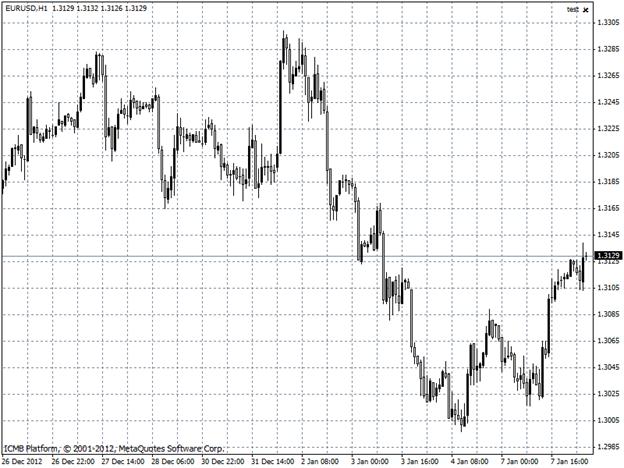

The euro rose for a second day against the dollar, reversing earlier losses, after failing to drop below its 50-day moving average. The 17-nation currency advanced from almost a three-week low after avoiding the $1.2993 level. The euro fell earlier before the European Central Bank meets this week amid concern the region’s economy is faltering. The euro appreciated 0.4 percent to $1.3117 after falling earlier to $1.3017. It touched $1.2998 on January 4, the lowest level since December 12.

GBP/USD

U.K. government bonds rose for the first time in six days as Prime Minister David Cameron’s prediction of a difficult year for the economy spurred demand for benchmark yields near the highest since April. The pound weakened for a second day versus the euro after Cameron said on BBC Television yesterday the economic environment is “tough” and “Britain needs low interest rates. The 10-year gilt yield jumped 30 basis points last week, the biggest increase since the five-day period ended January 23, 2009.

The Bank of England meets this week to review monetary policy. Convincing overseas investors they should keep buying U.K. government debt is ultimately more important than whether ratings companies downgrade gilts, Standard & Poor’s last month lowered its outlook on Britain’s top credit grade to negative, citing weak economic growth and a worsening debt profile.

USD/JPY

The yen headed for the biggest two-day gain in five weeks, extending a rally from its 2 1/2 year low on speculation recent declines were excessive. The currency strengthened against all of its 16 major counterparts even amid prospects Japanese Prime Minister Shinzo Abe will press the central bank to expand monetary stimulus at a Jan. 21-22 meeting in an effort to revive growth. The yen has had a very sharp depreciation and it must be due for some kind of consolidation, I do think the dollar-yen needs a bit of a breather.

The fact that the Bank of Japan is under pressure to make monetary policy even easier and print money is going to drive the yen weaker over time. Japan’s currency rose 0.2 percent to 87.65 per dollar, gaining 0.6 percent since January 4 and set for the biggest two-day percentage advance since December 4. It touched 88.41 on January 4, the weakest since July 2010. The yen was at 115.10 per euro.

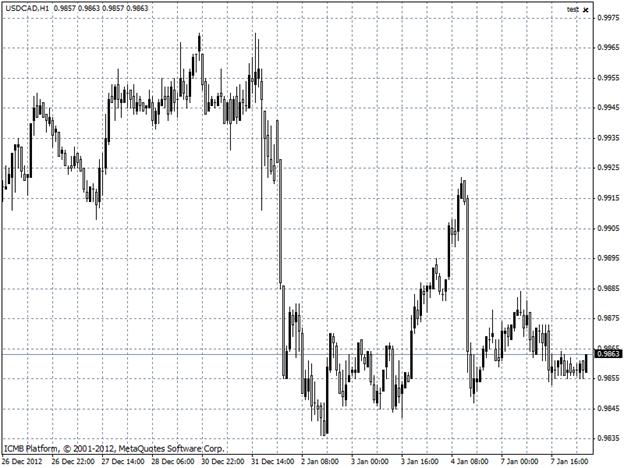

USD/CAD

The Canadian dollar rose for a second day against its U.S. counterpart after a measure of business activity expanded more than forecast in December, adding to signals of faster economic growth. The currency strengthened after Canada’s Ivey purchasing managers’ index was 52.8 in December, following a November reading of 47.5. It’s a sign that the recovery that’s burgeoning in the U.S. is starting to spill over the border, or at least optimism over the U.S. recovery is encouraging factories to ramp up production or hiring. The loonie rose 0.1 percent against its U.S. counterpart to 98.59 cents per U.S. dollar. One Canadian dollar buys $1.0143.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: January 08, 2013

Published 01/08/2013, 03:06 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: January 08, 2013

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.