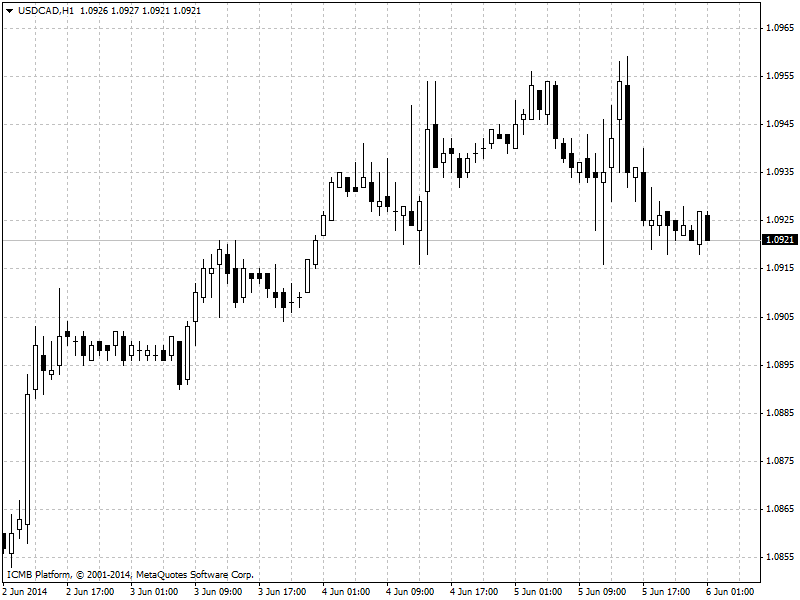

EUR/USD

Europe’s shared currency strengthened 0.5 percent to $1.3660 the biggest jump on a closing basis in three months. The $5.3 trillion foreign-exchange market rejected the European Central Bank’s unprecedented effort to weaken the euro, sending the 18-nation currency higher and providing a further headwind to manufacturers already coping with a slowing economy. “The path of least resistance should be upward in the medium term,” he said. “Draghi is furious that the euro is as strong as it is. That’s why last month he spent a great deal of time talking down the euro. Once he strikes a tad more of an optimistic tone I think the market is going to call his bluff in that he is just not capable of weakening the euro.” The European Central Bank became the first major central bank to take one of its main rates negative as President Mario Draghi unveiled historic measures to fight deflation. Gold rose more than 40 percent since the end of 2008 as policy makers printed money at a record pace to boost expansion. Futures gained less than 1 percent today.

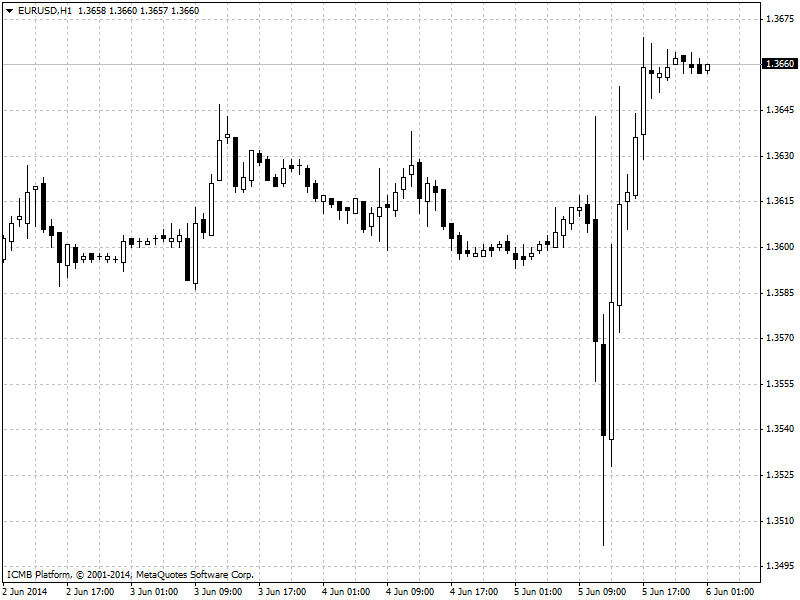

GBP/USD

Sterling gained versus the dollar after the Bank of England kept the main rate unchanged at a record-low 0.5 percent. in the U.K. the debate is about when officials will raise rates. said Neil Jones, head of hedge-fund sales at Mizuho Bank Ltd (NYSE:MFG) in London. “Sterling is outperforming in part because of the expectation that the next move, as far as the Bank of England goes, will be higher. Sterling rose 0.4 percent to $1.6802, having slipped yesterday to $1.6699 The Bank of England left its key rate at a record low of 0.5 percent and held its asset-purchase target at 375 billion pounds ($629 billion) data from house prices to manufacturing has fueled speculation that members of the Monetary Policy Committee will begin debating higher rates.

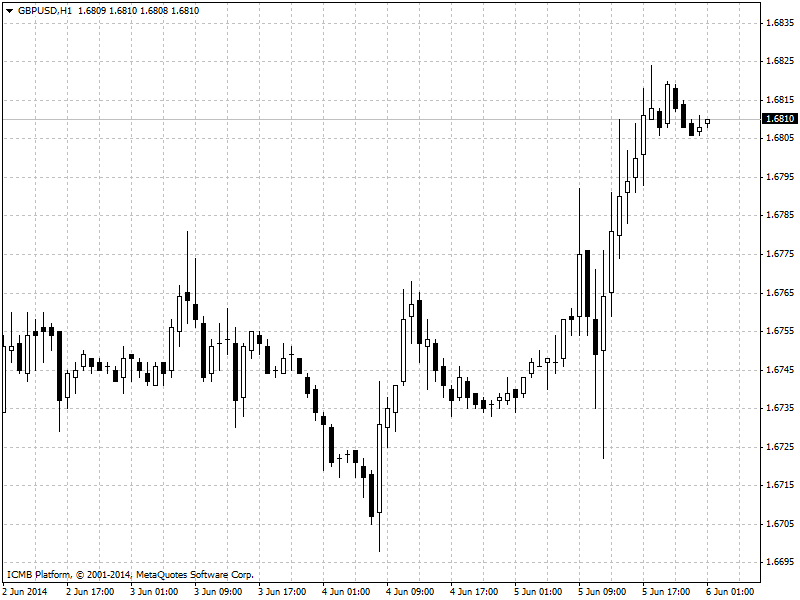

USD/JPY

The yen’s 5 percent fall against the dollar over the year through April boosted the cost of imports in a nation that is only 39 percent self-sufficient on a calorie basis and more reliant on inbound shipments of fossil fuels after a nuclear disaster in 2011. Japan will release gross domestic product figures for the first quarter. The initial reading was for annualized growth of 5.9 percent - Japan’s first-quarter GDP. The economy shrank 3.5 percent in the current quarter following an increase in the sales tax, before returning to growth in the July-September period.

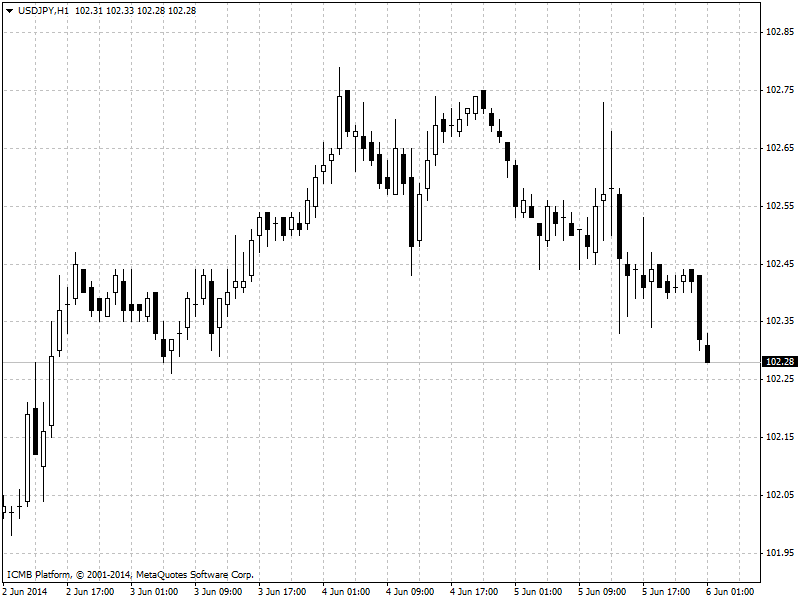

USD/CAD

The Canadian dollar fell to a four-week low after the Bank of Canada left rates unchanged and repeated concern that low inflation and weak exports are hindering the nation’s economy. Canada’s currency has been the worst performer among Group of 10 peers against the U.S. dollar during the past 12 months as the central bank began voicing concern about persistently low inflation and the importance of a weaker Canadian dollar to boost the exports. “As long as the economy is soft, and as long as there’s uncertainty about U.S. growth, and as long as exports remain tepid, I think the Bank of Canada is going to be very careful not to say or do anything to trigger a strengthening in the currency,” said Emanuella Enenajor, an economist at Bank of America Corp. (NYSE:BAC), by phone from New York. “The bank is likely to err on the side of caution.” Canada’s benchmark 10-year bond fell after erasing gains earlier today. The yield rose one basis point, or 0.01 percentage point, to 2.35 percent, reaching the highest level since May 13. The 2.5 percent security maturing in June 2024 dropped nine cents to C$101.32.