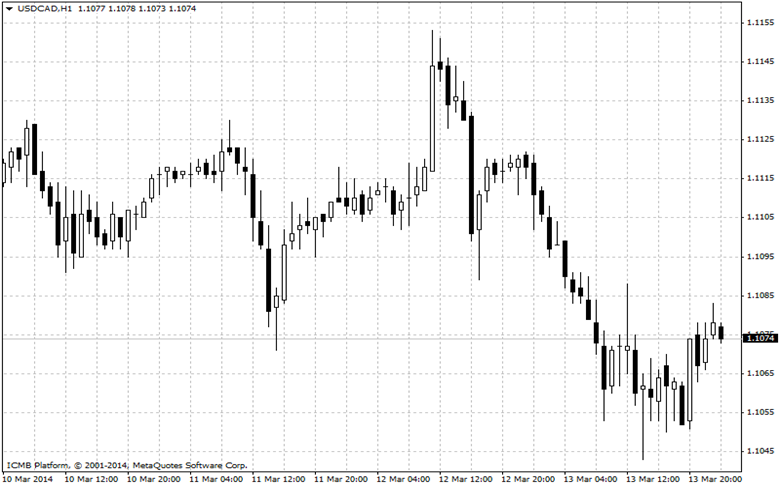

EUR/USD

The euro hit two-and-a-half year highs against the dollar on Thursday due to growing expectations for the European Central Bank to hold off on loosening policy any further due to improvements taking place in the continent's economy. The euro rose as markets bet the European Central Bank will hold off on implementing stimulus measures even though recent inflation rates have come in softer than market expectations. The ECB left interest rates at a record low 0.25% at its policy meeting last week and implemented no new policy measures to shore up growth despite forecasting low inflation for years to come. The dollar, however, saw some support from better-than-expected retail sales and jobless claims data. The Commerce Department reported that U.S. retail sales rose 0.3% in February, ending two months of declines and better than market expectations for a 0.2% increase. Core retail sales, which exclude automobile sales, also rose 0.3% last month, ahead of expectations for a 0.2% rise. Separately, the Department of Labor said the number of individuals filing new claims for unemployment benefits in the U.S. fell by 9,000 to a three-month low of 315,000 last week.

EUR/USD" title="EUR/USD" height="242" width="474">

EUR/USD" title="EUR/USD" height="242" width="474">

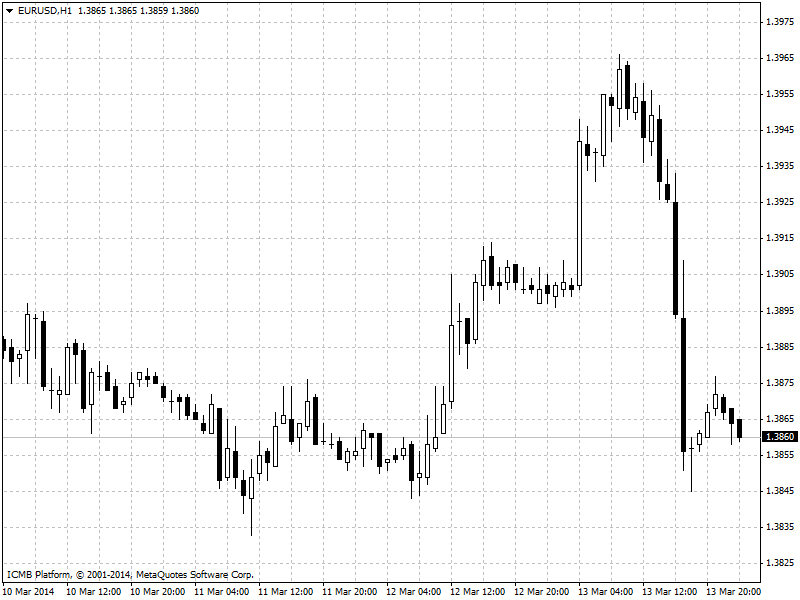

GBP/USD

The pound remained higher against the U.S. dollar on Thursday, as the release of strong U.S. economic reports lent support to market sentiment, despite disappointing Chinese data published earlier in the session. The Commerce Department reported that retail sales rose 0.3% in February, ending two months of declines. Market expectations had been for an increase of 0.2%. Core retail sales, which exclude automobile sales, also rose 0.2% last month, ahead of expectations for a 0.3% rise. Separately, the Department of Labor said the number of people filing new claims for unemployment benefits fell by 9,000 to a three month low of 315,000 last week, from the previous week’s revised total of 324,000. Analysts had expected initial jobless claims to rise by 6,000 last week. Market sentiment had weakened earlier, after data showed that Chinese industrial production rose 8.6% in the first two months of 2014, missing market expectations for an increase of 9.5%, while Chinese retail sales rose by a smaller-than-forecast 11.8% in the same period.

GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

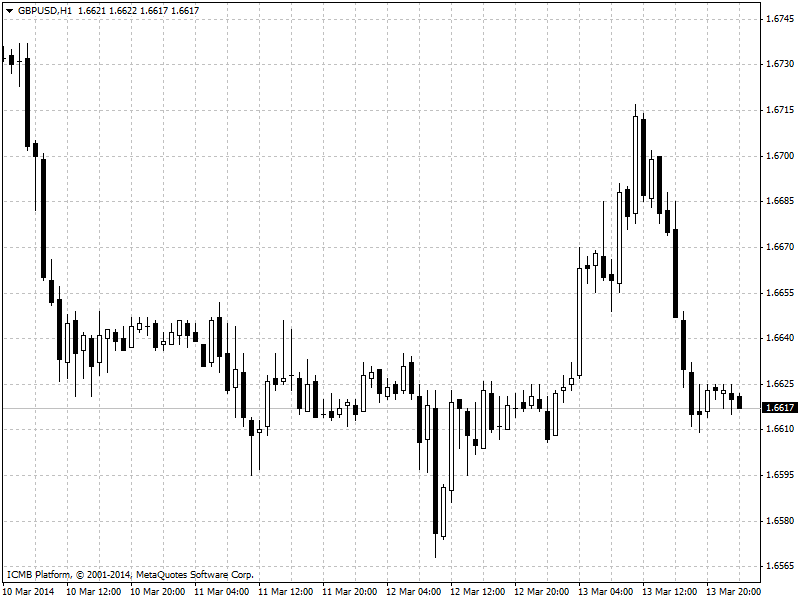

USD/JPY

The Japanese yen eased against the dollar in early Asian trade Friday ahead of the release of board minutes from the February policy review and an otherwise light data day in the region. Tensions between Russia and the West have remained high ahead of Sunday's referendum in Ukraine’s Crimea region, controlled by pro-Russian forces, on whether citizens there want to join Russia. Those concerns elevated the dollar and erased earlier losses stemming from upbeat takes on the euro area economy from various policymakers. The Commerce Department reported that U.S. retail sales rose 0.3% in February, ending two months of declines and better than market expectations for a 0.2% increase. Core retail sales, which exclude automobile sales, also rose 0.3% last month, ahead of expectations for a 0.2% rise. Separately, the Department of Labor said the number of individuals filing new claims for unemployment benefits in the U.S. fell by 9,000 to a three-month low of 315,000 last week. Analysts had expected initial jobless claims to rise by 6,000 last week. Soft production data out of China fueled demand for both the dollar and the yen. Chinese industrial production rose 8.6% in the first two months of 2014, according to data released on Thursday, missing market expectations for a 9.5% increase, while Chinese retail sales rose by 11.8%, beneath market forecasts for a 13.5% gain.

USD/JPY" title="USD/JPY" height="242" width="474">

USD/JPY" title="USD/JPY" height="242" width="474">

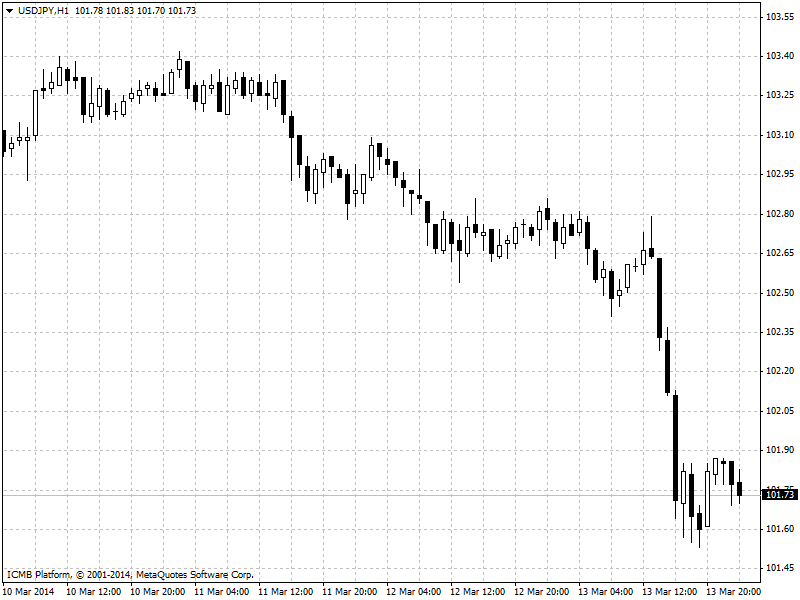

USD/CAD

The broadly weaker U.S. dollar fell to four-day lows against the Canadian dollar on Thursday as the euro’s strong gains against the dollar pressured the greenback lower across the board. The outlook for the U.S. economic recovery was boosted following the release of stronger-than-expected data on U.S. retail sales and initial jobless claims. The Commerce Department reported that U.S. retail sales rose 0.3% in February, ending two months of declines. Market expectations had been for an increase of 0.2%. Core retail sales, which exclude automobile sales, also rose 0.2% last month, ahead of expectations for a 0.3% rise. Separately, the Department of Labor said the number of people filing new claims for unemployment benefits in the U.S. fell by 9,000 to a three month low of 315,000 last week, from the previous week’s revised total of 324,000. Analysts had expected initial jobless claims to rise by 6,000 last week. But overall market sentiment remained subdued after weaker-than-expected data from China pointed to a slowdown in the world’s second-largest economy at the start of the year. Chinese industrial production rose 8.6% in the first two months of 2014, according to data released on Thursday, missing market expectations for an increase of 9.5%, while Chinese retail sales rose by a smaller than forecast 11.8% in the same period. Market sentiment was also hit by heightened tensions between Russia and the West ahead of Sunday's referendum in Ukraine’s Crimea region, now controlled by pro-Russian forces, on whether citizens want to join Russia.