EUR/USD

After a drop in inflation to the slowest pace in four years threatened its mission to keep prices stable The ECB on Nov. 7 trimmed its benchmark interest rate to 0.25 percent from 0.5 percent. The ECB expects interest rates to remain at the current level or lower for an extended period of time, President Mario Draghi said at a press conference after the announcement. Euro depreciated to 1.3340. EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="624" height="468">

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="624" height="468">

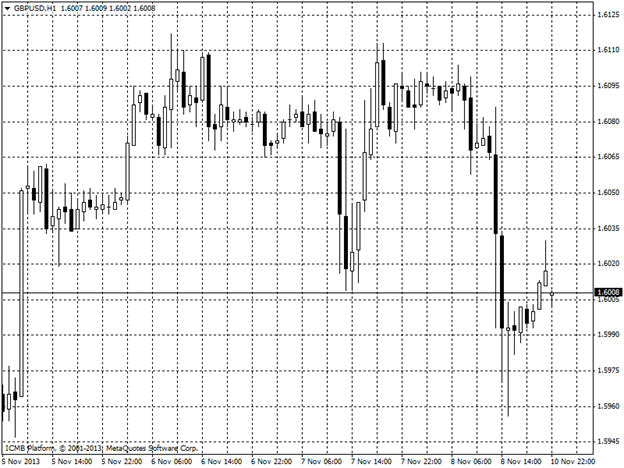

GBP/USD

The pound slid for the first time in five days against the dollar after a U.S. report showed payrolls increased last month more than economists forecast, boosting demand for the greenback. The Bank of England’s nine-member Monetary Policy Committee left its asset-purchase target at 375 billion pounds The London-based central bank has said it will keep the key rate at a record low until unemployment, currently at 7.7 percent, falls below 7 percent. U.K. inflation slowed to 2.5 percent last month from 2.7 percent in September. GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="624" height="468">

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="624" height="468">

USD/JPY

Japan’s second- and third-largest lenders by market value have already achieved 75 percent of their targets for the year ending March 2014, Analysts at BNP Paribas SA, Barclays Plc and Daiwa (8601) Securities Group Inc. say the Tokyo-based banks will raise their projections. USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="624" height="468">

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="624" height="468">

USD/CAD

Canada’s dollar slid to the weakest level in two months as stronger-than-forecast U.S. job growth fueled bets the Federal Reserve will start slowing the monetary stimulus that’s boosted riskier assets. Canadian currency depreciated 0.2 percent to C$1.0479 per U.S. dollar . USD/CAD Hourly Chart" title="USD/CAD Hourly Chart" width="624" height="468">

USD/CAD Hourly Chart" title="USD/CAD Hourly Chart" width="624" height="468">