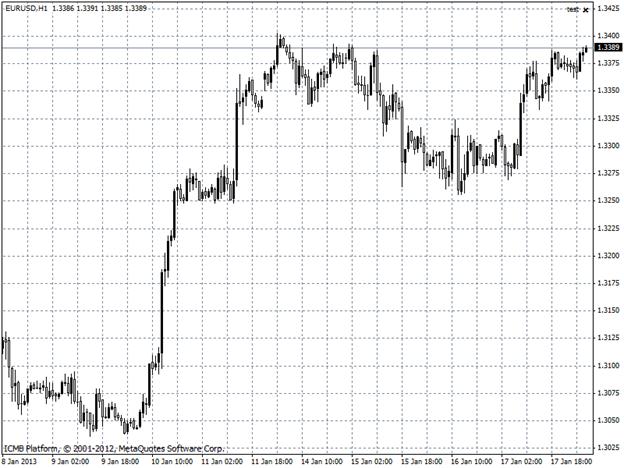

The euro approached a 10-month high against the dollar after Spain’s borrowing costs fell at a 4.5 billion-euro ($6 billion) sale of bonds, underscoring increased confidence in European debt markets. It strengthened as Spain sold 2.409 billion euros of 3.75 percent 2015 notes at an average yield of 2.713 percent, down from 3.358 percent at the previous sale in December.

The shared currency rose 2.5 percent over the past three months in a basket of 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The dollar lost 0.1 percent, and the yen slid 13 percent in the worst performance.

GBP/USD

The pound weakened to a nine-month low against the euro as investors favored assets in the 17- member currency region, betting they will outperform those in the U.K. Gilts dropped for the first time in five days as Spanish and Irish borrowing costs declined at debt sales, damping demand for safer assets. Sterling also declined against the euro as U.K. Prime Minister David Cameron prepares to give a speech in the Netherlands tomorrow in which he’ll call for the U.K. to get powers back from the European Union.

The pound fell for a fifth day versus the dollar. Sterling depreciated 0.7 percent to 83.58 pence per euro at 4:30 p.m. London time, after reaching 83.65 pence, the weakest since March 29. The pound slid 0.2 percent to $1.5976 after dropping to $1.5955, the least since November 23. The U.K. economy contracted in the fourth quarter and may risk slipping back into recession in the first three months of 2013, according to an e-mailed report from London-based Fathom Financial Consulting today.

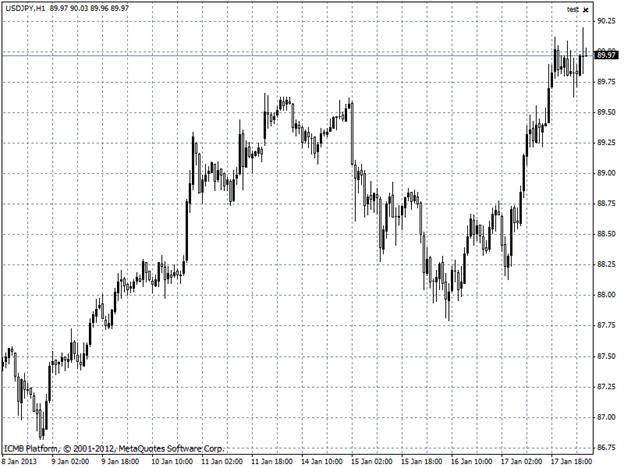

USD/JPY

Traders’ expectations for swings in the yen climbed to a 17-month high amid speculation the Bank of Japan will expand monetary stimulus at its two-day policy meeting starting January 21. The yen traded near a 2 1/2-year low and was set for a 10th weekly decline ahead of a reported meeting today between BOJ Governor Masaaki Shirakawa, Finance Minister Taro Aso and Economy Minister Akira Amari today.

Japan’s two-year note yield slid to a seven-year low amid speculation the central bank will boost bond purchases to end deflation. One-week implied volatility on the dollar-yen rates, derived from option premiums, reached 16.8 percent, the highest since August 2011. It jumped 47 basis points to 16.75 percent as of 11:02 a.m. in Tokyo. The yen traded at 89.87 per dollar after touching 90.13 yesterday, the weakest since June 23, 2010. It rallied 0.1 percent to 120.13 per euro.

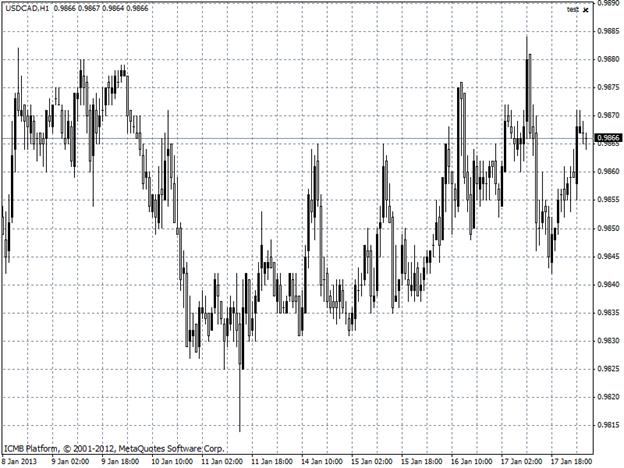

USD/CAD

The Canadian dollar rose from an almost two-week low against its U.S. counterpart as government data bolstered growth prospects for the world’s largest economy, the nation’s biggest trading partner. The loonie, as the currency is nicknamed, gained as U.S. housing starts climbed 12.1 percent last month, exceeding all forecasts in a Bloomberg survey of economists, and weekly jobless claims were lower than projected.

A report showed foreign purchases of Canadian securities slowed in November, with the fifth straight net acquisition blunted by a decline in demand for bonds. The Canadian dollar was little changed at 98.58 cents per U.S. dollar at 5:03 p.m. in Toronto. It earlier touched the weakest level since January 7. One loonie buys $1.0144.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: January 18, 2013

Published 01/18/2013, 02:45 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: January 18, 2013

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.