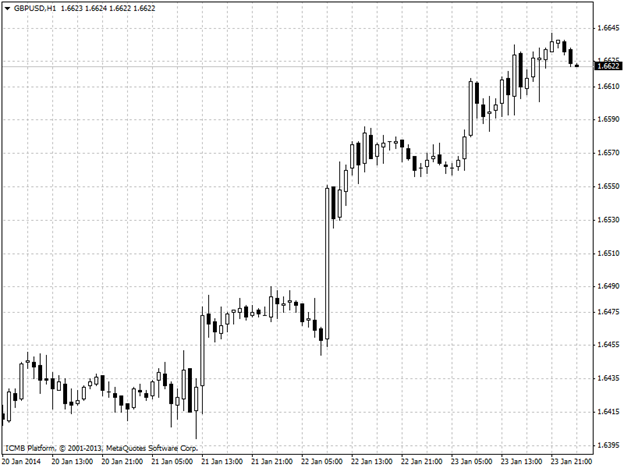

GBP/USD

The pound remained near 29-month highs against the U.S. dollar on Thursday, after the release of disappointing U.S. economic reports weighed on the greenback, while expectations for the Bank of England to raise interest rates sooner than expected boosted demand for sterling. the pound remained supported after data on Wednesday showed that the rate of unemployment in the U.K. fell to 7.1% in the three months to November, to stand just above the 7% level the BoE has said is its threshold for considering raising interest rates from their current record low of 0.5%. But the minutes of the BoE’s January meeting, also published on Wednesday, stressed that the bank is in no rush to act. The pound shrugged off private sector data on Thursday showing that retail sales growth slowed this month. The Confederation of British Industry said its index of U.K. retailers fell to 14.0 this month from 34.0 in December. Analysts had expected the index to decline to 25.0 in January.

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="474" height="242">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="474" height="242">

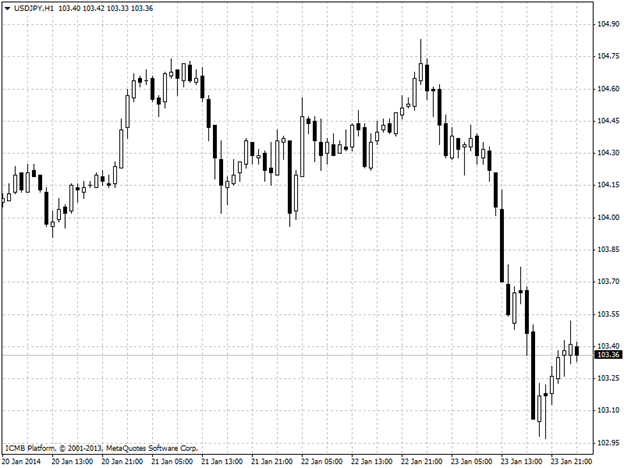

USD/JPY

After decades drowning in deflation, Japan’s property market is re-emerging, with average prices for new condos in Tokyo hitting levels not seen since 1992, according to the Real Estate Economic Institute said this week. If the trend continues and broadens, it could mark a turnaround in the long-dormant financial fortunes of the world's third-largest economy. Japan's Property Market Re-emerging Japan's Property Market Re-emerging Such a turnaround is long overdue: Japan’s real estate prices have been falling for nearly 25 years. From 1990 to 2002, falling real estate prices swallowed an estimated $9.3 trillion of the nation’s wealth, according to the Nomura Research Institute. Now there evidence from various sectors that the real estate market is rising.

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="474" height="242">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="474" height="242">

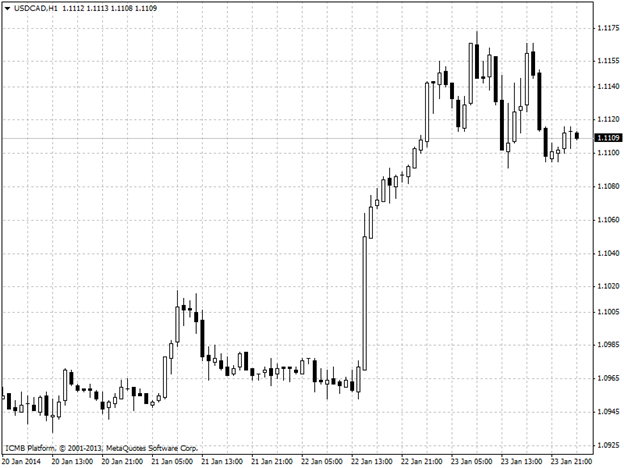

USD/CAD

The U.S. dollar pulled back from four-and-a-half year highs against the Canadian dollar on Thursday as a sharper-than-expected increase in Canadian retail sales prompted investors to take profits. The pair was likely to find support at 1.1050 and resistance at 1.1174, the session high. The Canadian dollar found support after official data showed that retail sales rose 0.6% in November, surpassing expectations for a 0.3% increased, recovering from a 0.1% decline in October. Statistics Canada said core retail sales, which exclude auto sales, rose 0.4% in November, slightly higher than forecasts for a 0.3% gain, but slowing from growth of 0.5% in October. The loonie, as the Canadian dollar is also known, remained under pressure after the Bank of Canada expressed concern over the inflation outlook on Wednesday, and left the way open for a rate cut, saying the path of the next rate move would depend on economic data. In the U.S., data on Thursday showed that initial jobless claims rose in line with expectations last week, but the number of continuing jobless claims remained above the three million mark for the second successive week.

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="474" height="242">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="474" height="242">