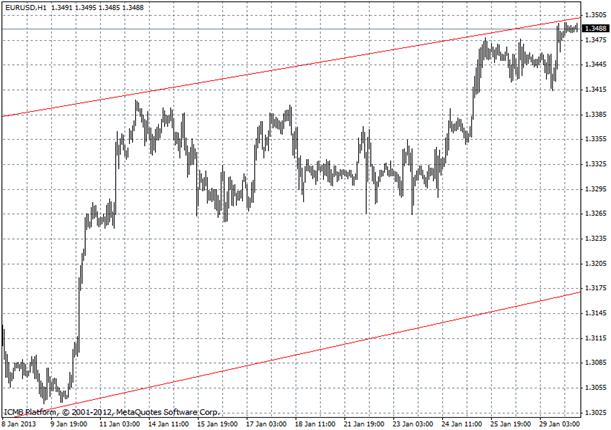

EUR/USD

The euro rose against the dollar and held onto its gains on Tuesday after German consumer confidence numbers beat expectations earlier. Many investors remained on the sidelines in anticipation of the Federal Reserve's decision on monetary policy due out Wednesday.

Data out of Germany, Europe's largest economy, continues to point to signs that the euro zone economy may have turned the corner to better days ahead. Earlier Tuesday, the forward looking Gfk consumer confidence index ticked up to 5.8 for February from an upwardly revised 5.7 in January. Analysts were expecting the index to come in at 5.7 for February.

Meanwhile in the U.S., consumer confidence numbers missed expectations, which fueled the euro's advance. The Conference Board reported earlier that its index of U.S. consumer confidence fell to 58.6 in January from 66.7 in December, missing expectations for a decline to 64.0. Elsewhere, home prices in the U.S. rose in line with market expectations in November, according to a widely followed industry report.

GBP/USD

The pound extended gains against the U.S. dollar on Tuesday, but gains were expected to remain capped ahead of a series of key U.S. events and as concerns over the U.K. outlook for growth continued to weigh. Investors remained cautious ahead of a number of significant U.S. economic events later in the week, including data on fourth quarter growth and the Federal Reserve’s monetary policy statement on Wednesday, as well as Friday’s U.S. nonfarm payrolls data. The pound was also under pressure after data on Friday showed that the U.K. economy contracted 0.3% in the fourth quarter, putting Britain on track for a triple-dip recession. Meanwhile, comments by incoming BoE Governor Mark Carney over the weekend were seen as increasing the likelihood for more easing measures by the central bank.

USD/JPY

The U.S. dollar climbed against most of its major rivals during Wednesday’s Asian session even though no major surprises are expected when the Federal Reserve delivers another monetary policy announcement later today. In Japan, the Ministry of Economy Trade and Industry said December retail sales there fell to a seasonally adjusted rate of 0.4% following an increase of 1.3% in November. Analysts had expected retail sales to fall at annual rate 0.3% in December. Following that news, USD/JPY jumped 0.21% to 90.93 as traders seemed to bet discouraging Japanese economic could open the door for swifter monetary easing. Earlier this month, the Bank of Japan disappointed financial markets when it committed to Fed-style asset-buying, but BoJ said it would not launch that program until 2014. Although traders have been embracing riskier assets in recent weeks, some of the riskier currencies were being punished against the dollar during Wednesday’s Asian session. AUD/USD slid 0.05% to 1.0470. NZD/USD tumbled 0.21% to 0.8377 as pressure mounts on New Zealand policymakers to take action to stem the Kiwi’s strength.

USD/CAD

The U.S. dollar slid lower against the Canadian dollar on Tuesday, but remained close to five-month highs ahead of a number of significant U.S. economic events later in the week. Investors remained cautious ahead of the outcome of the Federal Reserve’s policy meeting and U.S. data on fourth quarter growth on Wednesday, as well as Friday’s U.S. nonfarm payrolls report. Earlier Tuesday, a report showed that U.S. house prices rose in line with market expectations in November, increasing for the eighth consecutive month. The S&P/Case-Shiller home price index rose at an annualized rate of 5.5% in November from a year earlier. Month-on-month, U.S. home prices rose 0.6% in November, compared to expectations for a 0.7% increase, after rising by 0.7% in the preceding month. The Canadian dollar remained broadly weaker after the Bank of Canada indicated last week that rate hikes were less imminent, citing a weaker economic outlook. The U.S. was to release data on consumer confidence later in the trading day.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: January 30, 2013

Published 01/30/2013, 04:12 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: January 30, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.