Germany’s top court will take more than eight weeks to decide whether to suspend the euro-area’s permanent bailout fund, leaving Europe’s anti-crisis coffer less than half full to respond to the debt crisis.

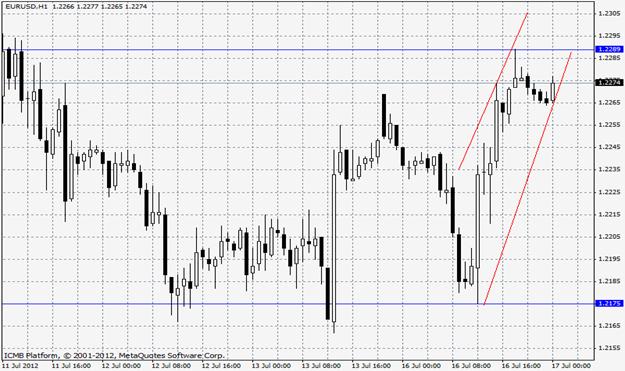

The Federal Constitutional Court in Karlsruhe will issue a ruling on bids to halt Germany’s participation in the European Stability Mechanism and the fiscal pact on 12th of September, it said in an e-mailed statement. The court has held a comprehensive hearing on the issue and will now take the time it needs to reach a decision, German government spokesman Steffen Seibert told reporters in Berlin. However, Finance Minister Wolfgang Schaeuble sees the risk of the prolong decision and warned the hearing last week that a delay in activating the ESM “could lead to a significant worsening” of the crisis. Thus, since the activation of ESM likely to be delayed, crisis managers will have to get by with the 240 billion euros ($293 billion) left in the temporary European Financial Stability Facility (EFSF). The euro rebounded from $1.2175 to $1.2289 as U.S retail sales slumped to 0.5 percent on the month of June.  EUR/USD" title="EUR/USD" width="534" height="395">

EUR/USD" title="EUR/USD" width="534" height="395">

GBP/USD

The British pound appreciated against the greenback after US retails sales declined. It surged to $1.5654, the strongest since 5th of July. US retail sales showed an unexpected drop in the month of June, according to figures released by the Commerce Department. Advance estimates for US retail sales for June came in at a seasonally adjusted level of $401.5 billion, a 0.5 percent drop from May levels. The drop came after sales fell 0.2 percent in May, in contrast from analyst expectation to climb at 0.1 percent. The unexpected decrease marked the third consecutive monthly decrease in sales. Partly, automotive sales drove some of the overall decline for the month with sales by motor vehicle and parts dealers dropping by 0.6 percent. Non-automotive retail sales also continued to contract, falling by 0.4 percent in June.  GBP/USD" title="GBP/USD" width="534" height="395">

GBP/USD" title="GBP/USD" width="534" height="395">

NZD/USD

Consumer prices in New Zealand were up 0.3 percent in the second quarter of 2012 compared to the previous three months, Statistics New Zealand said. That was below expectations for an increase of 0.5 percent which would have been unchanged from the first quarter. On a yearly basis, inflation was higher by 1.0 percent also dipping below forecasts for a gain of 1.1 percent and slowing from 1.6 percent three months earlier. The increase in consumer price index was the slowest annual pace since December 2009 as cheaper telecommunication prices offset the rising cost of electricity and rentals. The annual pace of inflation was 1 percent, slower than the 1.1 percent forecast, and at the bottom of the Reserve Bank's target band of 1 percent and 3 percent. Today's figures mean the Reserve Bank won't have to worry about any inflationary pressures creeping in from the rebuild in Canterbury, allowing Governor Alan Bollard to keep the official cash rate lower for longer. The kiwi dollar fell to 79.62 US cents after the numbers from 79.74 cents immediately before. NZD/USD" title="NZD/USD" width="534" height="395">

NZD/USD" title="NZD/USD" width="534" height="395">

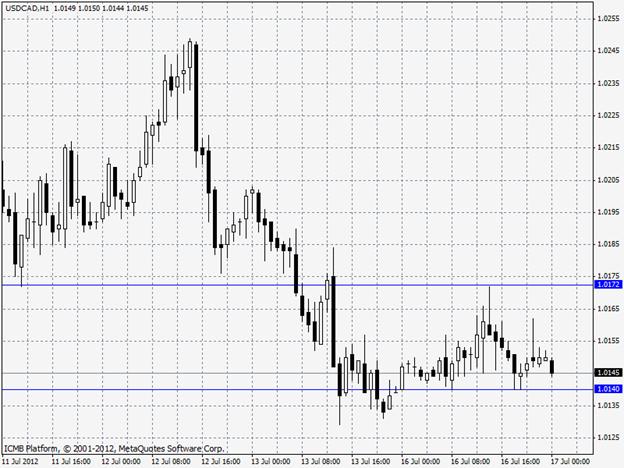

USD/CAD

The Canadian dollar weakened against most of its major counterpart, as the nation’s 10-year bond yields declined to a record low. It fell after US retail sales unexpectedly declined for a third month. It fell 0.1 percent against to CAD 1.0150 per US dollar. Meanwhile, foreign purchases of Canadian securities reached a record in May as demand for bonds was fed by a growing yield premium compared with US debt and the currency weakened. The May purchases of Canadian securities followed a net purchase of CAD 10.2 billion in April, Statistics Canada said in Ottawa. May bond purchases of CAD 16.7 billion reached a three-year high, led by CAD 9.5 billion of existing federal government debt and another CAD 3.5 billion of debt from government-owned companies.  USD/CAD" title="USD/CAD" width="534" height="395">

USD/CAD" title="USD/CAD" width="534" height="395">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: July 17, 2012

Published 07/17/2012, 07:10 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: July 17, 2012

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.