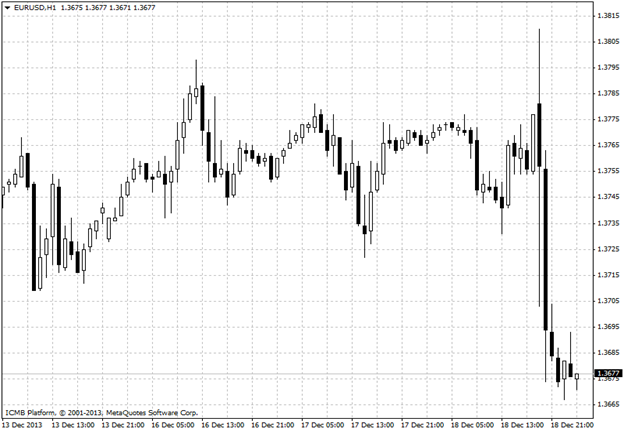

EUR/USD

The euro edged lower against the dollar on Wednesday in steady trading as investors remained in standby mode ahead of the release of the Federal Reserve's statement on monetary policy and the fate of its USD85 billion monthly bond purchases. The Census Bureau reported earlier that U.S. housing starts rose to 1.09 million units in November from 890,000 in October, beating consensus forecasts for an increase to 950,000 units. Building permits in the U.S. fell 3.1% to 1.01 million units in November, from 1.04 million units the previous month. Still, analysts were expecting building permits to drop 4.7% last month. The dollar inched up, though gains were limited ahead of the Federal Reserve's announcement on monetary policy, especially on its plans to taper or let stand its USD85 billion in monthly bond purchases. The Fed's monthly asset-purchasing program, now 15 months old, aims to spur recovery by driving down interest rates, weakening the dollar in the process. The euro showed little reaction after the Ifo German business climate index rose to a 20-month high of 109.5 in December, in line with forecasts and up from 109.3 in November. The single currency was down against the pound and up against the yen, with EUR/GBP trading down 0.82% at 0.8396 and EUR/JPY trading up 0.44% at 141.97. EUR/USD" border="0" height="431" width="624">

EUR/USD" border="0" height="431" width="624">

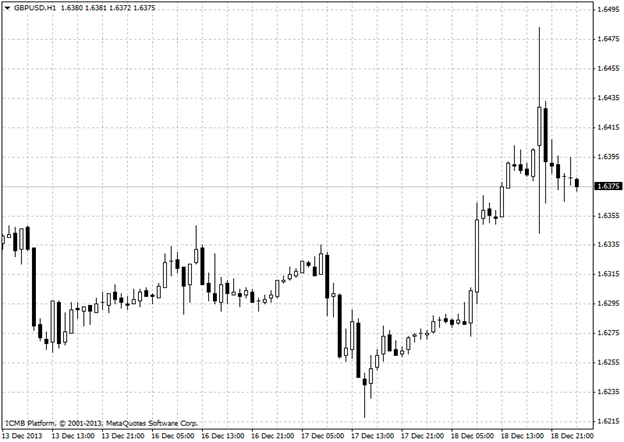

GBP/USD

The pound surged against the dollar on Wednesday after U.K. unemployment data beat expectations, while a Fed decision to taper its monthly bond-buying program by USD10 billion weakened the dollar due to the dovish language associated with the move. The pound shot up after data revealed that the U.K. unemployment rate unexpectedly fell to a four-and-a-half year low of 7.4% in the three months to October, fueling hopes that the Bank of England will raise interest rates ahead of other central banks. Analysts were expecting a 7.6% reading. Meanwhile in the U.S., the Federal Reserve left its key benchmark lending target, the fed funds rate, unchanged at 0.0-0.25% but said it was trimming its USD85 billion monthly asset-purchasing program by USD10 billion. Fed asset purchases weaken the dollar by driving down interest rate, and talk of their dismantling can strengthen the greenback. Relief buying sent stocks and higher-yielding currencies rising and the dollar falling in wake of the Fed's announcement. The dollar also came under pressure after the Fed said policy would remain accommodative until the U.S. unemployment rate dips below 6.5% and added it could beef up its stimulus program anew should recovery falter.  GBP/USD" border="0" height="442" width="624">

GBP/USD" border="0" height="442" width="624">

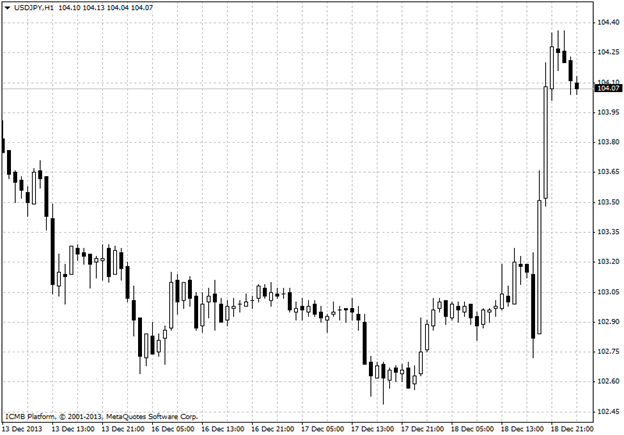

USD/JPY

The dollar was higher against the yen on Wednesday amid ongoing speculation over whether the Federal Reserve will announce any reduction to its stimulus program following its policy meeting later in the trading day. Investors remained wary ahead of the outcome of the Fed’s final policy meeting of the year, with some expecting the bank to announce a small reduction in the pace of its USD85 billion-a-month asset purchase program. However, many believe that the bank will wait until early next year to start rolling back stimulus, despite recent indications the U.S. economic recovery is deepening. In Japan, data on Wednesday showed that the trade deficit widened to JPY1.29 trillion in November, increasing 35% from the same month last year as imports rose 21.1% and exports increased by 18.4%. USD/JPY" border="0" height="435" width="624">

USD/JPY" border="0" height="435" width="624">

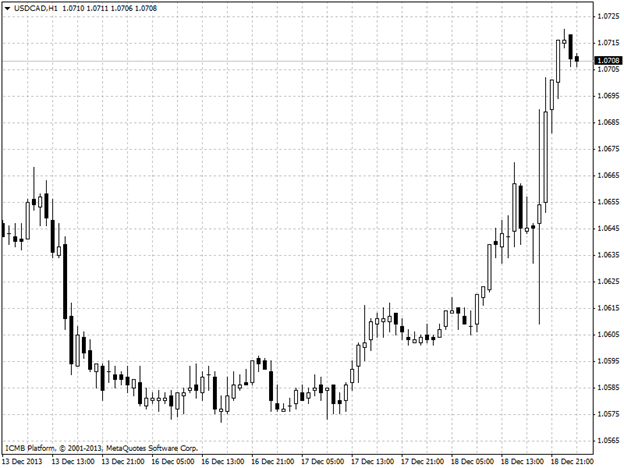

USD/CAD

The U.S. dollar rose to session highs against the Canadian dollar on Wednesday, ahead of the keenly anticipated outcome of the Federal Reserve’s last policy meeting of the year. Investors remained wary ahead of the outcome of the Fed’s policy setting meeting later in the session, with some expecting the bank to announce a small reduction in the pace of its USD85 billion-a-month asset purchase program. However, many believe that the bank will wait until early next year to start rolling back stimulus, despite recent indications the U.S. economic recovery is deepening. The greenback was boosted after data on Wednesday showed that U.S. housing starts rose to the highest level in nearly six years in November. U.S. housing starts rose to 1.09 million units, the Commerce Department said, from 0.89 million in October, compared to expectations for an increase to 0.95 million units. Building permits in the U.S. fell 3.1% to 1.01 million units in November, from 1.04 million units the previous month. Analysts had expected building permits to drop 4.7% last month to 0.99 million units. In Canada, official data showed that wholesale sales rose 1.4% in October, beating expectations for a 0.4% gain, after a 0.2% uptick the previous month. USD/CAD" border="0" height="468" width="624">

USD/CAD" border="0" height="468" width="624">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: Euro Edges Lower Against Dollar

Published 12/19/2013, 04:16 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: Euro Edges Lower Against Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.